By Gareth Aird, Head of Australian Economics at CBA

Key Points:

- The 2021/22 Australian Budget is scheduled for release at 7.30pm (AEST) 11 May.

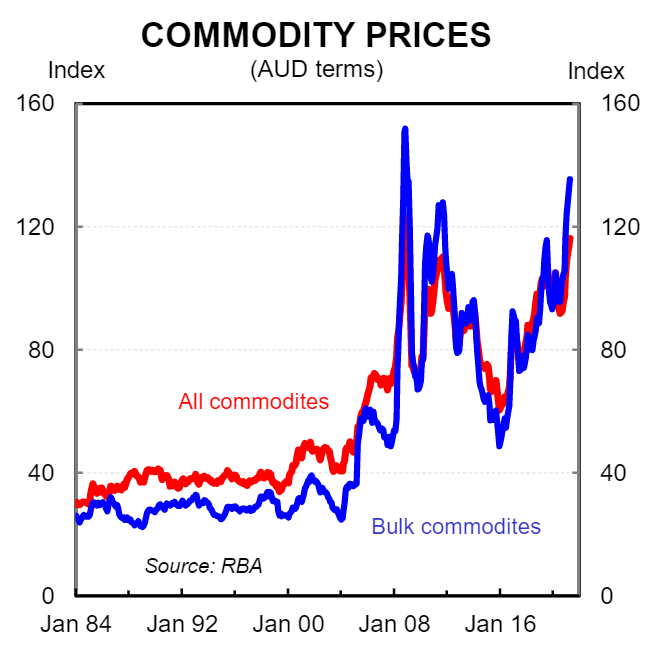

- The Budget bottom line will be greatly improved because of the much better performing economy and significantly higher commodity prices.

- Notwithstanding, more stimulus is expected to be announced, including an extension of the low and middle income tax offset (LMITO) as well as spending on child care, aged care, defence, infrastructure, rural and regional Australia, digital and targeted industry support.

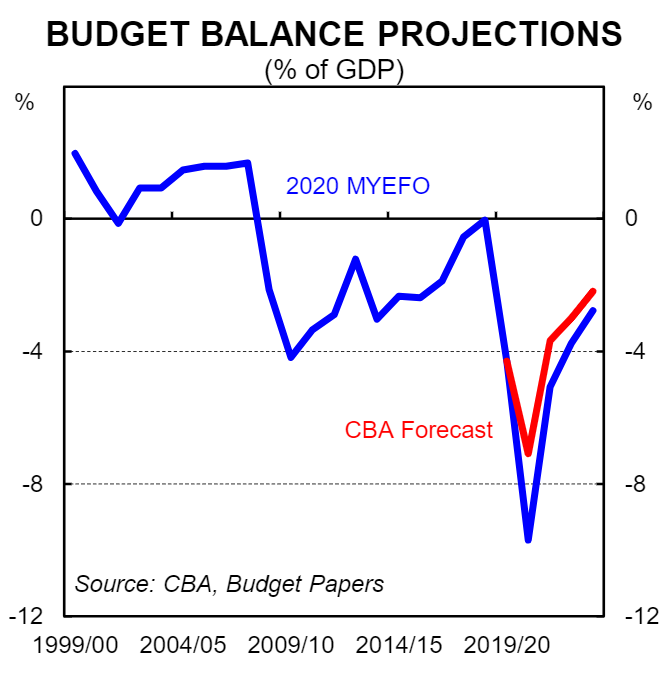

- Our point estimate for the underlying cash deficit in 2021/22 is $A78bn (3.7% of GDP).

- Net debt is forecast to reach 33.6% of GDP in 2021/22.

Overview

In the words of the Commonwealth Treasurer, the upcoming May 2021 Budget “will be another pandemic budget”. The focus will be on economic growth, job creation and dropping the unemployment rate. In summary, that means a combination of more targeted and temporary fiscal support as well as some permanent policy initiatives.

The Government’s Economic and Fiscal Strategy comprises two phases: (i) “the COVID‑19 Economic Recovery Plan” – a strong economic recovery, jobs growth and minimal scarring; and (ii) longer term fiscal sustainability.

