US inflation data for January was much lower than expected, which took the edge of the weak USD meme running through currency markets as stocks also stumbled on Wall Street . US Treasury yields pulled back further while commodities kept on bidding with copper and oil making new yearly highs again.

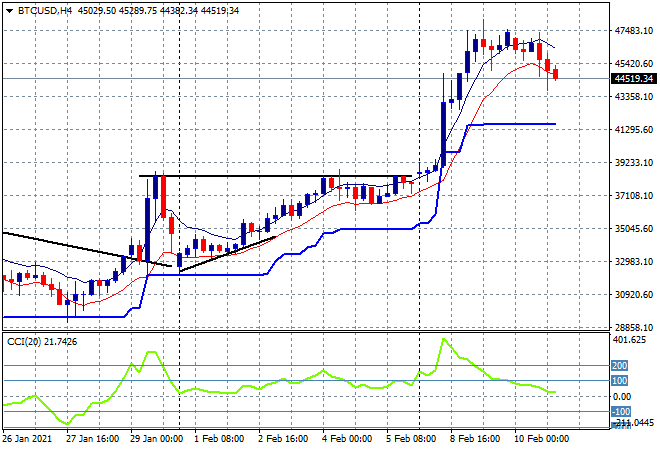

Bitcoin is having an interesting week to say the least, having found some resistance at the $48K level it has now deflated slightly down to just above the $44K level this morning, taking some heat out of the bubblicious rise with support at $41K the area to watch:

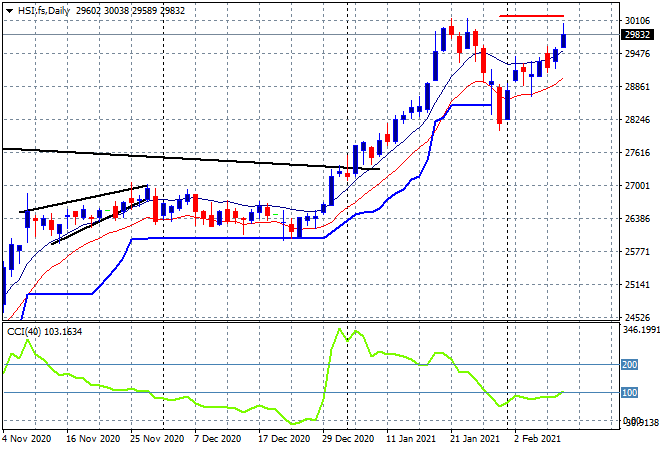

Looking at share markets in Asia from yesterday’s session where the Shanghai Composites closed 1.4% higher, remaining well above the 3600 point barrier while in Hong Kong the Hang Seng Index was up nearly 2% to finally crack through the key 30000 point level. This rebound is really gaining momentum after a temporary stall with price well above the high moving average on the daily chart, and retesting the mid January highs proper:

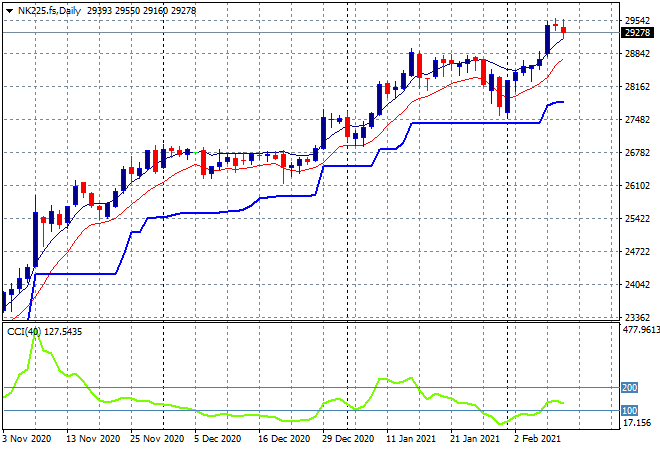

Japanese markets however remain in stall mode with the Nikkei 225 lifting only slightly to close 0.1% higher at 29562 points. Daily ATR support continues to firm higher as medium term support builds at the 28000 point level but there is considerable resistance building at the 30000 point level – will the fall in the USDJPY hinder this run?

The ASX200 took back its previous loss to rebound 0.5% higher to close at 6858 points. SPI futures are down more than 30 points or 0.5% so my theory of a trading range through the week continues:

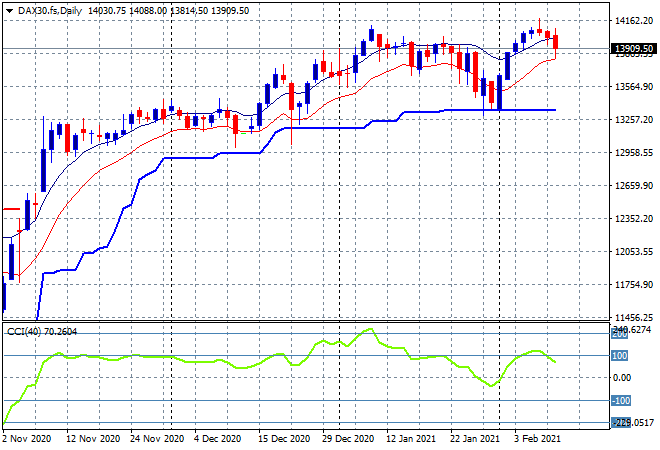

European markets sold off across the continent with the German DAX pulling back 0.5% to close back below the 14000 point level at 13932 points. Price needs to get back above that level as it still has not exceeded the former highs in early January which is firming as strong natural resistance going forward:

