DXY was up Friday night:

The Australian dollar was down versus DMs:

But up versus EMs:

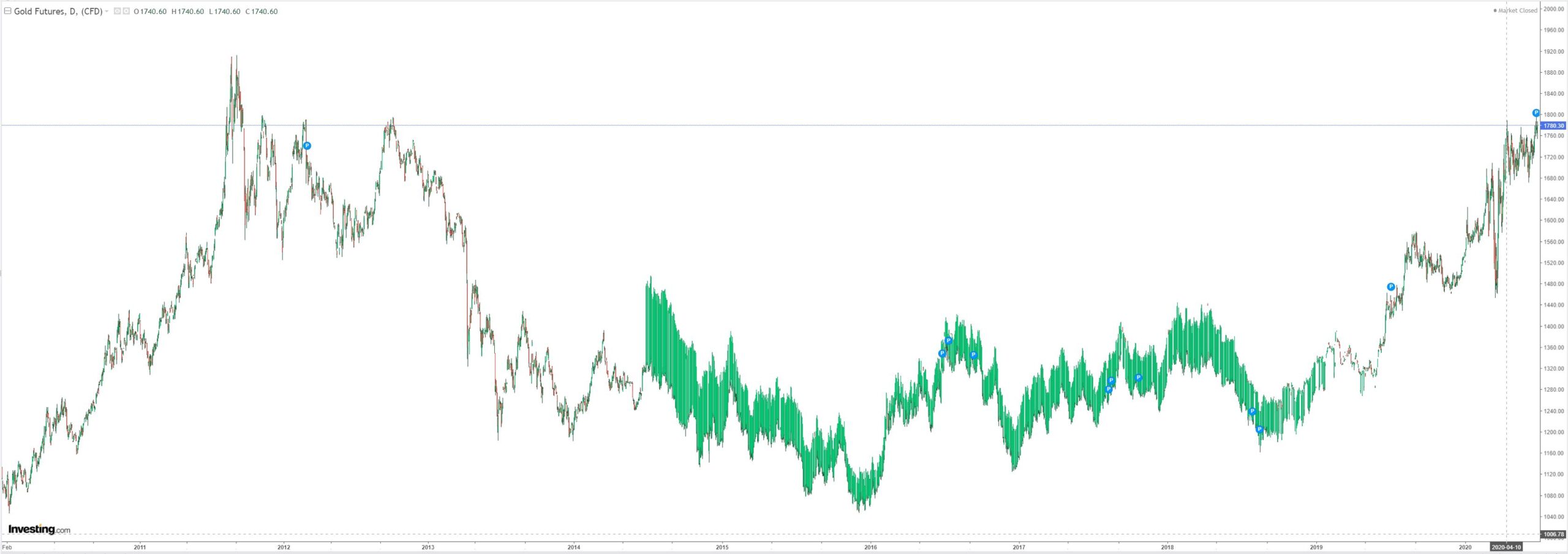

Gold flew but I’d be more comfortable if it pushed more decisively above its break out line:

Oil was soft:

Dirt was better:

Miners fell:

Junk looks vulnerable:

EM stocks fell:

