After experiencing 20%-plus declines in values and rents in the six years from 2014, Perth’s property market is experiencing booming conditions not seen since the mid-2000s mining boom:

REIWA statistics showed during the December quarter the average time it took for a Perth house to sell was nearly halved to 21 days, compared to 38 days the year before…

Bourkes Property real estate agent Steven Webster said the surge in demand had led to one in five of the Como agency’s properties being sold before it even reached market.

“It would have been lucky if it was one in 50 sold off-market last year,” he said…

Curtin University housing expert Steven Rowley said the interest had been brought on by a perfect storm of COVID-19 and other market factors.

“The market was showing strong signs of recovery pre-COVID and a lot of that demand has been held over until now so there’s a big flood of buyers that would have been coming back into the market after a period of very slow activity,” he said.

“There’s also the herd mentality as well. A lot of these people have been sitting off buying and just waiting until the market bottomed out and have seen stories of price growth and so forth.”

Australians returning to Perth from overseas and the eastern states are also contributing to the growing pool of people looking to buy up in the west.

While it would be easy to discount these anecdotes as spin, they are supported by the macro data.

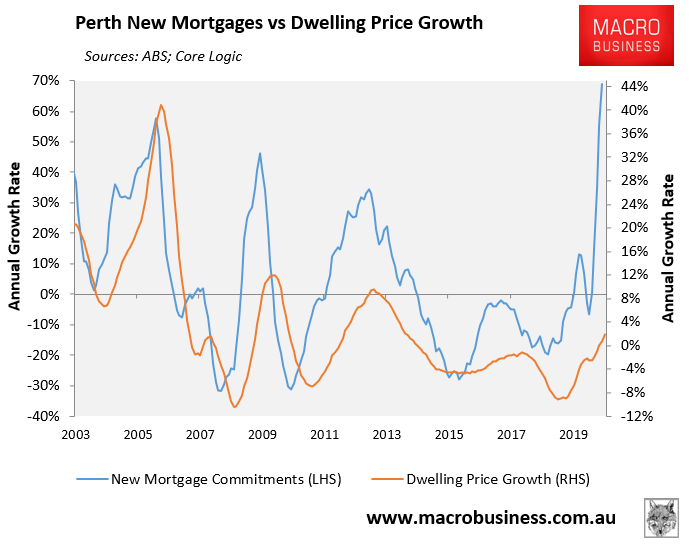

First, mortgage demand has rocketed to record high levels, signaling strong price rises:

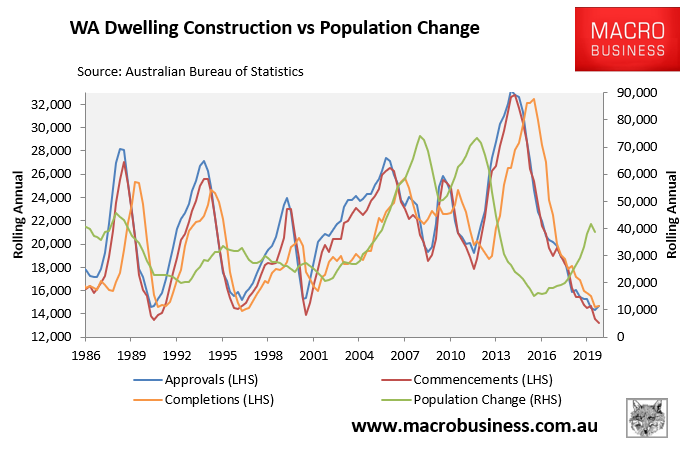

Second, Perth dwelling supply has tightened materially, with construction rates falling well below population growth:

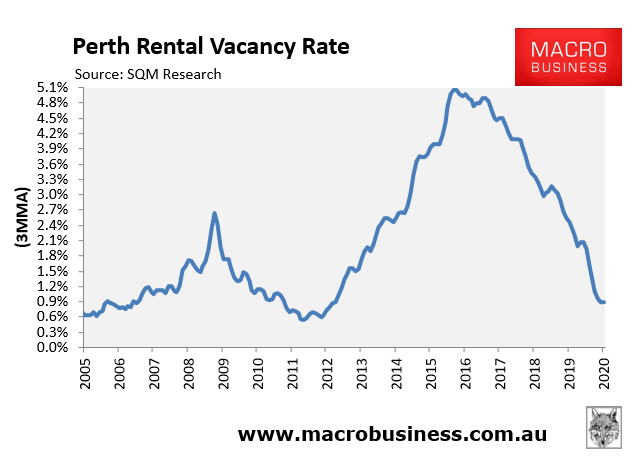

Reflecting this undersupply, rental vacancy rates across Perth have plummeted to just 0.9%:

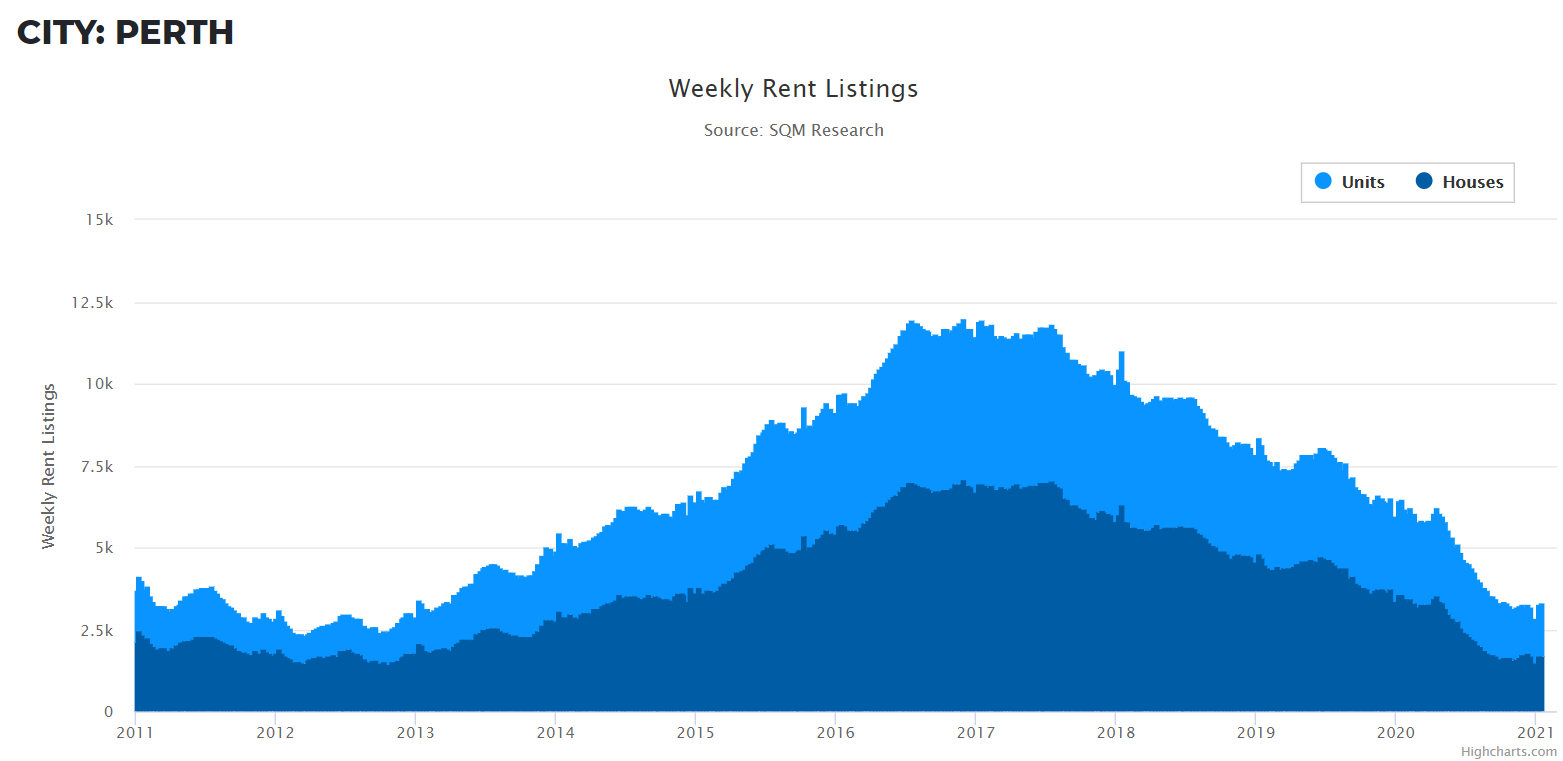

Rental listings have also collapsed:

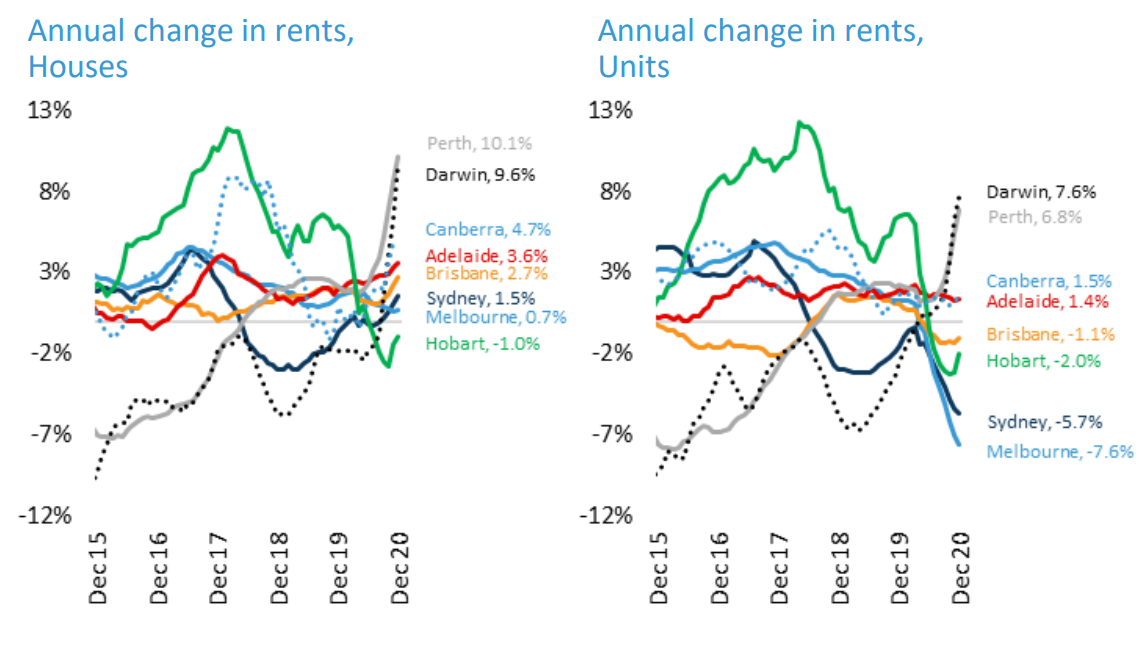

Accordingly, Perth rental growth is booming, with house rents rising an unprecedented 10.1% in the year to December 2020:

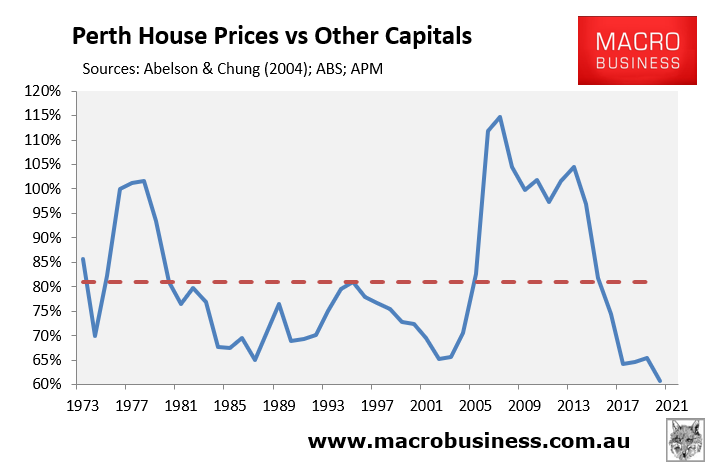

Finally, Perth property is at its best relative value in around half a century:

Perth property is justifiably red hot.