In December 2018, a parliamentary committee into Managing Compliance with Foreign Investment Obligations for Residential Real Estate slammed the Australian Tax Office (ATO) for failing to enforce rules precluding foreign nationals from purchasing established Australian homes:

Despite at least 877 breaches of the country’s foreign ownership laws being uncovered in Victoria, the Australian Taxation Office has failed to land a single criminal prosecution since tough new laws came into effect more than three years ago…

Labor MP Julian Hill, the deputy chairman of the Public Accounts and Audits Committee, said it was “astonishing that there had been no prosecutions”…

This followed a parliamentary committee’s finding that not one intermediary facilitating illegal foreign sales (e.g. real estate agents, developers or conveyancers) had been prosecuted by the ATO.

Fast forward two years and Treasurer Josh Frydenberg is talking tough on stopping illegal foreign purchases of Australian homes:

The Morrison Government will launch a new Tip Off and compliance campaign, to ensure foreign investors purchasing residential real estate in Australia are doing the right thing, and those that breaking the rules are subject to appropriate penalties…

The Tip Off campaign continues to build on the Government’s reforms to strengthen Australia’s foreign investment framework. This follows legislation passed by the Parliament that introduces higher infringement notice penalties for residential land valued over $5 million to support more effective enforcement, as well as new civil penalties and infringement notices for providing false or misleading information…

Australians expect their Government to maintain a high standard of enforcement in order to safeguard Australia’s national interest, businesses and the economy.

If you have information about someone who may be breaking the foreign investment rules or you have concerns about suspected illegal behaviour and activities by foreign persons relating to their ownership of Australian residential real estate, you can make a confidential tip off by calling the Australian Tax Office’s hotline on 1800 060 062 or completing the online tip off form.

If you are a foreign person and you have not followed the rules you should also contact the tip off hotline. There are strict penalties including criminal prosecution resulting in large fines or up to three years’ imprisonment for breaching foreign investment rules. Lower penalties may apply for foreign persons who come forward voluntarily.

This is pure tokenism on Josh Frydenberg’s part. How do we know?

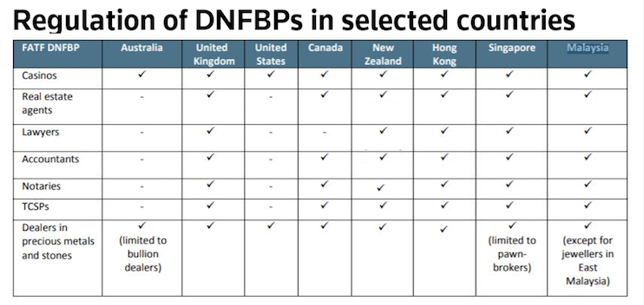

First, Australia has refused to implement global anti-money laundering (AML) rules pertaining to real estate gate keepers (e.g. real estate agents, accountants, conveyancers, etc), despite promising to do so 14 years ago.

This has left Australia with the weakest property AML rules in the world, and has opened the way for illegal money to gush through Australian real estate:

Second, despite having the ability to financially penalise illegal investment in established housing by foreign nationals, as well as third parties that knowingly assist foreigners to illegally purchase Australian homes, the ATO has failed to prosecute.

It is astonishing that the ATO can vigorously pursue small businesses and individuals for minor avoidance or errors in tax returns, but turn a blind eye to illegal foreign buyers scooping-up Australian homes, along with their enabling real estate agents.

When combined with its soft touch on AML rules, it is clear the Australian Government has little interest in actually policing illegal foreign buyers of real estate, and is complicit with the dirty money flooding into Australia’s homes and robbing young Australians of a housing future.