Macro Morning

Risk is bouncing back with Wall Street leading the charge overnight for no tangible reason apart from sentiment and technical oversold reasons as market catalysts remain scarce. The latest UK CPI print underwhelmed with Pound Sterling falling slightly while other major currencies bounced back against USD. Bond markets remain range traded while the bigger moves were in commodity prices as the latest oil inventory reports saw Brent and WTI crude fall over 2% while iron ore pulled back ever so slightly from its recent ten year high and gold found a new weekly high.

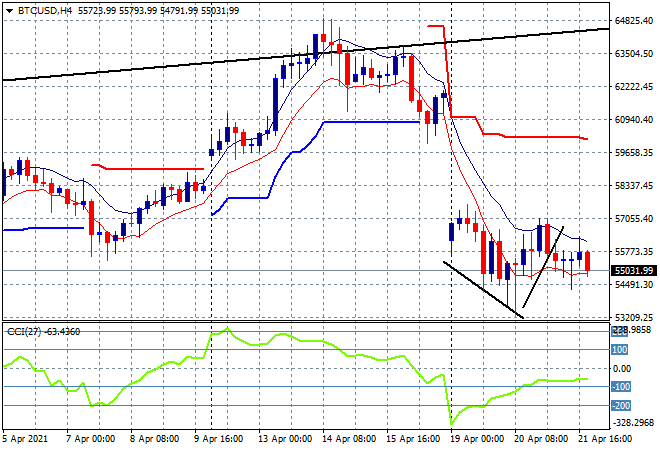

Bitcoin is still trying to fill its recent near 20% drop with the four hourly chart showing a potential bottom forming here above the $53K level but a failure to gain traction over the $55K level as price remains decidely below the high moving average zone. That neckline at a very clear $57K resistance level needs to be cleared to the upside soon or sentiment could see a big reversal well below $53K:

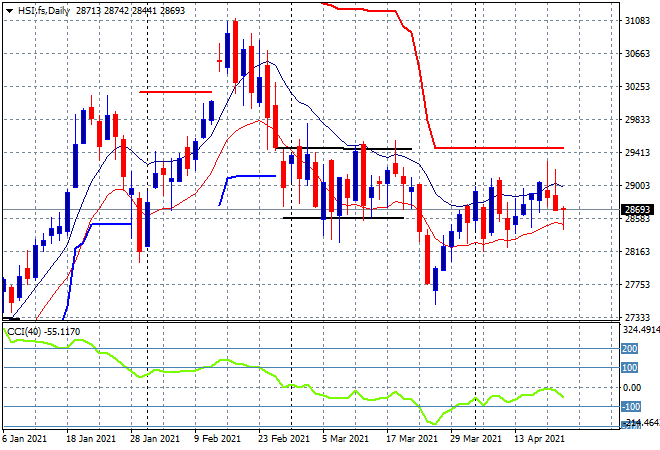

Looking at share markets in Asia from yesterday’s session where the Shanghai Composite was looking to be the only bourse to move higher, but eventually pulled back to a scratch session, unchanged at 3472 points. Meanwhile the Hang Seng Index was off a very solid 1.8% as it played catchup to the wider risk off mood, closing at 28623 points. Futures however are suggesting a fill on the open this morning in line with risk appetites overnight, but price action remains unable to get back above 29000 points and return to the March highs. This overall move remains bearish due to no new weekly high for some time now:

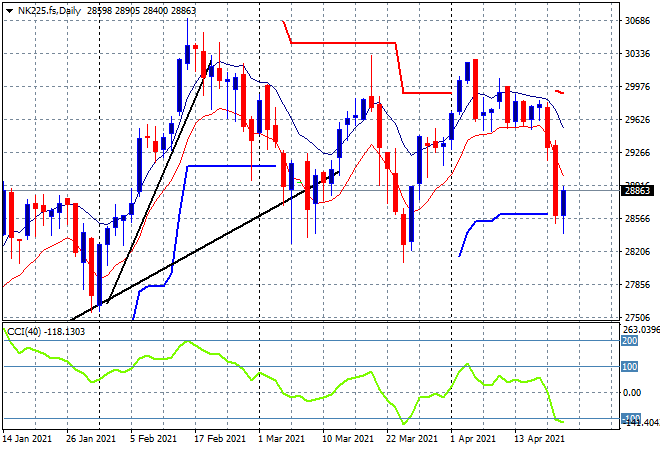

Japanese markets suffered another blow with the Nikkei 225 falling another 2% to close at 28505 points. The daily chart shows futures indicating a fill in an attempt to get back to the 29000 point level but I remain way of this market too with as it continues to oscillates between fear and hope. The next technical level below at the 28200 point level is not that far away:

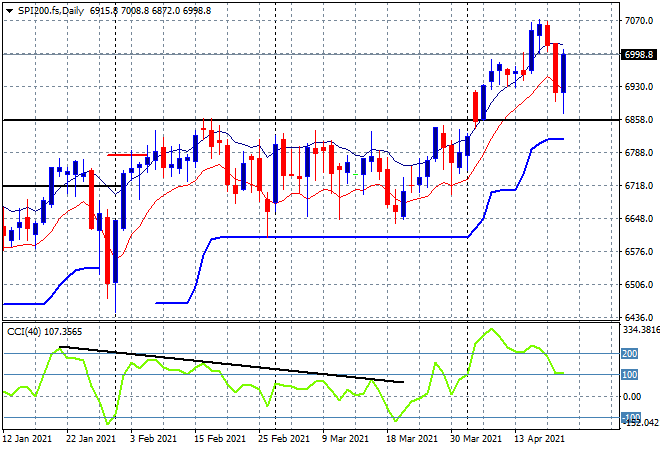

The ASX200 didn’t really suffer as much relatively speaking, down only 0.3% to finish at 6997 points as traders remain hopeful that the 7000 point barrier can hold. SPI futures are up over 30 points or just over 0.5% so it looks like the 7000 support level should hold today but will it be enough to reignite animal spirits and make a new high? Again, support is key here to watch with daily momentum still slightly overbought which is nominally positive:

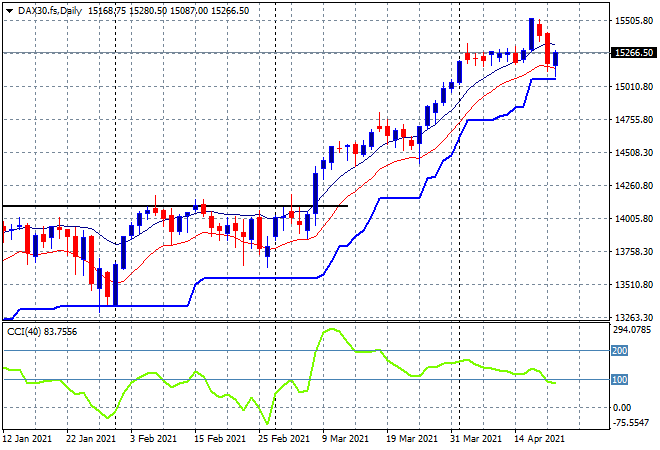

European markets bounced back slightly with some modest rises overnight, the FTSE up 0.5% while the German DAX regained 0.14% to finish at 15195 points. This market and its hangers on continues to oscillate around sentiment on COVID and while daily ATR support is still firm at the 15000 point level I remain cautious as momentum readings subside and do not yet indicate a re-entry position:

