New Treasury data shows that the federal government received 75,143 applications for the HomeBuilder grant during the first phase of the scheme, including more than 35,000 during the last three weeks of 2020.

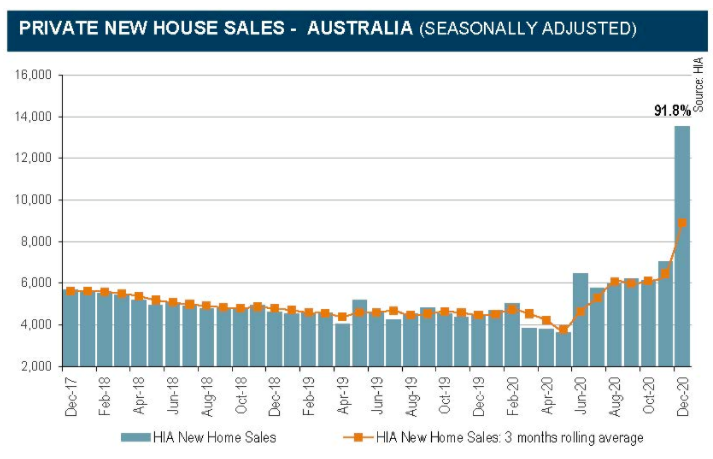

The Treasury had forecast in June that it would receive just 27,000 applications for the grants by 31 December. The unexpected surge in demand for HomeBuilder will result in the cost of the scheme rising from $688 million to around $2 billion. It has also been behind the unprecedented rise in new home sales, as reported yesterday by the HIA:

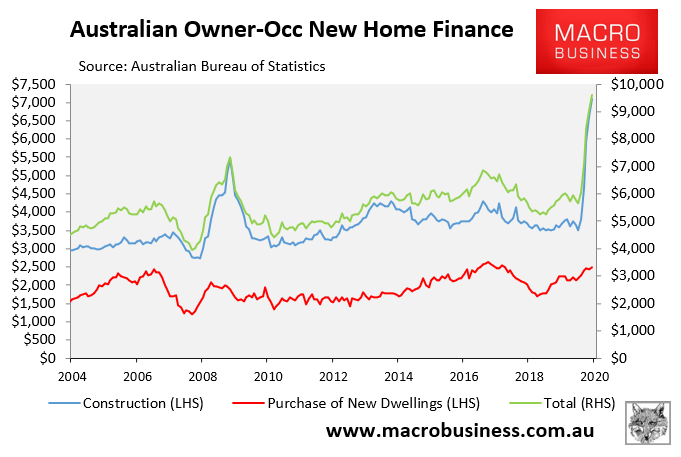

As well as the huge lift in construction finance commitments:

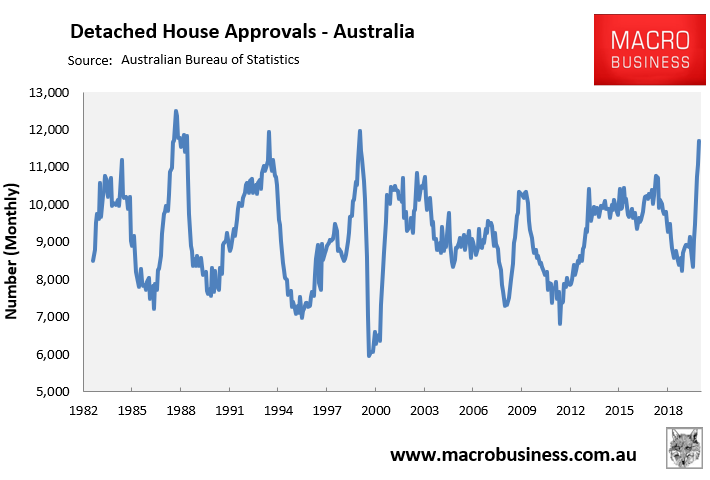

And the strong lift in detached house approvals to 20-year highs:

Accordingly, the HomeBuilder scheme is now expected to boost residential construction activity by up to $18 billion over the next year and increase broader economic activity by $50 billion over this period:

The surge in applications for new dwellings or major renovations, will see the cost to the budget of the scheme balloon from its original $688m to upwards of $2bn. However, modelling of the new data shows the added activity will support more than $18bn worth of new construction over the coming year and deliver an unexpected boost to growth through the broader economy.

