DXY was firm last night as EUR breaks:

The Australian dollar bounced off 70 cents again:

Gold still looks troubled:

Oil bounced just because. The outlook is terrible if Biden wins as Iran joins Libya in a new gusher

Metals were mixed:

Miners did better:

EM stocks too:

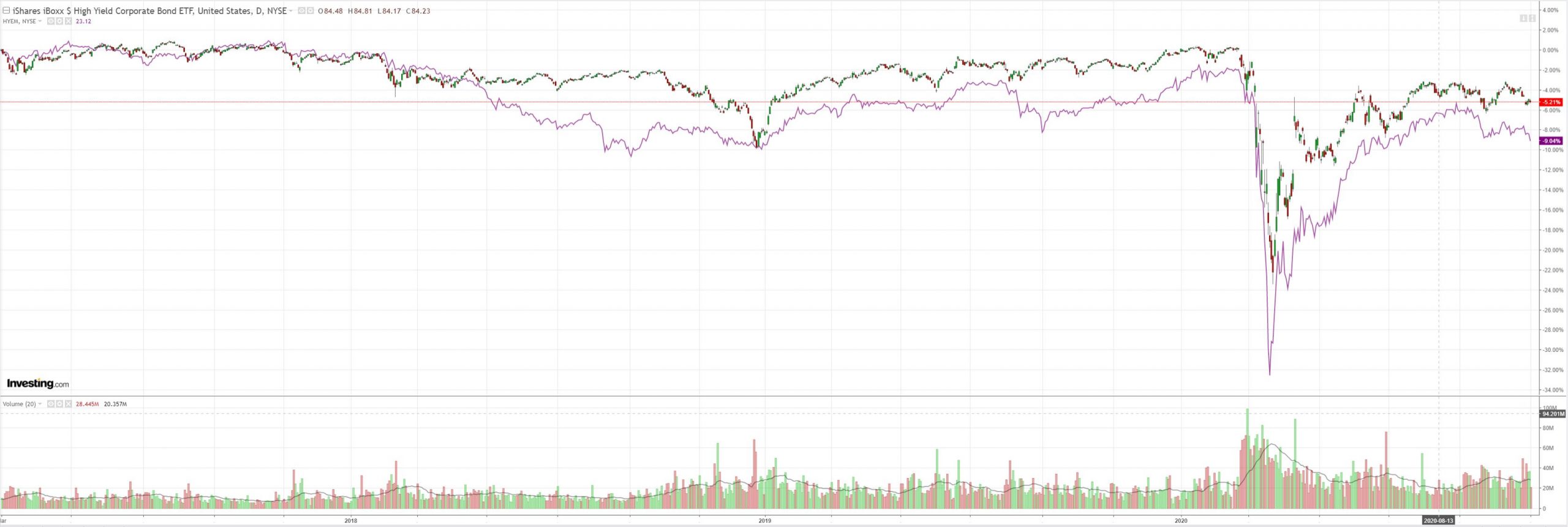

But EM junk issued a new warning:

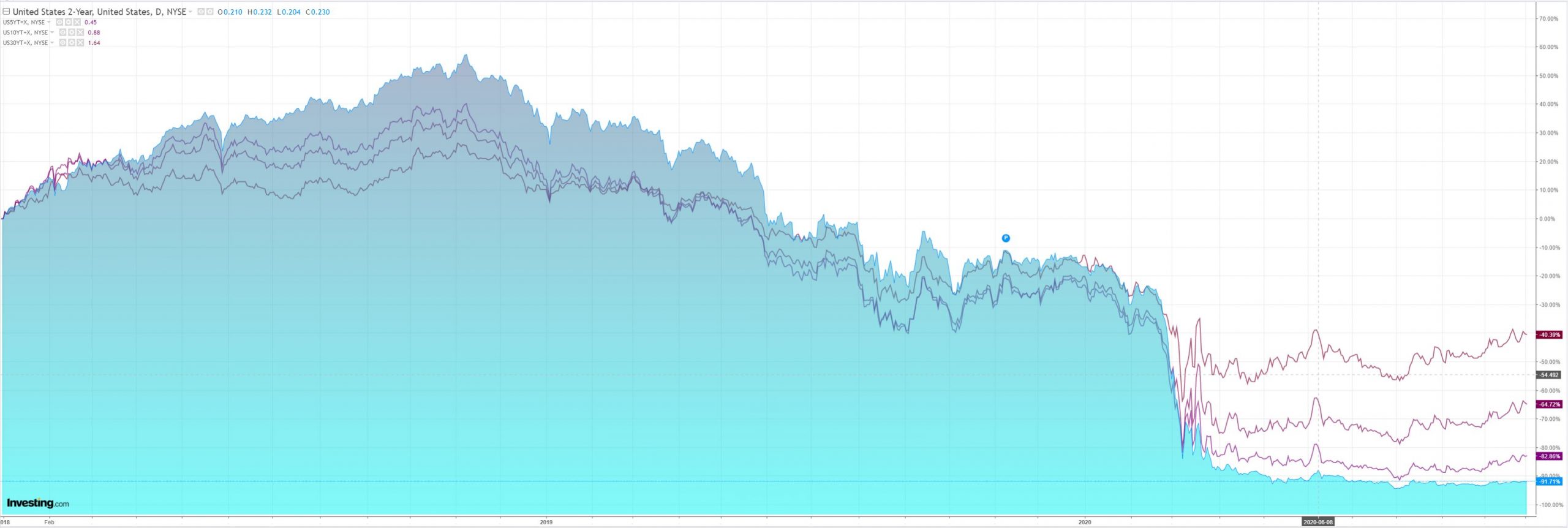

As Treasuries rallied:

Which should have supported tech but stocks went the other way:

Westpac has the wrap:

Event Wrap

US manufacturing ISM in Oct. rose to 59.3 (vs. est. 55.8, prior 55.4) – the highest level since September 2018 (when it was also at 59.3). The key drivers of the gains were new orders (rising to 67.9 from 60.2), production (to 63 from 60.2), prices (to 65.5 from 62.8) and new export orders (to 55.7 from 54.3). The employment component also rose, to 53.2 from 49.6. Final Markit manufacturing PMI rose to 53.4 (est. 53.5, flash 53.3).

Eurozone final Markit manufacturing PMI rose to 54.8 (flash 54.4, 53.7 in Sep.). UK final Markit manufacturing PMI also rose, to 53.7 (flash 53.3, 54.1 in Sep.). Although the European surveys improved, there were clear concerns over the increases in COVID cases and restrictions, and uncertainty over the continuing EU/UK post-Brexit trade talks.

Event Outlook

Australia: The RBA will hold its Nov policy meeting. Westpac expects the cash rate; 3-year bond rate target; and TFF rate to be lowered to 0.10%. The bond purchase program will also be expanded. VIC willobserve Melbourne Cup Day.

US: Throughout the day, all eyes will be on the 2020 US Presidential Election. Results are expected to start coming in Wednesday around midday ADST.

Factory orders have been supported by transport and electronic orders in recent months (prior: 0.7%, market f/c: 1.0%).

Global manufacturing is up and away on catch-up growth and the inventory cycle. This has a way to run and will be a market support through the virus. But it’s lagging not leading.

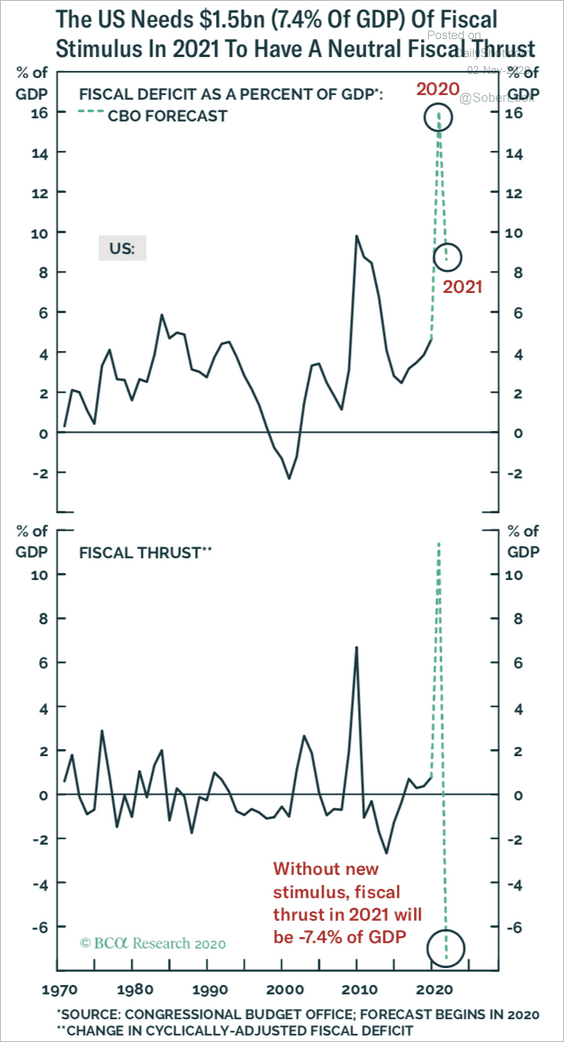

Leading is the virus, fading stimulus and shocked services. The stimulus is about to turn massive fiscal drag in the US:

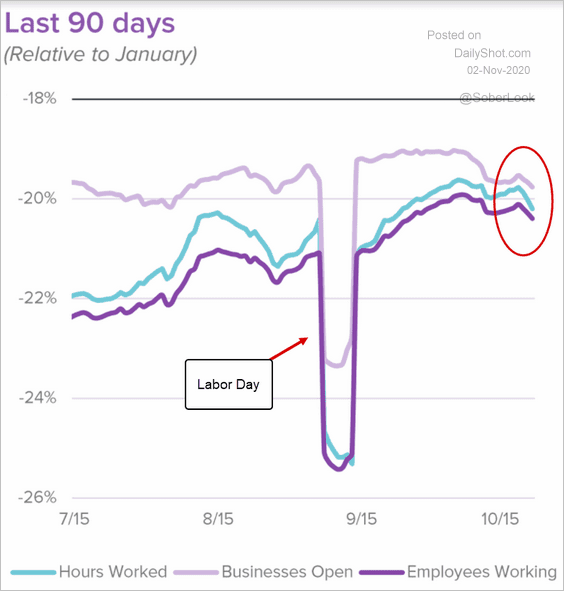

Even as the virus has begun shutting down US activity:

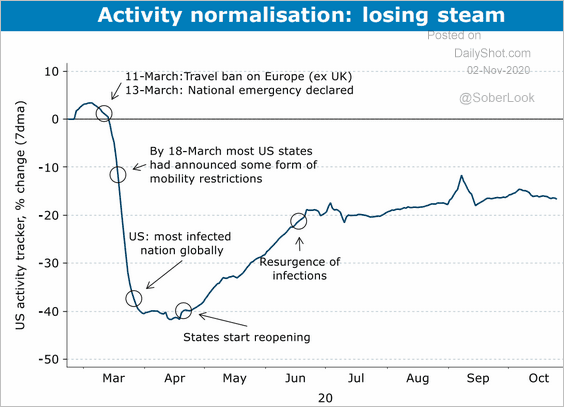

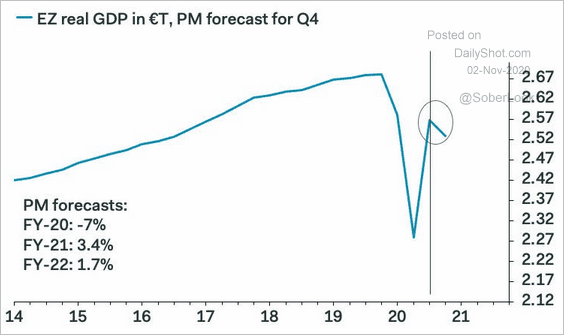

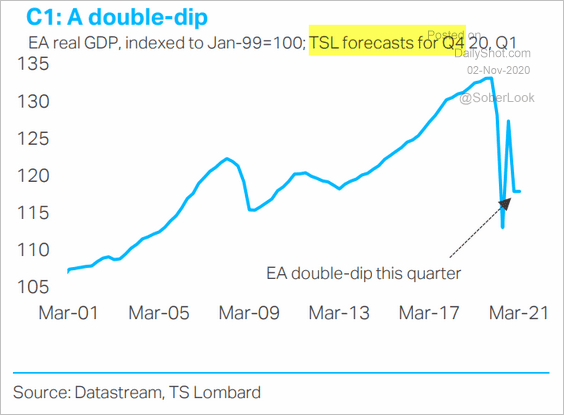

In the Eurozone as well:

Earnings are about to be smashed again. When or whether markets price that will determine the direction for the Australian dollar.

They certainly should, and the poo should break 70 cents and move lower, but markets are borderline incoherent now.

They bid value when yields fall. They bid risk when tyranny rises. They bid equity when credit falls. They go long capitalism as it dies.