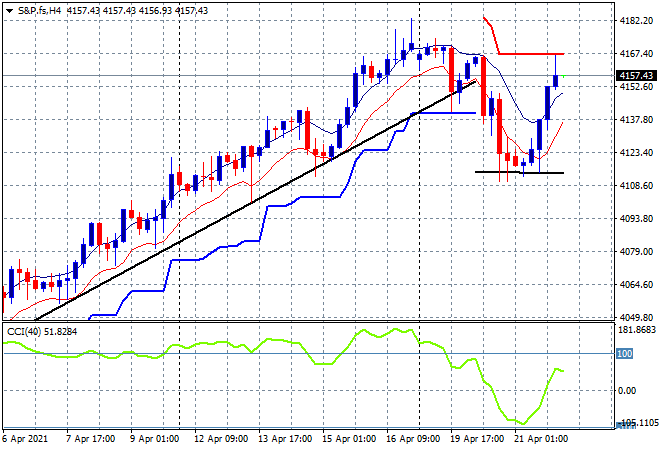

Wall Street bounced back even further with the NASDAQ up over 1.2% while the broader S&P500 nearly lifted a total 1% to close at 4173 points. Price action bounced right off tentative support at the 4100 point level (note the long tails below holding there as I indicated yesterday) but also note resistance definitely building at just below the previous highs at the 4170 point level. Can this market actually push through and re-engage or is this the first step of a wider correction:

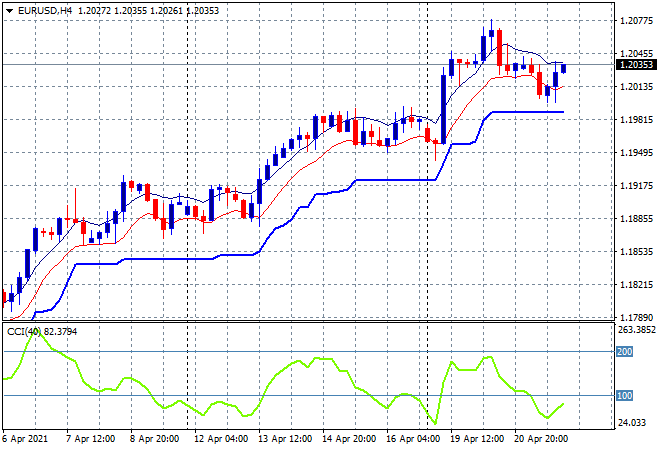

Currency markets remain somewhat calm although Pound Sterling was again the darling in terms of volatility with a pullback on the subued CPI print, with Euro having a very small dip towards the 1.20 handle before bouncing back for a tepid finish this morning in the process. This keeps it well above the previous resistance high level reached in early March, but watch trailing ATR support just below the 1.20 handle plus momentum rollovers for signs of a possible swing play in the days ahead:

The USDJPY pair however remains on the ropes in the wake of a weak USD as it remains stuck at the start of week lows just above the 108 handle. There is somewhat of a wedge forming on the four hourly chart but its not acute enough to classify as a bullish falling wedge pattern, but still – watch for a potential breakout above the upper trend line to finally stop this selloff. As I continue to point out, daily ATR support remains properly breached, alongside negative momentum and the March support levels which all give weight to another potential breakdown:

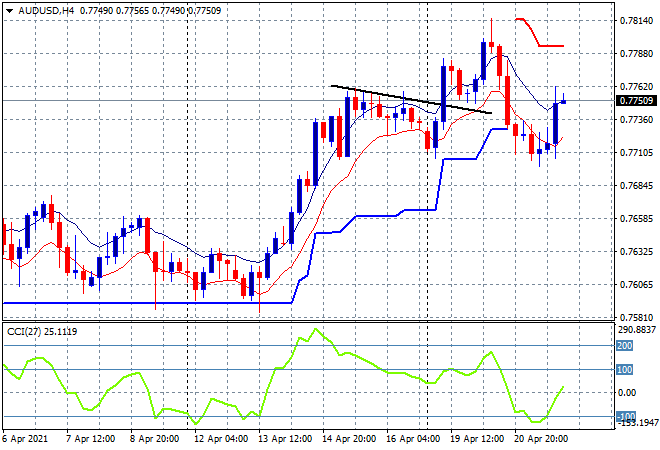

The Australian dollar had yet another reversal overnight as it acts as the risk currency de jeure. A small dip towards the 77 level was filled with a bounce up to the mid 77s, taking it back to where it started on Monday. I still contend that this oscillating price action confirms the previous selloff hasn’t finished yet:

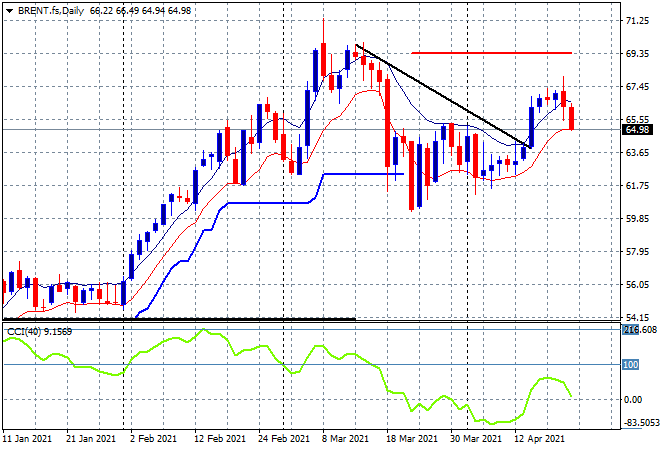

Oil prices were trying to push slightly higher but were swamped by the EIA report which saw subdued demand lead to higher inventories with Brent crude pushed straight below the $65USD per barrel level as a result. As I noted previously, daily momentum was not yet overbought so this move above the $60-61 zone remains a relief rally and not a new trend. Watch for a potential bearish follow through tonight:

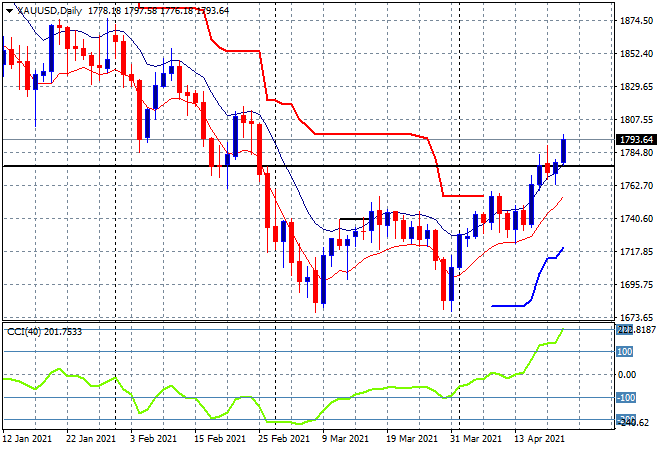

Gold is getting a lot more upside traction with a clear breach above the previous support/resistance swap zone (and 2020 lows) at the $1780USD per ounce level overnight, almost making it to what could be a psychologically important $1800 handle. While the longer term charts continue to signal a downside target at the 2019 pre-breakout highs around $1500, this could have more legs if the USD remains weak against the major currencies:

Glossary of Acronyms and Technical Analysis Terms:

ATR: Average True Range – measures the degree of price volatility averaged over a time period

ATR Support/Resistance: a ratcheting mechanism that follows price below/above a trend, that if breached shows above average volatility

CCI: Commodity Channel Index: a momentum reading that calculates current price away from the statistical mean or “typical” price to indicate overbought (far above the mean) or oversold (far below the mean)

Low/High Moving Average: rolling mean of prices in this case, the low and high for the day/hour which creates a band around the actual price movement

FOMC: Federal Open Market Committee, monthly meeting of Federal Reserve regarding monetary policy (setting interest rates)

DOE: US Department of Energy

Uncle Point: or stop loss point, a level at which you’ve clearly been wrong on your position, so cry uncle and get out!