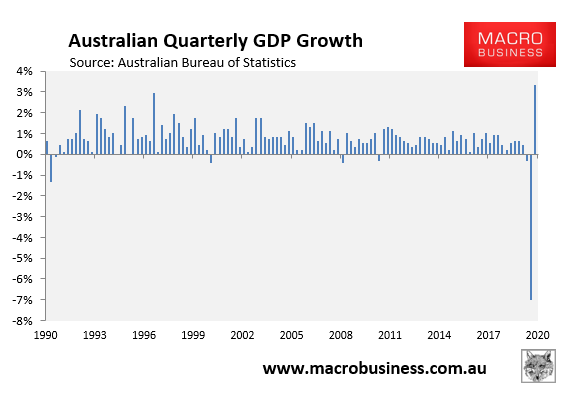

As reported last week, the Australian economy rebounded strongly from its first official recession in 30 years, registering 3.3% growth. This followed declines in GDP of 0.3% and 7.0% respectively over the March and June quarters:

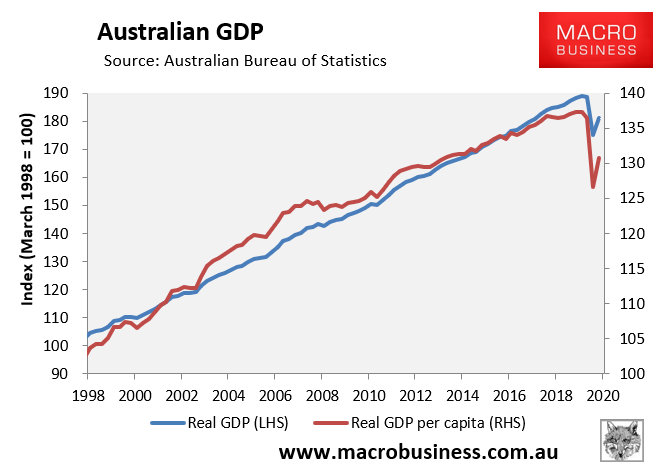

Despite the strong rebound, Australia’s real GDP remains 4.2% below its December 2019 peak, whereas GDP per capita remains 4.8% lower:

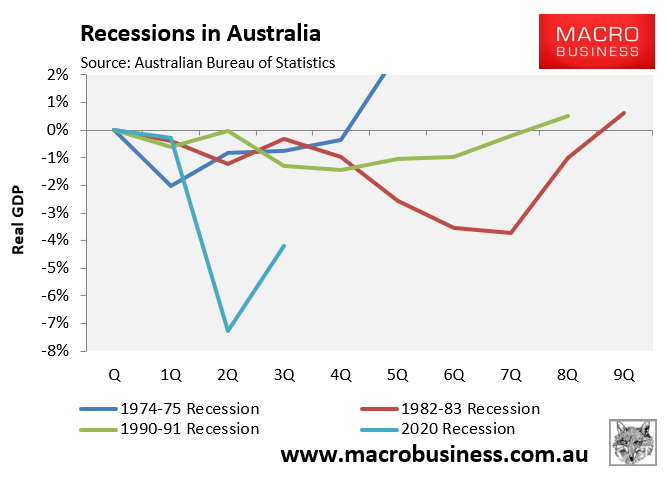

In order to put the COVID-19 recession and rebound into perspective, below is a chart comparing the current episode to the recessions / recoveries of the mid-1970s, early-1980s and early-1990s:

As you can see, the COVID-19 induced recession dwarfed the three prior episodes, with the cumulative 7.3% downturn roughly twice as severe as the 1980s recession (-3.7%) and roughly three to four times more severe than the 1970s (-2.0%) and 1990s (-1.4%) recessions.

However, the rebound from the COVID-19 recession has also been swift and ‘V-shaped’ as lockdowns and restrictions have eased and the virus has been contained.

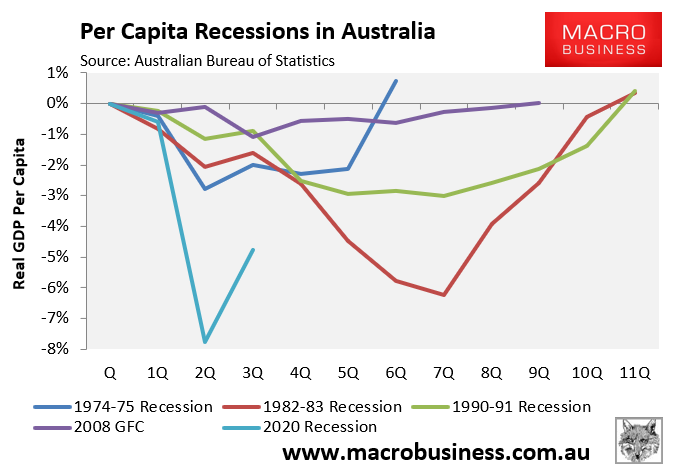

Turning to per capita recessions, we also need to include the 2008 Global Financial Crisis (GFC):

Here the story is similar. Australia’s COVID-19 economic contraction of 7.8% easily surpassed those of the 1980s (-6.3%), 1990s (-3.0%), 1970s (-2.8%) and GFC (-1.1%) per capita recessions.

Again, however, the 3.0% rebound over the September quarter was particularly swift and ‘V-shaped’ compared with prior recessions.

Australia’s strong economic recovery is poised to continue for the following reasons.

First, the primary cause of Australia’s recession – economic lockdowns – have ceased, meaning the economy will naturally recover as the artificial barriers preventing economic activity have been removed.

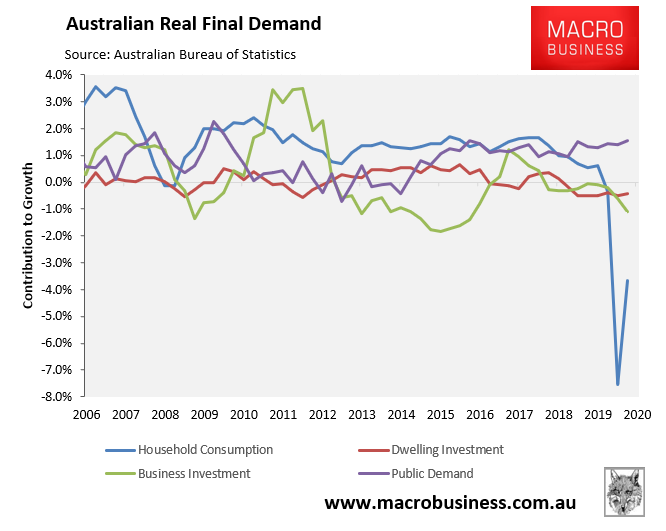

We have already witnessed the effects, with household consumption driving the contraction (due to restrictions on spending) and subsequent recovery (as lockdowns eased):

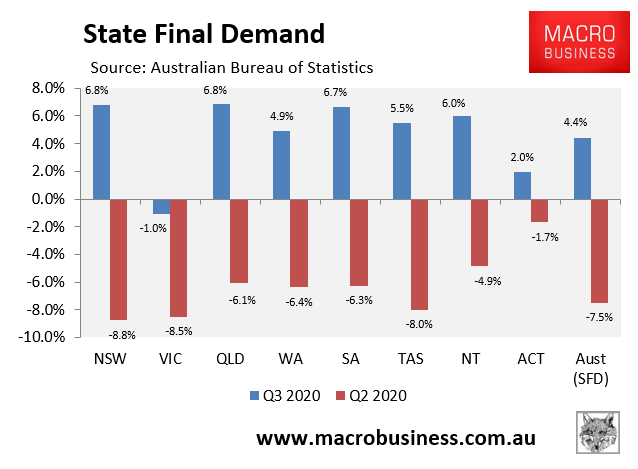

Second, Australia’s September quarter recovery was strong despite Victoria remaining under lockdown and detracting from national growth:

As Victoria has now opened up, its economy will experience strong catch-up growth over the December and March quarters, thus fortifying Australia’s rebound.

Third, federal and state governments are engaging in enormous amounts of fiscal stimulus at the same time as the private sector economy is naturally recovering post lockdowns. This will continue to drive growth and fortify the economic recovery.

Sure, emergency income support measures like JobKeeper, the JobSeeker supplement and early superannuation release will continue to be pulled back over the first half of 2021. But this won’t be enough to offset the rebounding private sector economy (especially household consumption) post lockdowns.

Fourth, monetary stimulus is strong. The RBA is actively intervening to crater interest rates. Access to credit is also likely to become easier thanks to the proposed axing of responsible lending laws alongside the neutering of Australia’s financial regulators.

Finally, a vaccine rollout from mid-2021 could see immigration and international tourism return faster than expected, further supporting aggregate growth.

In summary, everything concerning the Australian economy has turned out better than expected and the economy now faces the prospect of a strong rebound and V-shaped recovery in 2021.