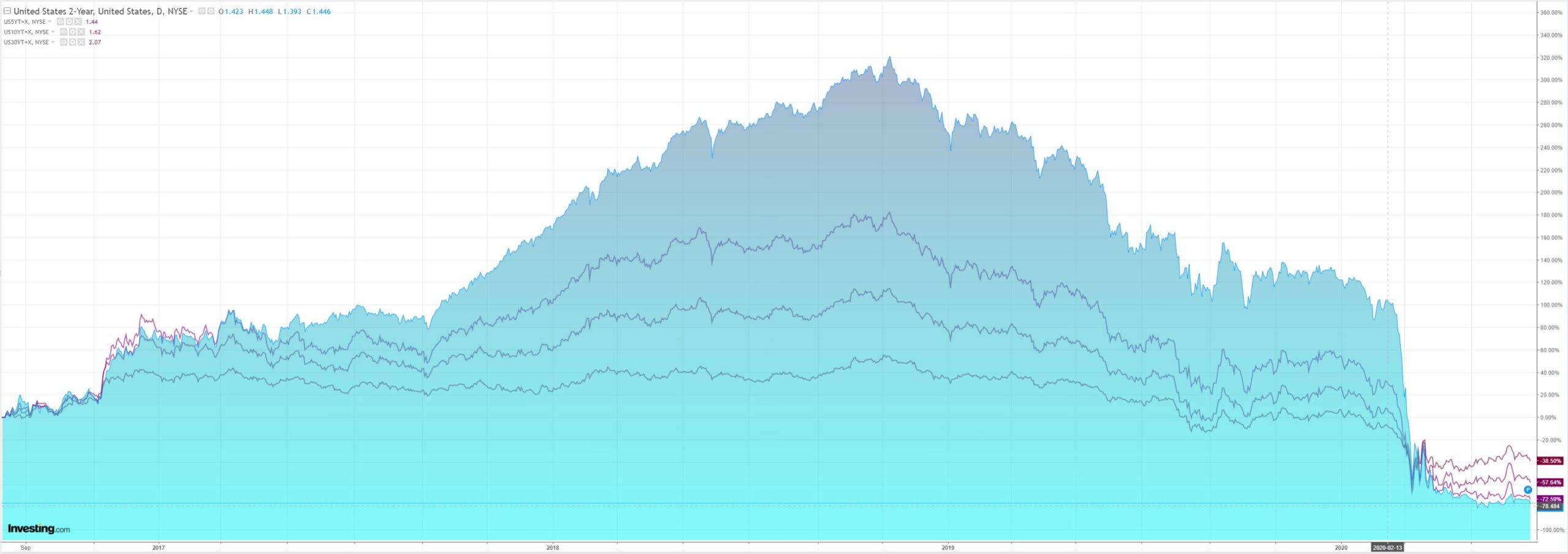

Bonds were bidly:

As stocks sank:

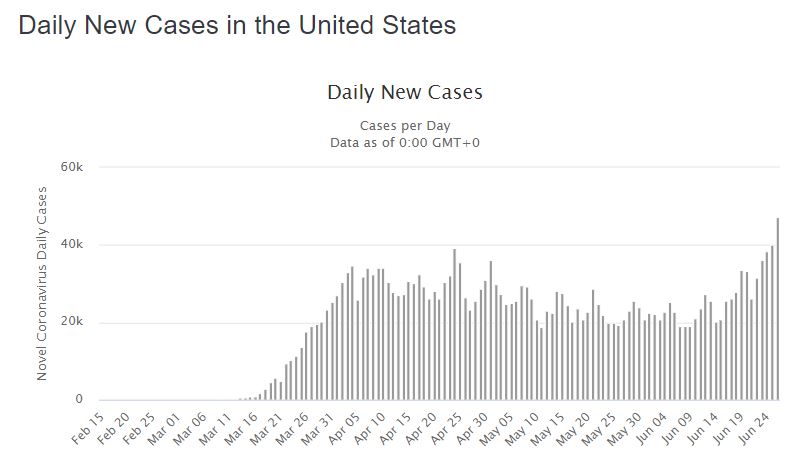

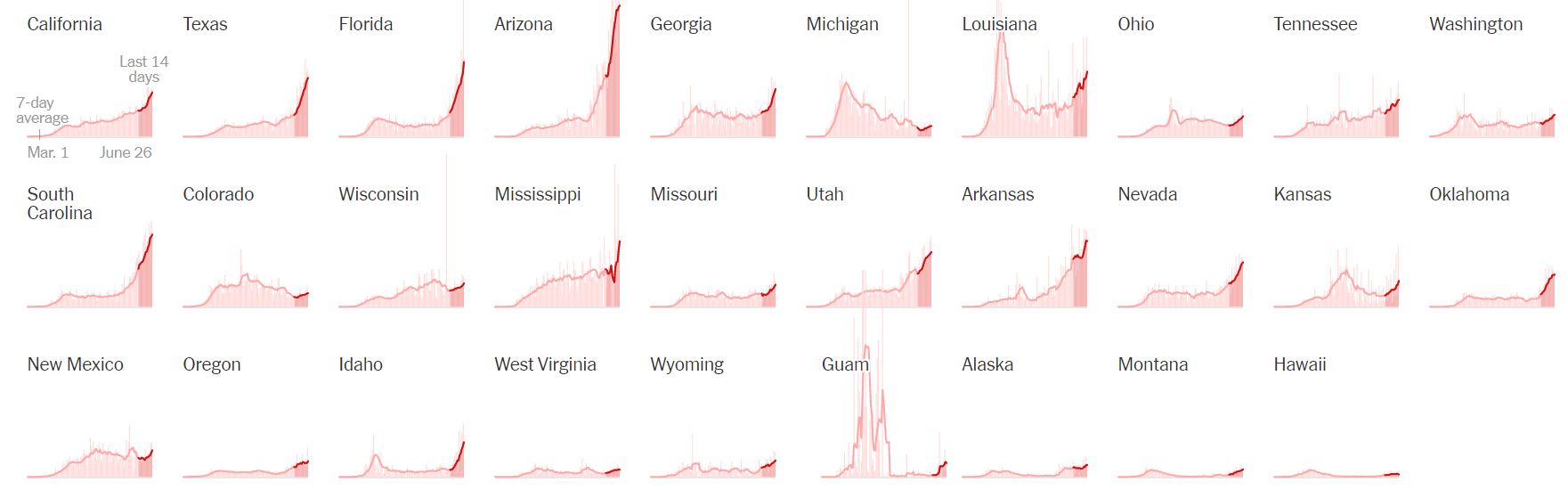

The news flow is all virus in the US and it ain’t pretty:

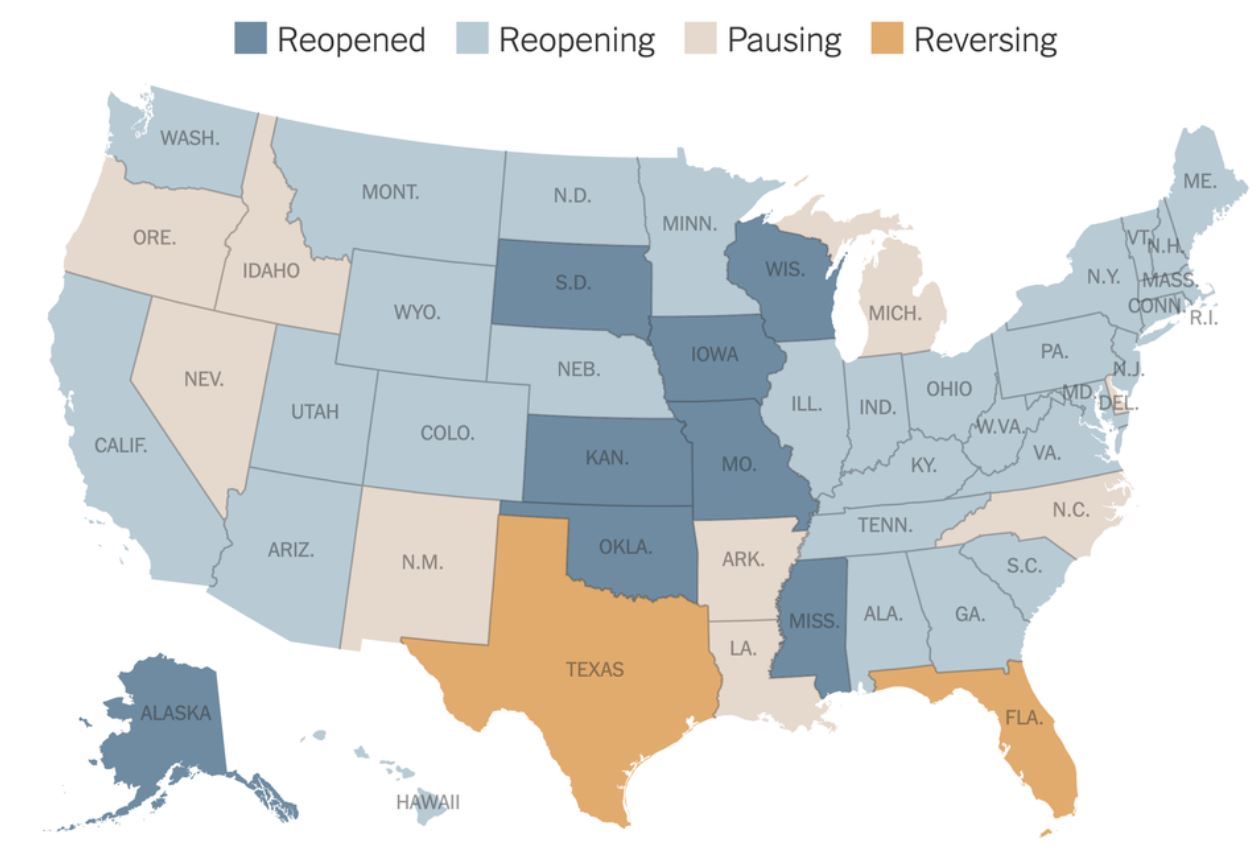

Major states are “pausing” their reopening. Which is spin for shutting back down. They need to and it’s not just a few and they are big, via NYT:

Before long it will be most of the south and west:

90m people are already into new degrees of lockdown. California and Arizona will need to follow at minimum making it 140m in short order.

Once you add the other states with swiftly rising cases it will rise to, and surpass, half the country.

The death rates are lower and these lockdowns will probably not be as harsh as the first round, so macro data may continue to rebound from the April lows, but the recovery (if you can call it that) is sure going to slow and the profits hit is immense all over again. With the added specter of this happening again and again.

