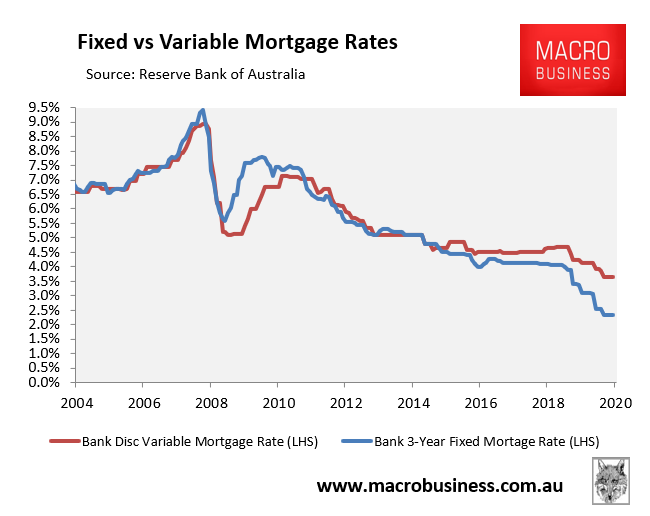

The latest indicator mortgage lending rates from the Reserve Bank of Australia (RBA) revealed that the average discount variable mortgage rate was just 3.65% at the end of September, whereas the average 3-year fixed rate was even lower at just 2.35%:

According to RateCity, mortgage rates offered by Australia’s big four banks could fall below 2% if the RBA cuts the official cash rate to just 0.1%:

RateCity research director Sally Tindall said that if the cash rate was cut, the home loan rates of the big four were likely to fall below 2 per cent.

“There are 12 lenders now offering home loans below 2 per cent, and the list is growing by the week,” she said.

“With a possible rate cut waiting in the wings, we could even see a big four bank break the 2 per cent barrier over the next few months”…

In April the lowest variable rate across all lenders was 2.39 per cent. In September it was 1.89 per cent – a decline of 50 basis points.

The lowest rate for a two-year fixed rate mortgage in April was 2.09 per cent; now, it’s 1.99 per cent.

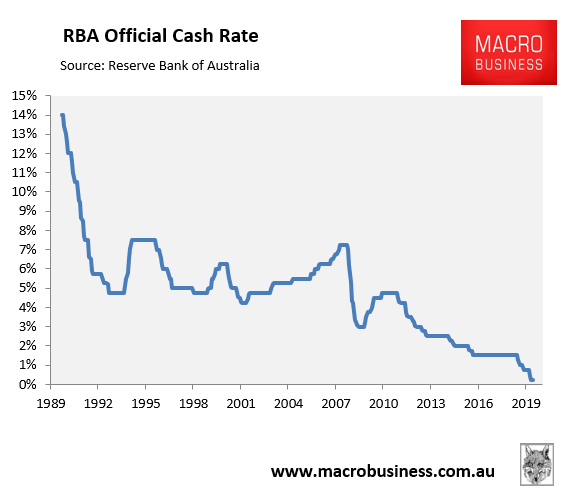

I’d previously worked off the assumption that with the RBA cash rate almost at zero, the 30-year decline in mortgage rates has run its course:

In turn, I’d argued that Australians would no longer be able to rely on the tailwind of falling interest/mortgage rates to help repay their debts, which would prevent home prices from inflating much faster than income growth.

However, the Term Funding Facility (TFF) recently set up by the RBA is a potential game changer. As noted by Nucleus Wealth’s Damien Klassen last week:

The Reserve Bank of Australia has begun providing three-year funding to banks at 0.25% for mortgages. Banks can probably use this money to go below 2% for three-year loans. And that is just the beginning.

It started in April with an “initial” funding allowance for banks. Then an “additional” funding allowance. Now there is a “supplementary” one.

There is clearly a risk of running out of adjectives to describe the bank funding. But there is no risk of running out of the desire to keep the property market ticking over with low interest rates and oodles of credit. The Treasurer’s announcement last week requesting banks to start lending irresponsibly confirmed that for anyone who still doubted.

Europe has already paved the way. The European Central Bank started with 0.1% funding for banks in 2014. By 2016 the rate was -0.4%. Now, -1.0%. Yes, the central bank will pay commercial banks up to 1% if they can just find someone (anyone!!!) who will just borrow the money.

Thus, if the RBA follows Europe’s path, we could soon see the TFF eventually providing negative interest rates and plunging mortgage rates well below 2%.

When combined with the Morrison Government’s proposed gutting of responsible lending rules, easier access to credit alongside cheaper credit will obviously be bullish for Australian property prices (other things equal).