by Chris Becker

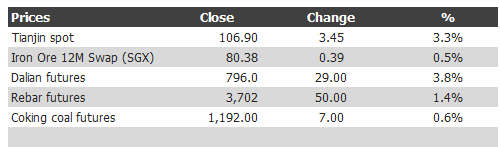

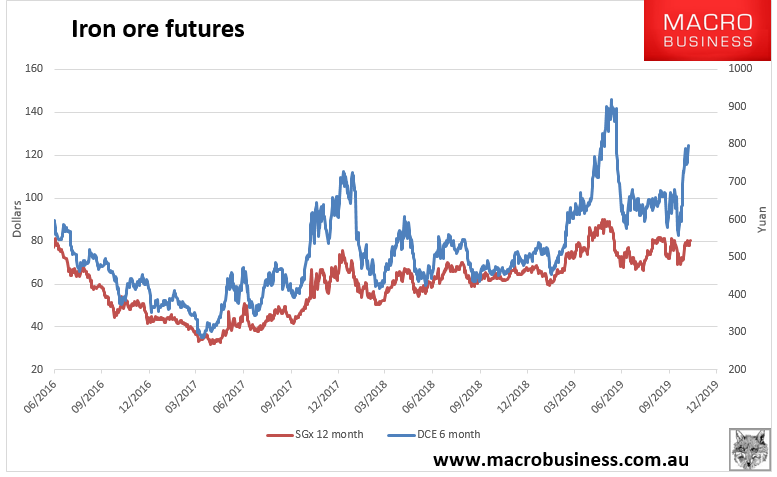

Iron ore prices shot out of the gates again yesterday, with spot prices up more than 3% with steel rebar futures up nearly 2%, lifting for five days in a row.

Here’s the full price list and charts:

The rally in steel prices may be due to a low inventory level with “rebar and hot-rolled coil stockpiles fallen more than 40% from this year’s peak” according to SteelHome consultancy data.

Meanwhile, here comes the blockchain revolution with the first trade in iron ore done digitally. Via Reuters:

China’s Nanjing Iron & Steel Co Ltd said on Wednesday it has completed its first blockchain-backed trade in iron ore after booking a $16.87 million shipment of the steelmaking ingredient from a joint venture of miner Rio Tinto.

For the past several years, commodities groups have been seeking to save time and money by using blockchain to digitalise a sector that still relies heavily on paperwork, but have come up against obstacles.

Nanjing Iron spokesperson said the steel mill has acquired 170,000 tonnes – the equivalent of one Capesize bulk carrier – of Pilbara iron ore fines and lump from Hope Downs, a joint venture between Australian miners Rio Tinto and Hancock Prospecting Pty Ltd.

The dollar-denominated transaction, supported by Singapore-based bank DBS and trade finance platform Contour, underscores the inroads being made by blockchain in the commodities sector in China, the world’s biggest iron ore consumer.