On 29 April the Treasurer stated that, “we remain firmly in the first phase of our Economic and Fiscal Strategy.” And he articulated that the Government “wants to drive the unemployment rate down to where it was prior to the pandemic and then even lower”.

We interpret this as a clear signal from the Government that budget repair (i.e. austerity) will not part of the May 2021 Budget. Indeed the policy announcements in the Budget will be quite the contrary.

The Government will now play a more active role in demand management in the economy compared to pre‑COVID. The aim is to continue to use the fiscal levers in the short run to push the unemployment rate down. This will ultimately help the RBA to achieve its objective of full employment and to meet its inflation target. Put another way, both fiscal and monetary will be pulling in the same direction which was not always the case pre‑COVID.

A better starting point

The Australian economic recovery has been a lot stronger and a lot faster than the official forecasting family expected (i.e. the Commonwealth Treasury and the RBA).

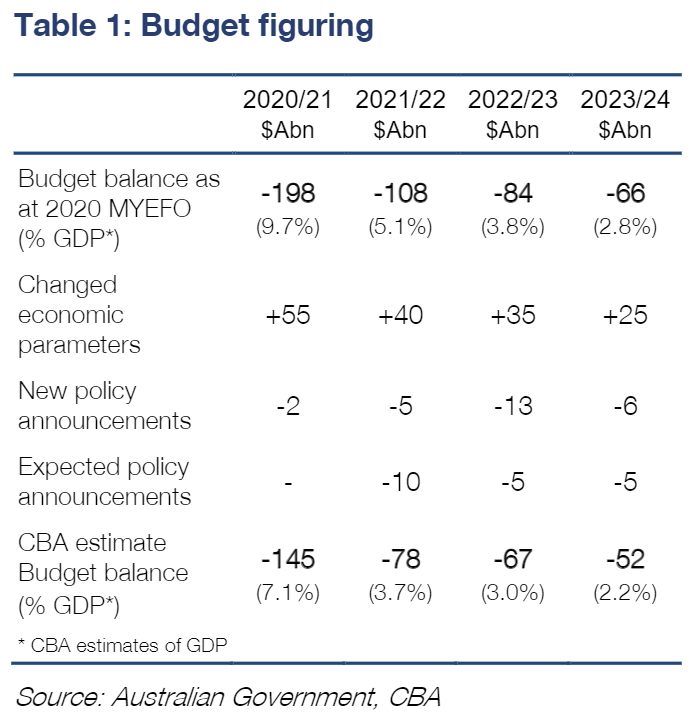

A better performing economy means an improved fiscal position. We put the starting point for this year’s Budget in a materially better position than expected at the time of the Mid-Year Economic and Fiscal Outlook (MYEFO) in December 2020.

On our estimates, changes to the economic parameters that drive the fiscal forecasts will deliver a massive improvement of $A55bn in 2020/21 relative to MYEFO (see Table 1).

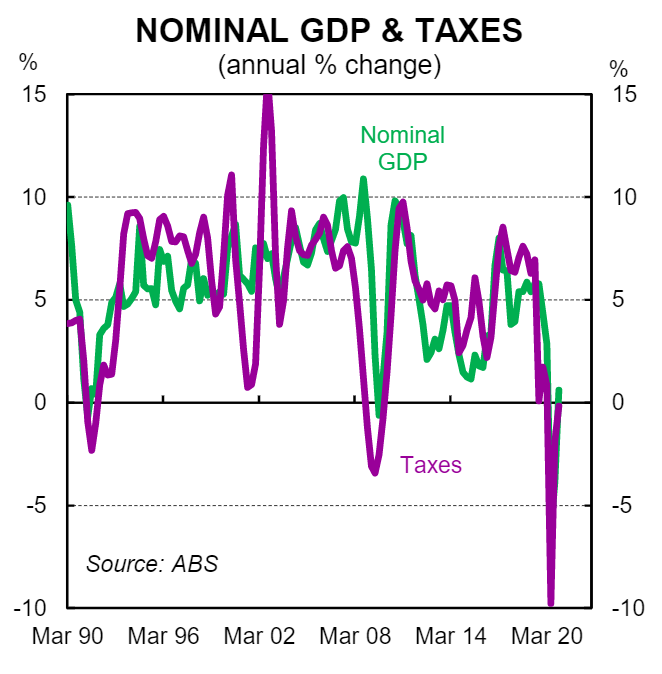

Nominal GDP growth (the tax base) is running well above expectations. Our forecasts have nominal GDP growing by 2.8% in 2020/21 compared to the MYEFO estimate of 1.0%.

