Another wild night on markets Friday. DXY was smashed as risk trades roared. Equities are out of control. Bond yields firmed. The Australian dollar rebounded but underperformed materially. EUR crunched DXY:

The Australian dollar still has a giant head and shoulder topping pattern versus the US and is trending down versus other DMs:

AUD is also underperforming key EM competitors now. Pretty remarkable given Brazil is overrun with virus:

Copper is a massive and still inflating bubble:

Big miners were firm:

EM stocks caught a bid but still look sick:

The global economy early warning system, junk debt, is all green:

US yields firmed:

Stocks roared to the top or recent ranges:

Global PMIs tell an interesting story. The US is blasting off with its combined manufacturing and services PMI at 62.2. Both services and manufacturing are above 60 and still accelerating:

Europe is lagging badly at 53.7 with manufacturing booming at 63.4 but services floundering at 50.3:

You could be forgiven for wondering why DXY is falling EUR is rising in such circumstances. But this is absolutely typical of global economic recoveries. As global crises unwind, and with them DXY safe haven trades, capital flows out of the US and into Europe (and higher-yielding EMs) which typically lags the recovery owing to its export fixation.

In March, we saw this classic trade go into reverse as US vaccine, growth, inflation and yield exceptionalism threatened to disrupt normal programming. April has reverted to form, now that we’re into a phase of recovery with a strong US and Europe coming up behind.

The question is, how long can these typical dynamics hold sway? Goldman has a crack at it:

- Now: look for Europe to outperform — a region that is well behind the US in terms of fundamentals recovering. We now expect the vaccine-led boost to asset prices we saw in the United States to broaden to Continental Europe.

- We still favor commodities for cyclical (reopening fuel) as well as secular (the components of a greener world) reasons.

- There remains more upside in 10-year yields.

- We are cyclically and structurally negative on the USD. Look for investors to seek yield elsewhere.

- Next up: look for Tech, ‘long duration’ equities and EM equities to outperform in the next phase for markets once growth peaks. Near-term inflation risks are real but well digested by markets, and we see scope for investors to soon anticipate the point where growth momentum starts to slow (US growth may peak in the next month or two), inflation pressures ease, and a new batch of assets starts to outperform.

Goldman is giving short shrift to two complicating factors in this cycle. The first is that US exceptionalism is real. Its fiscal tailwind is extraordinary from 2022 onwards. Bond markets have not fully priced this. Indeed, they are currently pricing the falling away of US inflation in H2 as base effects pass.

Given the accelerated nature of this cycle, we need to be more sensitive than usual to next year’s more serious inflation rebound being priced earlier than normal and Fed tightening with it.

The second unusual feature is that China does not normally lag global recoveries but its reversion to structural reform means that it will from the second half of this year:

This throws up a bunch of questions that are atypical for asset prices at this stage of recovery:

- How long can commodities rally when the overwhelming source of demand is about to slow?

- Can DXY can keep falling as China slows and CNY falls?

- When does a weakening China take the gloss of Europe and EUR?

- What happens to EMs as they lag the vaccine recovery then get hit by a slowing China?

All of these are typically mid-to-late cycle questions that arise when the Fed begins to tighten perhaps six years into a new cycle, not six months.

Yet they are questions now which is why I remain of the view that the Australian dollar does not have its normal cyclical upside, notwithstanding another short-term leg of EUR strength.

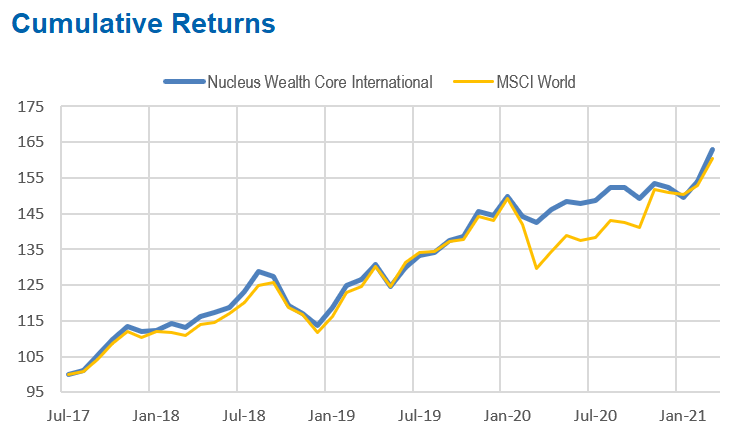

David Llewellyn-Smith is Chief Strategist at the MB Fund and Nucleus Wealth. The MB Fund/Nucleus Wealth Core International fund is one way to get quality international equities exposure. The fund has outperformed the MSCI World index for four years with consistently lower volatility:

If you are interested in knowing more about the fund then contact us below: