It’s been a frustrating few months for gold investment. Following the big COVID-19 spike, a falling USD and real interest rates have been unable to sustain the rally, even though these are prime conditions for doing so. DXY:

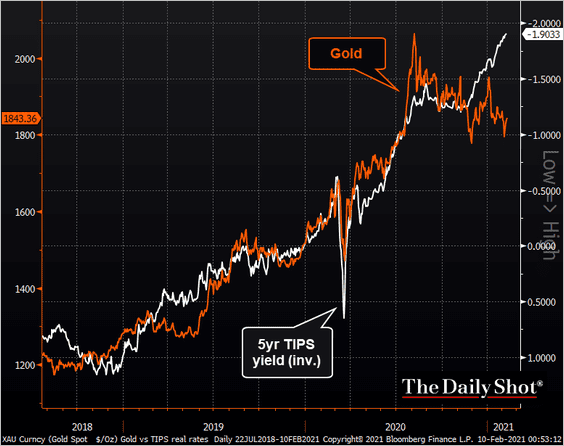

Gold versus TIPS:

Doubtless, gold got overvalued. But its recent underperformance is either a signal that the consensus falling USD and incipient inflation surge isn’t coming or the market is now arguably underpriced.

I don’t put much stock in the notion that it is being displaced by BTC. The two are like chalk and cheese.

Anyway, today, Newcrest has finally fired up the market with a good result:

As Moody’s notes:

“Newcrest’s strong first-half fiscal 2021 results are a credit positive, as elevated gold prices more than offset slightly lower gold production and higher costs. Newcrest’s low cost position and production profile supported record free cash flow in the half and will enable the company to continue generating solid earnings and cash flow levels, even at lower gold prices.

…Although Newcrest raised its target dividend payout ratios, this is manageable for the rating in light of strong cash flow generation and Newcrest’s conservative balance sheet. Maintaining a dividend payout based on free cash flow is credit supportive and allows for flexibility during periods of elevated capital spending.”

The gold price should react positively to its traditional drivers again soon. Given I do not subscribe (yet) to the thesis that we’re in for endless falls in both DXY and US real rates as inflation surges, I would probably take the opportunity to exit the trade when it comes.