One has to be careful to sift what comes out of ZeroHedge. If it is taken literally then we’d all have dropped into caves long ago. But sometimes it does provide fantastic insights into market dynamics. Such as today with this cross-posted gem:

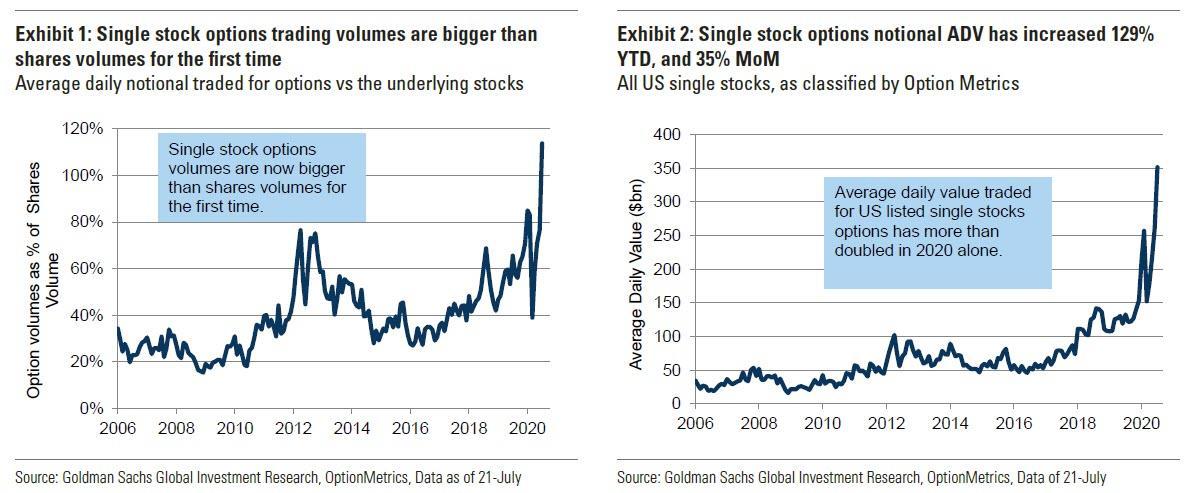

It was back in July when we first reported that Goldman had observed a “historic inversion” in the stock market: for the first time ever, the average daily value of options traded has exceeded shares, with July single stock options volumes hitting 114% of shares volumes.

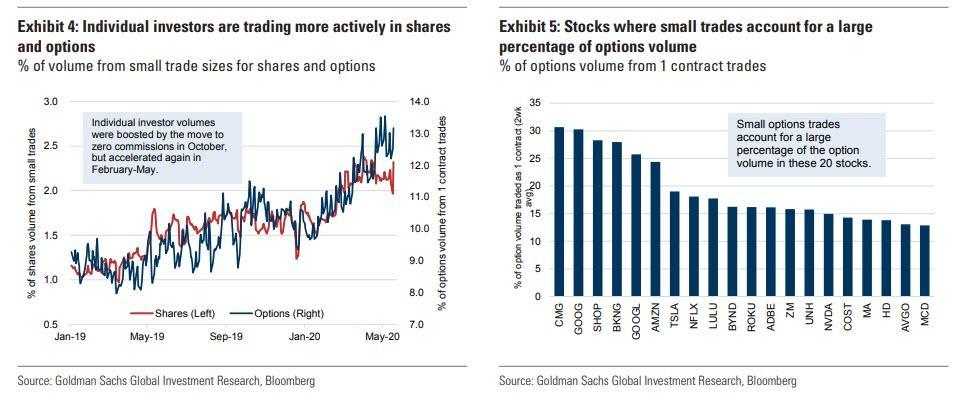

This followed a May report in which we discussed “how retail investors took over the stock market”, pointing out the “recent surge in options trading – which has far more impact on market flows due to embedded leverage” and cited Goldman data which showed that “individual investor active trading is playing an increased role in market volatility, particularly in select stocks. In the shares market, 2.3% of all volume is made up of trades for $2,000 or less. The increase in small trades has been even more notable in the options market, where 13% of all trades are for 1 contract.”