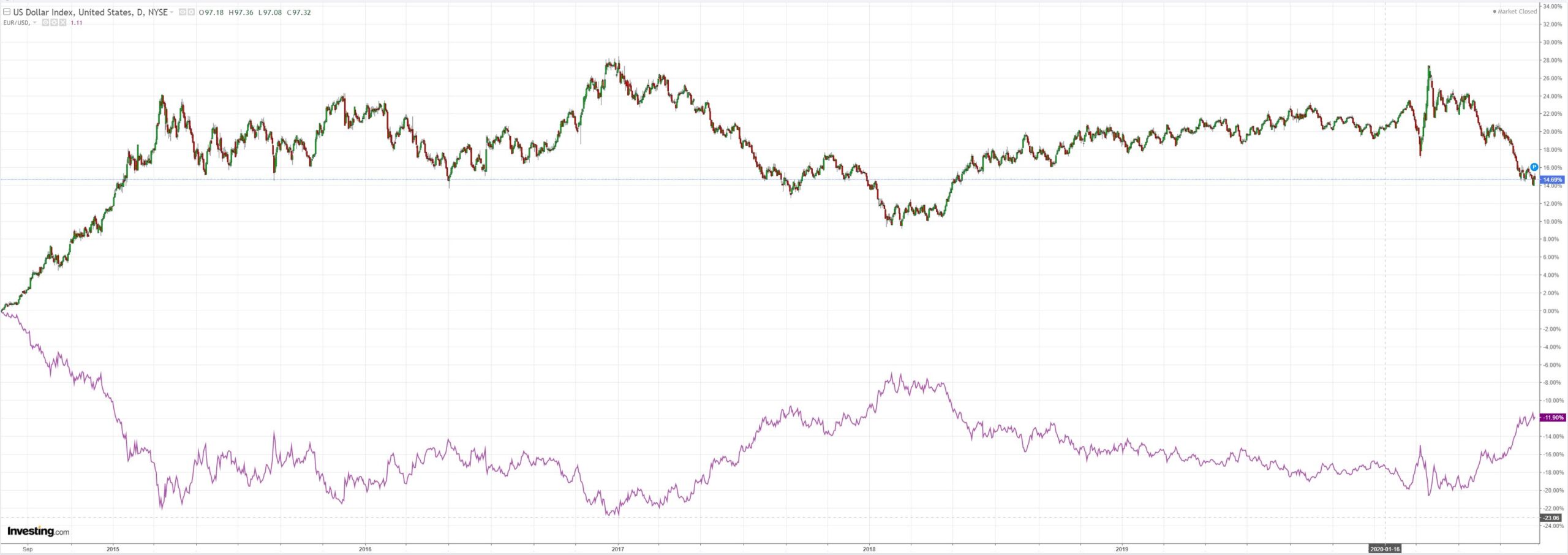

DXY was down last night EUR climbed:

Australian dollar up:

Gold up:

Oil is struggling:

Metals fell:

The market is struggling to believe in miners:

EM stocks fell:

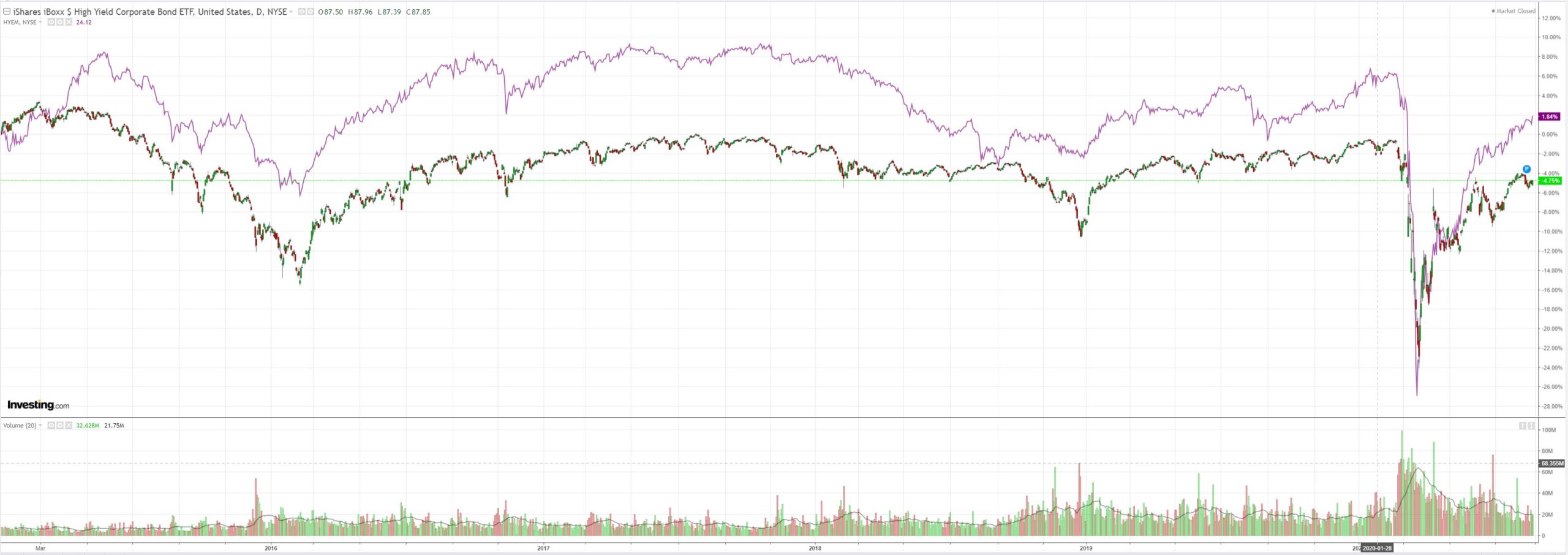

Junk did better:

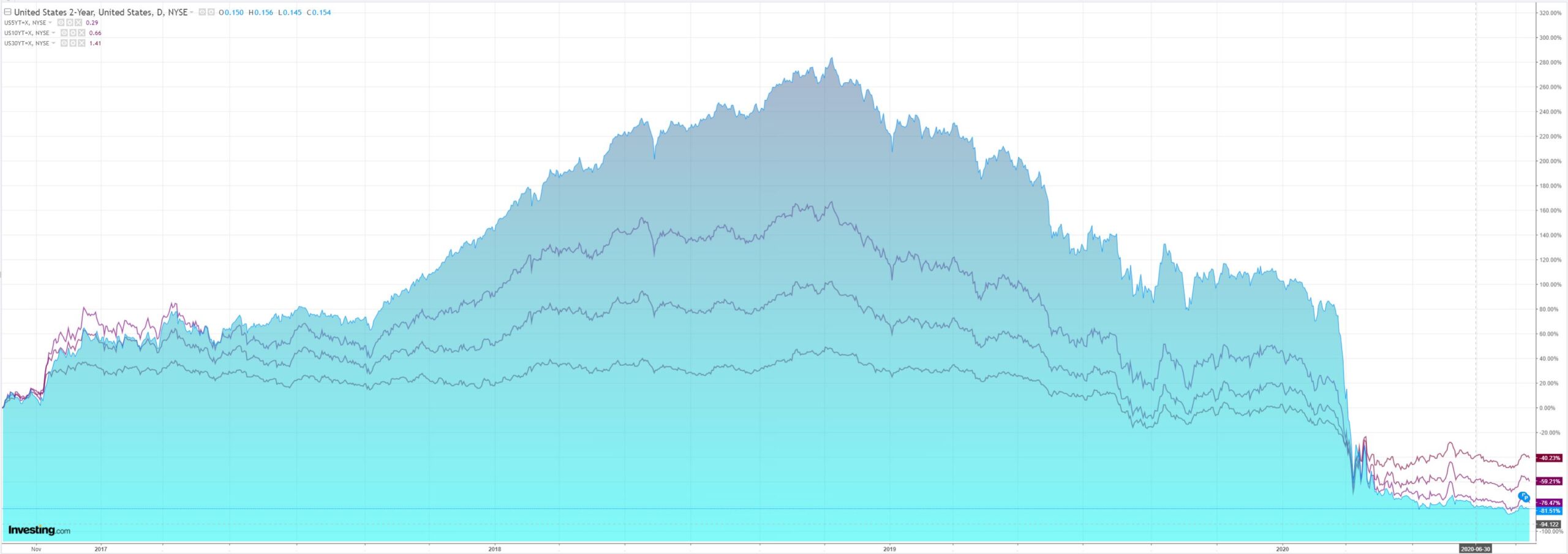

As yields fell:

Which pushed stocks up:

Westpac has the wrap:

Event Wrap

US weekly jobless claims were higher than markets anticipated at 1.106m (vs est. 0.92m) while continuing claims fell 633k to 14.844m (est. 15.0m). The Philly Fed survey was soft. The business outlook pulled back to 17.2 from prior 24.1 (and vs. est. 20.8), led by a fall in employment (to 9.0 from 20.1) and fall in new orders (19.0 from 23.0). However, the forward (6mth) outlook rose to 38.3 from 36.0. The relatively little watched Conference Board leading index rose for a third month by 1.4% (est. 1.1%), but still suggests a weakening of growth in 2H’20 according to their senior economist.

The ECB’s minutes of their policy meeting noted concern that the rebound in markets might prove to be premature and stressed continued uncertainty. They consider their base scenario for the economy post-COVID-19 to be more likely now, though the uncertainties and risks were seen as skewed to the downside.

The continued improvements in monetary and financial conditions and the distinct lack of a feared USD funding squeeze saw BoE, ECB, SNB, BoJ and the Federal Reserve jointly decide to reduce their 7-day USD liquidity operations, from three times a week to once a week.

Event Outlook

Australia: Indicators point to a solid gain in July retail sales ahead of the Victorian lockdown. Westpac predicts a lift to 3.0%, from 2.7% in June.

Japan: CPI inflation will remain weak in July (prior: 0.1%yr, market f/c: 0.3%yr). The Jibun Bank manufacturing and services PMIs remain weak, with both measures still below the 50 expansion/ contraction threshold (prior: 45.2 and 45.4 respectively).

Eurozone: Markit manufacturing and services PMIs remain on a clear upward trend from the lows of April; manufacturing 51.8 to 52.7, and services 54.7 to 54.5.

UK: The surge in retail sales last month, 13.9%, is expected to be followed by a 2.0% gain in August, with many shops still struggling for foot traffic. New orders and increased new business volumes are expected to push manufacturing and services PMIs to their fastest pace of expansion since 2019 (prior: 53.3 and 56.5, market f/c: 54.0 and 57.0 respectively).

US: New orders rose sharply and exports returned to growth in July, aiding manufacturing. Services recorded a more modest pace of expansion. The market expects momentum to continue in August manufacturing and services PMI data (prior: 50.9 and 50.0, market f/c: 52.0 and 51.1 respectively). June saw the largest gain in existing home sales since the series began. Another gain is expected in July (prior: 20.7%, market f/c: 14.4%).

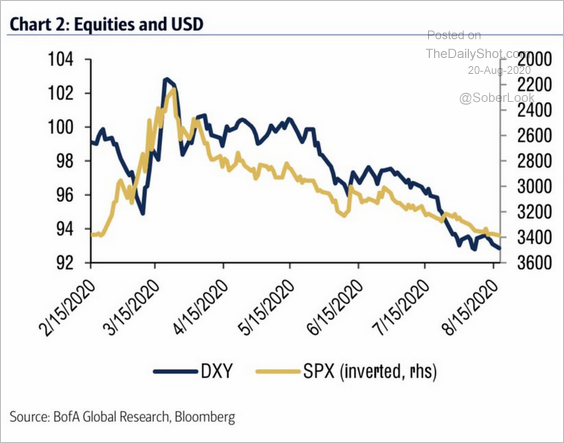

Nothing new. The direction of US yields and DXY has now become the key market driver of everything. If it falls then stocks rise:

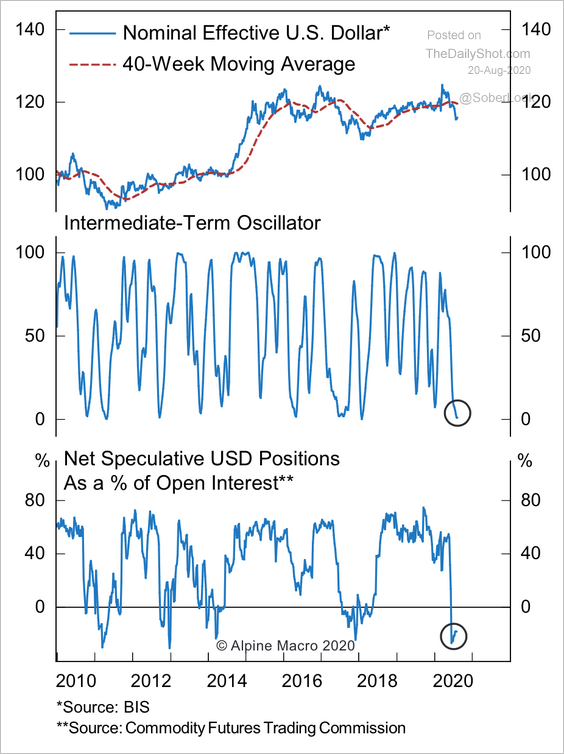

But it is hugely oversold:

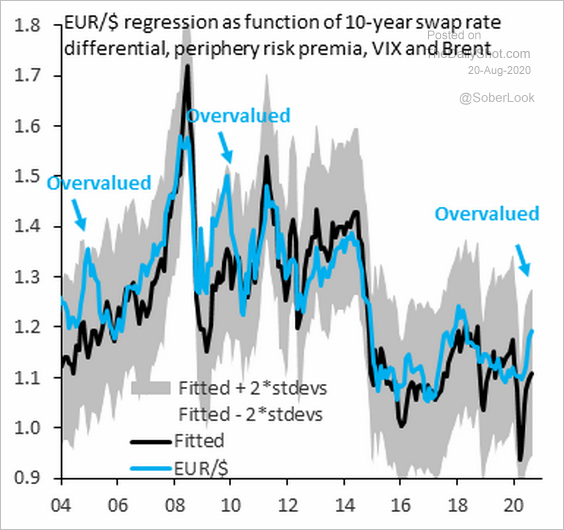

And the key EUR input massively overbought:

So volatility is rising:

Australian dollar is a cork on this wild ocean storm.