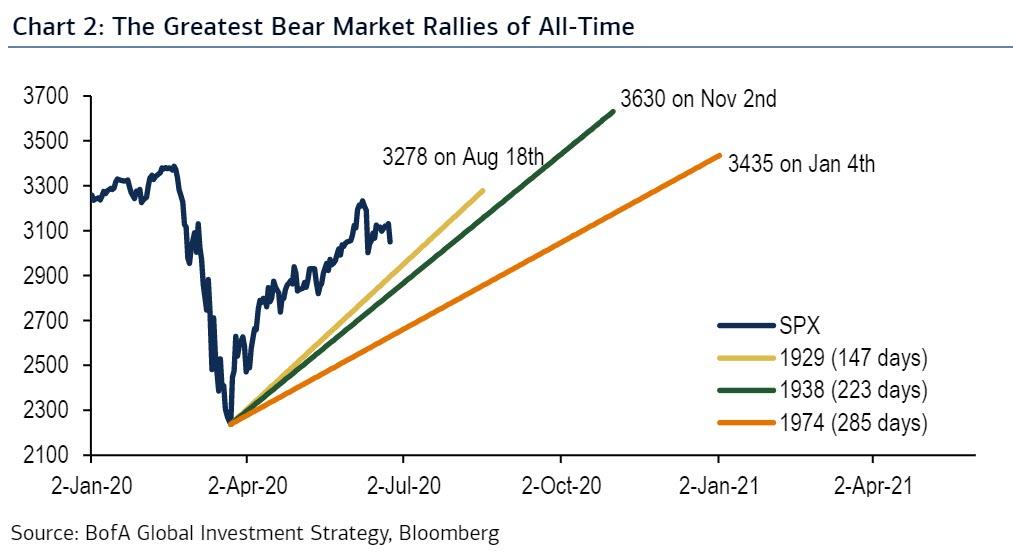

The stock market has jumped the shark and its wild bear market rally going to have to correct at some point:

The obvious conclusion is that forex will follow. RaboBank sums it nicely:

While the AUD is linked to commodity prices and therefore to proxies for global demand, some of the recent strength in AUD/USD has a domestic source – such as the strength of iron ore prices and the country’s relative success in dealing with Covid-19.

We see the potential for a move lower in both AUD/USD and NZD/USD during the second half of the year on the view that broad levels of risk appetite will correct lower and domestic weaknesses will be exposed.

Despite recent strong demand from China for Australian iron ore, the worsened relations between China and Australia has been a concern for other exporters. Unhappy with Canberra’s demand for an investigation into the source of Covid-19, Beijing is reportedly considering tariffs on Australian products that include wine and fruit while possibility encouraging a boycott of other goods and services. At the same time fears are growing about the outlook of domestic Australian demand.

We see risk of a pullback to the NZD/USD 0.60 area during the second half of this year. In view of the huge reflation trade in recent weeks, we have revised this forecast up from 0.57. We expect AUD/USD to dip to 0.64 in the same time frame.

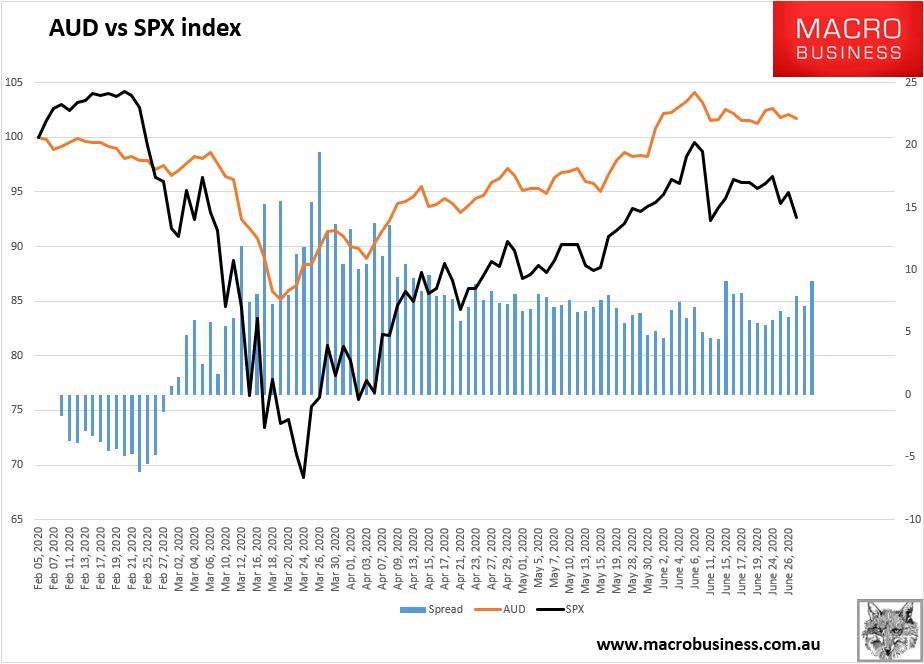

It is true that the AUD has started outperforming SPX again likely on better virus performance:

So we may not fall as far as round one if and when SPX corrects. 64 cents seems like a pretty good target.