Economists have estimated that the combination of government grants and the commitments of home builders would drive more than $50bn in broader economic growth, with a three times multiplier effect on investment.

Beyond that, the picture is less rosy, with the strong pull forward of demand likely to crash dwelling construction in 2022 and 2023 as subsidies are withdrawn.

The HomeBuilder grant was extended by three months to 31 March, but at the lower rate of $15,000 (instead of $25,000) from 1 January. And from 1 April 2021, HomeBuilder is scheduled to end entirely.

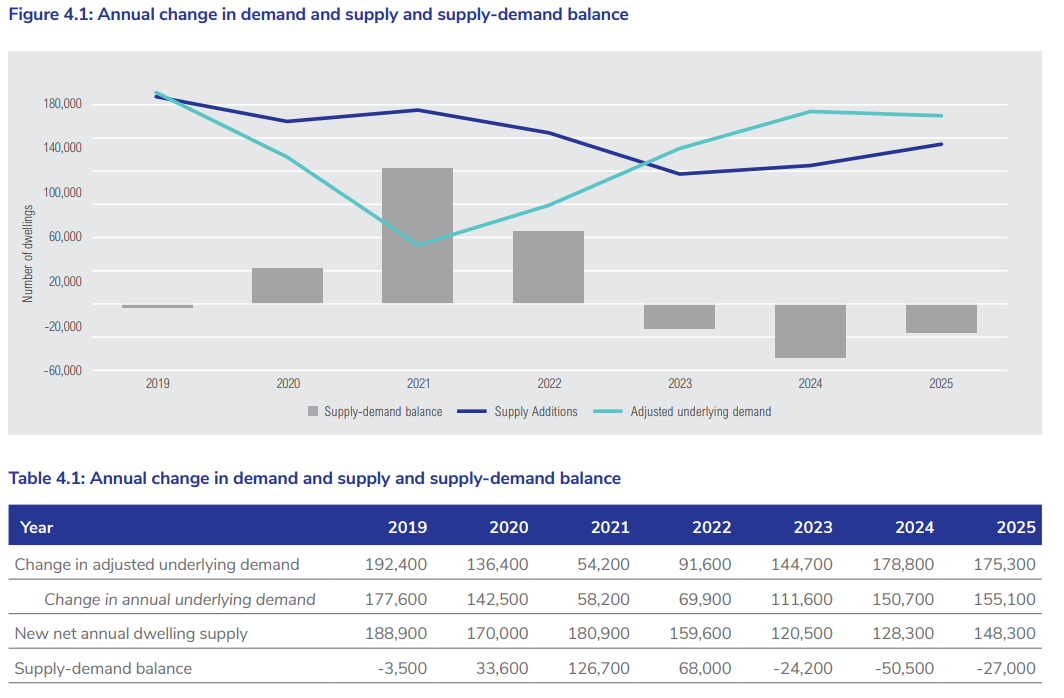

Indeed, official forecasts from the National Housing Finance & Investment Corporation (NHFIC), released last month, projected that construction will dive off a cliff next year:

According to NHFIC, net annual dwelling additions will decline from 180,900 to 159,500 in 2022 and then to only 120,500 in 2023.

Thus, expect to see intense lobbying from property groups calling on the federal government to provide more subsidies, as well as to open Australia to migrants.

Without a return to the mass immigration population ponzi, the housing construction industry will eventually be forced to contract to meet lower levels of demand. They will fight tooth and nail to prevent this from happening.