It’s just awful listening to the lunatically conservative RBA, via yesterday’s minutes:

The US dollar had depreciated significantly against the currencies of other advanced economies over recent months, including the Australian dollar. In part, this reflected an unwinding of the earlier appreciation of the US dollar related to an episode of financial market volatility in March and April during which investors had sought less risky investments. The appreciation of the Australian dollar had been consistent with the increase in commodity prices, particularly iron ore prices, over recent months. While members noted that the Australian dollar was broadly aligned with its fundamental determinants, a lower exchange rate would provide more assistance to the Australian economy in its recovery.

Forex markets do not give two hoots about this stodgy rhetoric. Discussion of “fundamentals” and “aided recoveries” is so yesterday. So responsible.

If you want a lower AUD then you need to get irresponsible which, ironically, is the new responsible. How do you do that? Print or be damned!

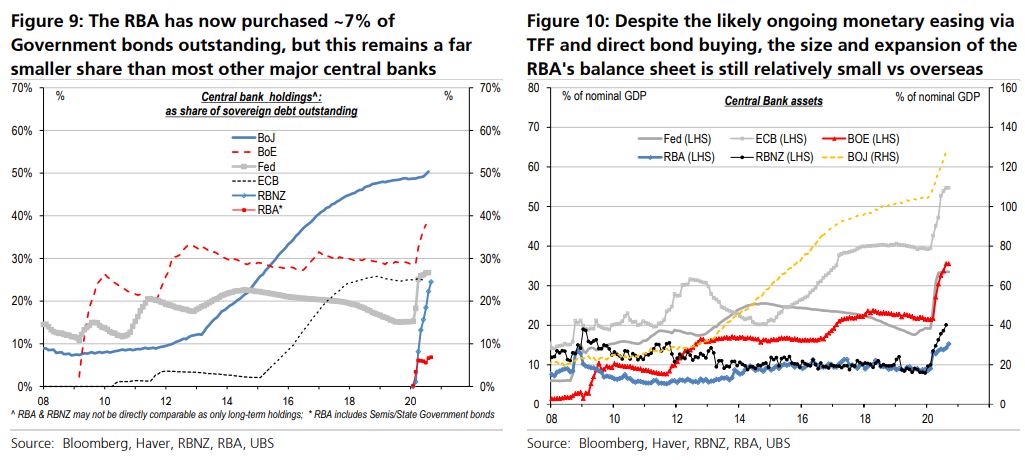

Deploy the balance sheet. Roll QE purchases out the bond curve. Start buying primary issuance, as well as in the secondary market. Buy state government debt for both. Print money for AUD portfolio holders. Monetise the virus.

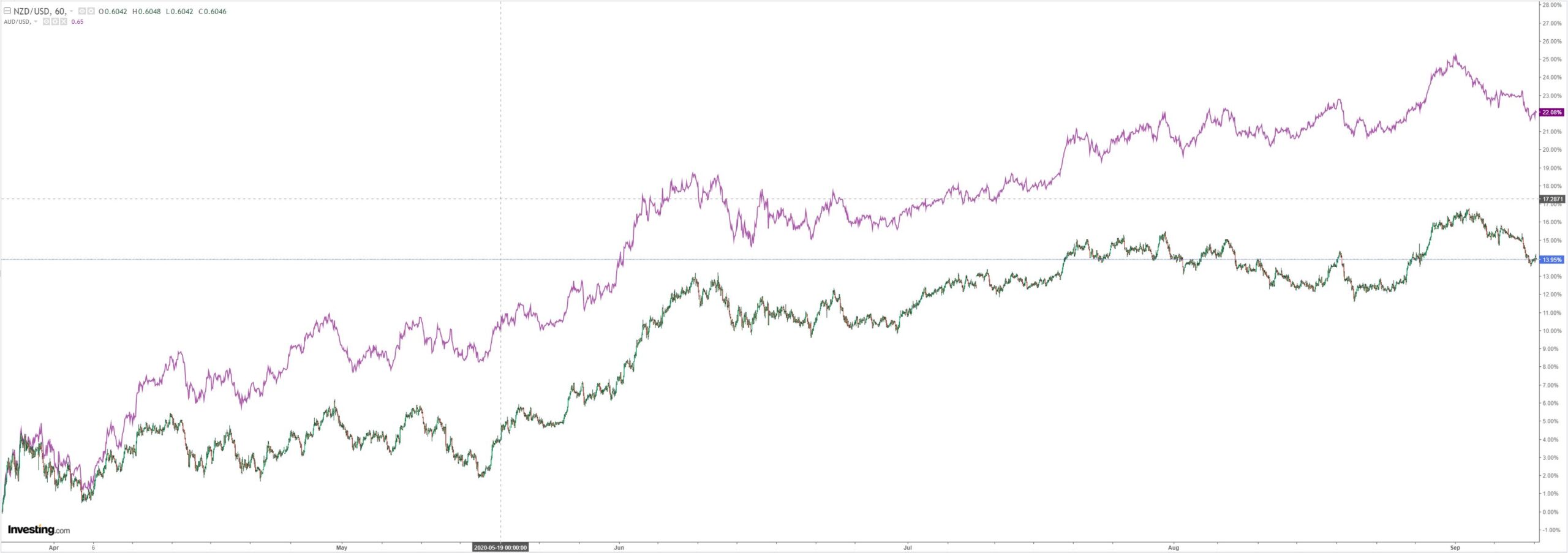

NZ has a better recovery, higher terms of trade, less virus, yet LOWER BOND YIELDS than Australia, snuffing out the carry trade. As such, its currency is radically underperforming ours:

Sack Deflation Phil and put a wild-eyed and irresponsible money printer in charge.

It’s the only responsible thing to do.