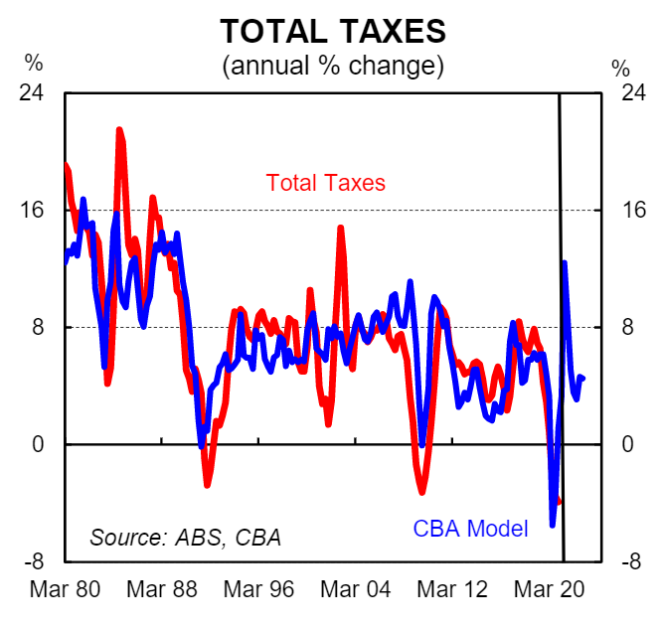

The stronger than expected improvement in nominal GDP has been driven by a sharp rebound in production and a surge in commodity prices, particularly the price of iron ore. Our fiscal model indicates that tax receipts should be boosted by ~$A35bn in 2020/21 relative to what was expected in the MYEFO (indeed the monthly Government financial statistics indicate that revenue was tracking $A16.9bn higher in March 2021 relative to MYEFO).

We anticipate that the Government will make upgrades to revenue of $A30bn in 2021/22 and $A25bn in 2022/22 relative to MYEFO.

The expenditure side also looks in much better shape. The unemployment rate has significantly undershot Treasury estimates which means unemployment benefit payments will be lower than forecast. There will be JobKeeper savings too. Based on the monthly Government financial statistics the JobKeeper payments in Q1 2021 were materially lower than Treasury forecast in the MYEFO.

Overall we estimate a reduction in total expenditure of $A20bn in2020/21 relative to MYEFO. That figure primarily comprises the savings from less people receiving both JobKeeper and JobSeeker. In addition it includes an expectation that the impact of the expiry of JobKeeper in terms of job losses will not be as large as Treasury would have assumed in the MYEFO (note that we don’t have specifics, but measures of labour demand are no doubt stronger than the Government would have expected at end-March 2021 when the MYEFO was published). It also takes account of some policy announcements since MYEFO that add to expenditure.

Upgraded economic forecasts and a better starting point will lower the expenditure profile over the forward estimates on an unchanged policy basis. But we expect a suite of new policies in the Budget to boost demand in the economy that will of course add to the expenditure side of the ledger.

More stimulus is forthcoming

The Government’s objective to drive the unemployment rate lower will mean more policy measures to boost demand and create jobs will be announced in the May 2021 Budget.

The measures are expected to result in more spending on child care, aged care, infrastructure, unemployment benefits, defence, digital and small business. The Budget is also likely to contain direct and targeted support for industries that remain negatively impacted by the closure of the international borders –particularly the tourism and education sectors.

At the time of publication, some of the policy details on measures that will be in the Budget have already been announced or circulated in the press. The Government’s child care package, which is designed to make childcare cheaper and boost female participation in the workforce, will cost $A1.7bn per year. However, the changes do not start until July 2022.

The aged care package is estimated to cost $A2.5bn per year and is expected to commence in 2021/22.It has been widely reported that the Government will extend the low and middle income tax offset (LMITO) for another year (i.e. it will be extended through 2021/22). The LMITO is estimated to cost $A7bn per year. The cost of the extension in the underlying cash balance will be recorded in 2022/23 given it is a tax refund that is paid to eligible households once the financial year has been completed and a tax return lodged.

There will of course be other initiatives and policy measures in the May Budget. We may hear about some of these over the next few days while some policy measures are likely to be saved for Budget night itself. We have pencilled in $A20bn of not yet announced stimulus measures that will be in the Budget ($A10bn in 2021/22, $A5bn in 2022/23 and $A5bn in 2024/25–this excludes the LMITO which we assume will be extended as has been widely reported).

What else to watch out for

Economic forecasts drive the Budget projections so we will closely scrutinise them, as is always the case. We suspect that the economic forecasts will look very similar to the updated RBA economic forecasts which will be in the May Statement on Monetary Policy (due 7 May).

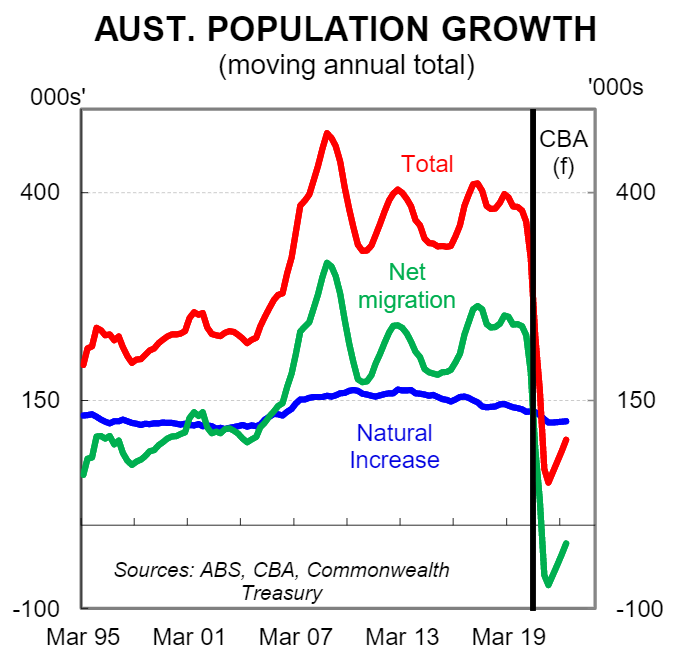

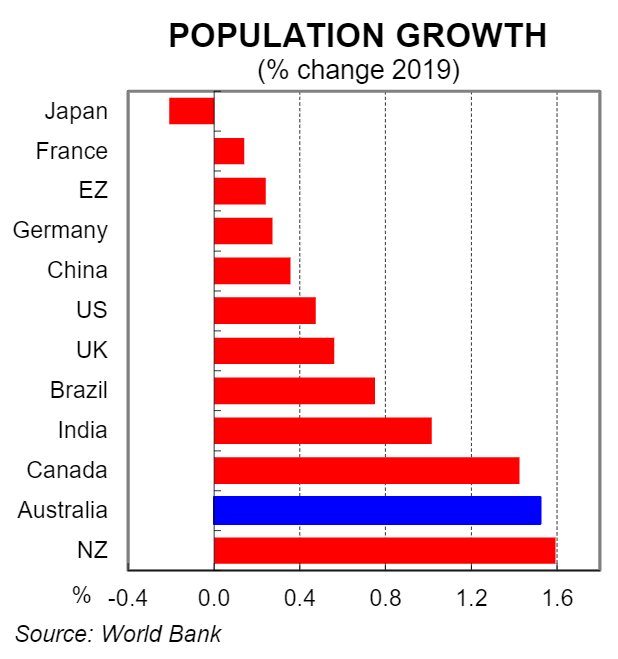

The forecast profile for net overseas immigration is one assumption that will be particularly important in the Budget. Each year in the Budget the Government publishes an estimate for net overseas migration which feeds into their forecasts for population growth. By extension this has an impact on potential GDP and growth in labour market supply.

We do not know what the Government’s current thinking is around the reopening of the international borders and what that may mean for the flow of people in and out of Australia. The assumption around net overseas immigration in the Budget will give us a clear insight into what the Government’s plans are for immigration once the borders are reopened. The rate of immigration going forward will have a particularly important impact on wage outcomes given we believe the NAIRU has increased with the closure of the international borders