Industry Super Australia (ISA) is preparing to ramp up its media campaign over what it claims is the federal government’s reluctance to proceed with the legislated increase in the superannuation guarantee (SG) to 12%.

Superannuation Minister Janet Hume has accused the ISA of “self-interest”, claiming that the super industry stands to receive an additional $2.5 billion in fees by 2030 if the increase goes ahead.

ISA’s advertising falsely suggests the government wants people to sell their homes in order to finance their retirement.

ISA spends around $12 million of members’ funds annually on advertising.

From The AFR:

ISA chief executive Bernie Dean said the group was moving to a “war footing” with a national media buy designed to raise awareness of a possible shift in government policy to not proceed with the super guarantee increase…

Reflecting the ferocious attacks launched by former prime minister Paul Keating earlier this year, the ads suggest the government wants people to sell their homes to fund their retirements.

“We’ve worked all our lives for this place, we’d hate to have to sell it to fund our retirement,” one couple says…

When will ISA openly admit that Australia’s compulsory superannuation system is grossly unfair given that it provides the greatest concessions to those that need it least: high income earners?

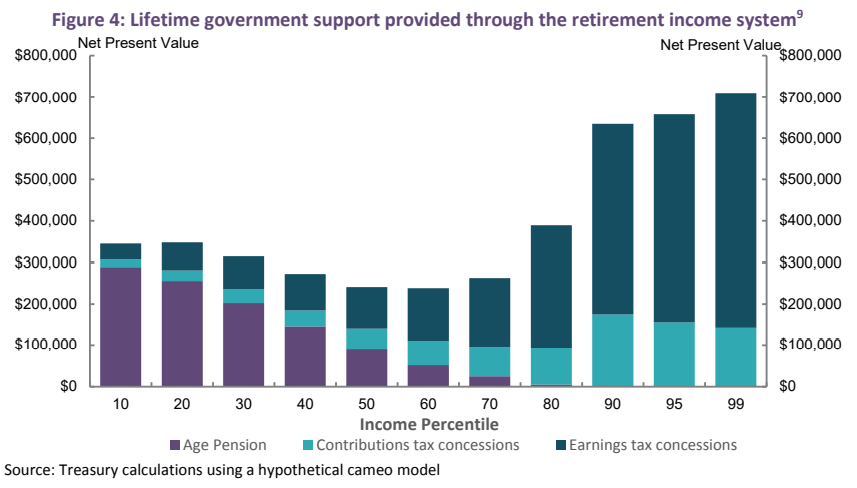

This inequity is illustrated clearly by the below Treasury chart showing that high income earners receive the overwhelming majority of tax concessions, as well as way more taxpayer support than low income earners receiving the full aged pension:

Looking at superannuation in isolation, Treasury projects that the top 1% of income earners will receive over $700,000 in tax concessions on average over their working lives, which is roughly 14-times the $50,000 of concessions that will be received by the bottom 10% of income earners.

Thus, Australia’s superannuation system is basically a tax dodge for the rich and an ‘inequality machine’.

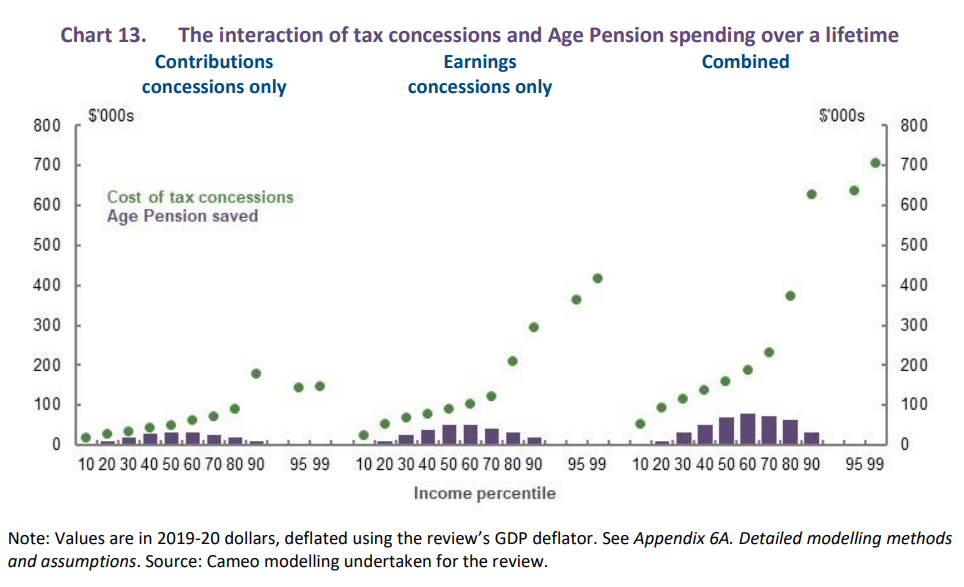

The cost of these concessions on the federal budget is also gigantic, with around $40 billion of revenue lost via super concessions every year. It’s so bad that Australia’s compulsory superannuation system is projected to cost the federal budget far more than it saves in aged pension costs:

Lifting the SG to 12% would obviously make these problems worse, in addition to lowering workers’ take home pay.

The logical thing to do, therefore, is to abandon the legislated lift in the SG and instead reform the concession system to make it more progressive. This would provide ordinary Australians with more funds in retirement without punching a bigger hole in the federal budget.

Of course, ISA opposes sensible super reform because it would not lead to more funds under management. It’s far better for ISA’s bottom line to lazily raise the SG to 12% and skim an additional $2.5 billion in fees, as noted by Jane Hume above.

The fact that ISA is spending members’ funds on an advertising campaign to spread propaganda is the ultimate insult.