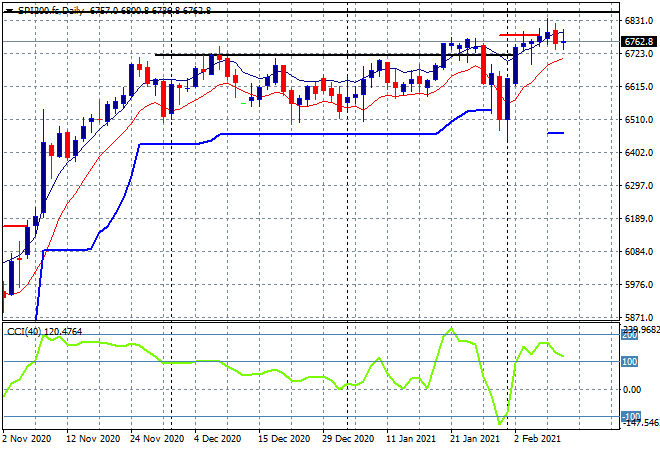

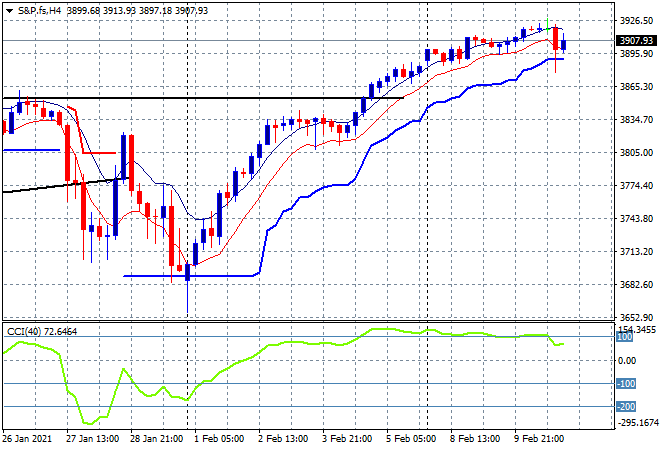

Wall Street continued its stumble with only the Dow putting in a nominal gain while the S&P500 finished with a scratch session, down 0.1% to remain just above the 3900 point level at 3909. The four hourly chart shows price reaching an apogee here even though it wants to get to the 4000 point level, watch momentum, four hourly ATR support at 3900 points and the low moving average for signs of a stall:

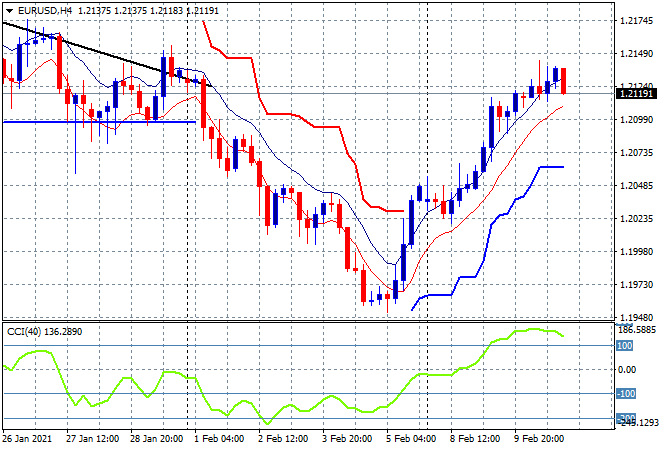

Currency markets are starting to look more interesting with both the German and US inflation prints retesting the weak USD meme as Euro had a very minor stumble overnight that could be presaging an imminent reversal. While momentum remains nicely overbought, price is pulling back to the 1.21 handle with resistance at 1.2150 quite clear:

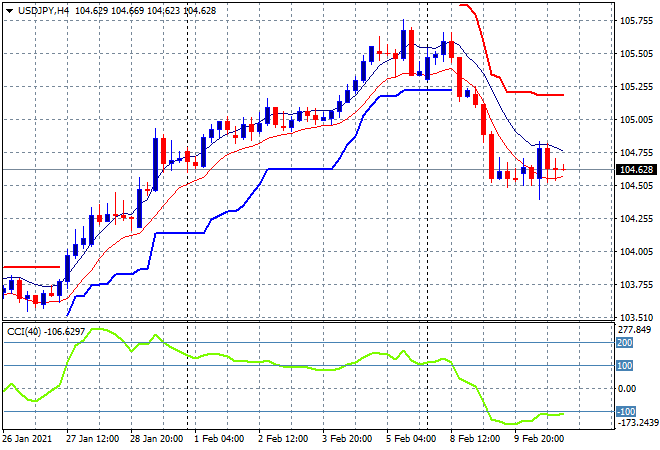

The USDJPY pair remains fixed at the 104.50 level with some intrasession volatility around the US inflation print absorbed without much fuss. In fact, volatility is dropping fast which means a breakout is likely imminent, so I’m watching for any Yen buying that could pick up here on risk aversion and take the pair back to the previous weekly low at the 103’s, with any new session low below the 104.50 level:

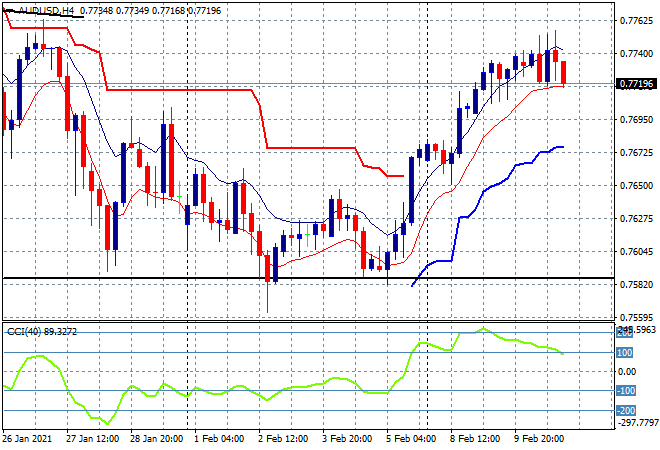

The Australian dollar is also showing signs of topping out in the short term with a pullback towards but not below the 77 handle overnight. The four hourly chart is showing upside resistance at the 77.50 level (not the last three candles) with momentum starting to cross back from the previously overbought levels. As I said yesterday, the Pacific Peso is ripe for a small pullback as exhaustion could be settling it as it closes in on the previous weekly highs above the 77.40 level:

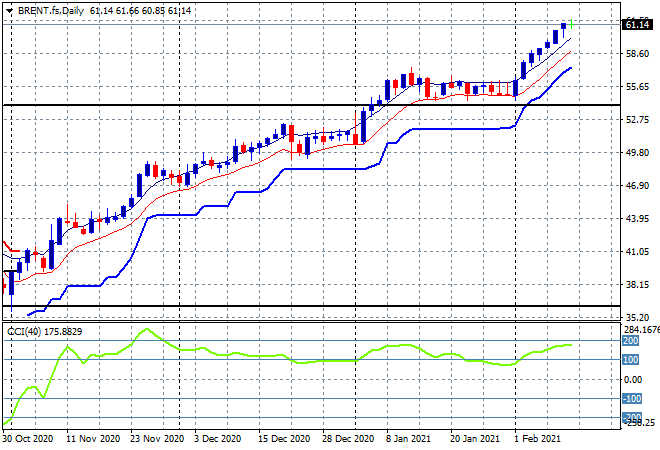

Oil prices continued their breakout with Brent moving higher yet again, this time remaining above the $61USD per barrel level, just making another new daily high and still well above the pre-COVID level trading range. I maintain the upside target here could be as high as $70USD per barrel at the 2019 highs:

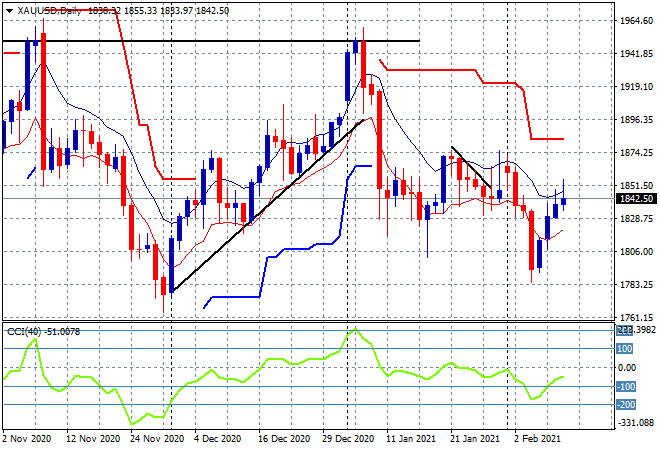

Gold is slowly coming back in line with other alternative currencies but remains weak at best, despite a small move higher overnight through the $1842USD per ounce level. Momentum is slowly picking back up as this swing long play matures, but the obvious level to watch is the former highs at the $1870 level as key daily resistance:

Glossary of Acronyms and Technical Analysis Terms:

ATR: Average True Range – measures the degree of price volatility averaged over a time period

ATR Support/Resistance: a ratcheting mechanism that follows price below/above a trend, that if breached shows above average volatility

CCI: Commodity Channel Index: a momentum reading that calculates current price away from the statistical mean or “typical” price to indicate overbought (far above the mean) or oversold (far below the mean)

Low/High Moving Average: rolling mean of prices in this case, the low and high for the day/hour which creates a band around the actual price movement

FOMC: Federal Open Market Committee, monthly meeting of Federal Reserve regarding monetary policy (setting interest rates)

DOE: US Department of Energy

Uncle Point: or stop loss point, a level at which you’ve clearly been wrong on your position, so cry uncle and get out!