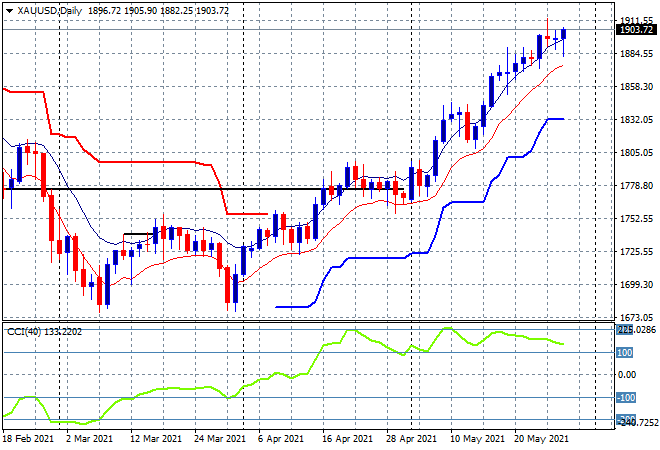

Wall Street reacted meekly to the first Biden budget on Friday night, ending the trading week with a zero result. Volatility in currency markets briefly spiked while other markets also experienced some end of month window dressing going into the US long weekend, with Monday expected to be very quiet. Commodity prices were nominally bullish with a mild uplift across the industrial and precious metals, with gold still hovering just above the $1900USD per ounce barrier.

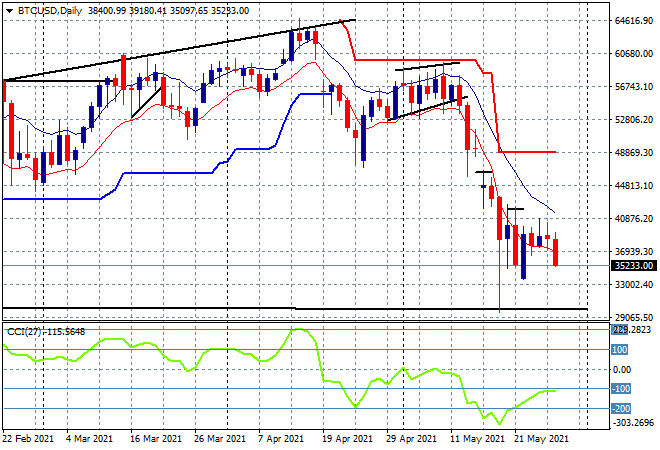

Bitcoin and other crypto’s continue to crater with the leader of the pack still unable to return above the $40K level all last week, with the technical resistance level at $42K completely unattainable. A fall on Friday night to the $35K level and daily momentum still oversold means this is nowhere near a bottom yet – watch for the $30K level to come under pressure this week:

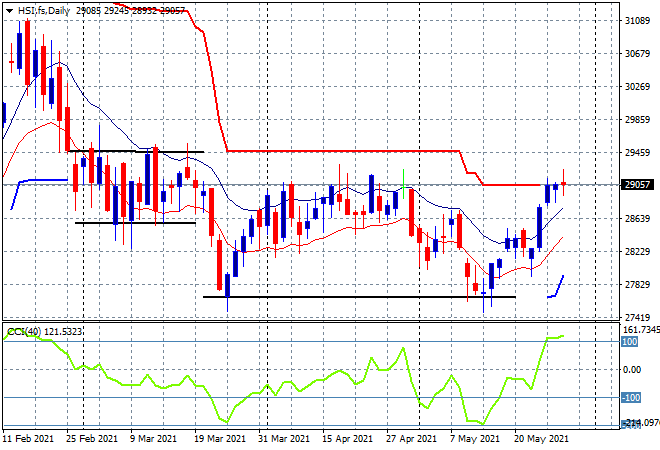

Looking at share markets in Asia from Friday’s session, where the Shanghai Composite tread water all along, eventually closing 0.2% lower at exactly 3600 points while the Hang Seng Index also finished with a scratch session at 29124 points. The daily chart is still showing a solid bounce off the March lows with resistance at the 29000 point level almost punched through with momentum now showing overbought and ready to clear away:

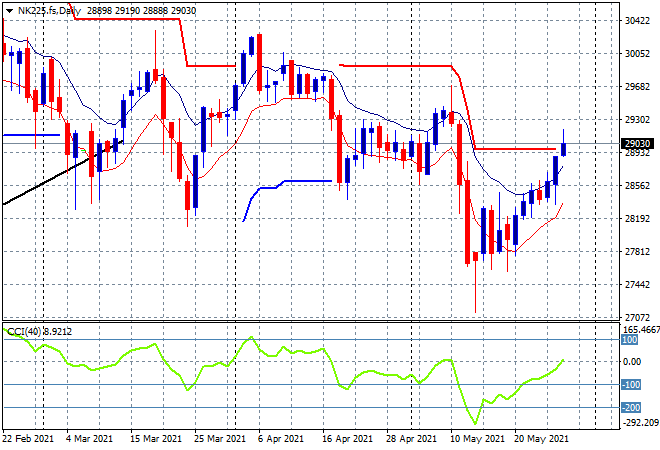

Japanese stocks were the stars with the Nikkei 225 closing more than 2% higher at 29149 points as Yen was sold off tremendously against USD. Daily futures are looking more promising with a potential breakout above the trailing ATR daily resistance but this will require another solid session above the 29300 point level to confirm a bottom is in:

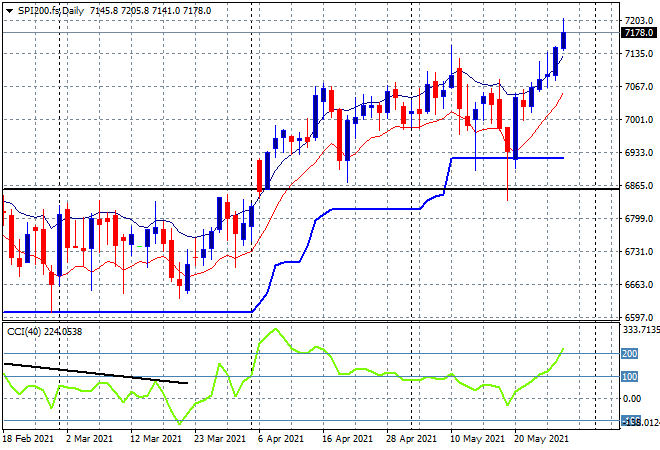

The ASX200 also put in a solid session to finish the week, closing more than 1.2% higher at 7179 points. SPI futures are up around 5 points or so, with the 7100 point resistance level now swapping to support and a much lower Aussie dollar helping lift stocks ever higher as the former rounding top bearish pattern becomes completely negated on the daily chart:

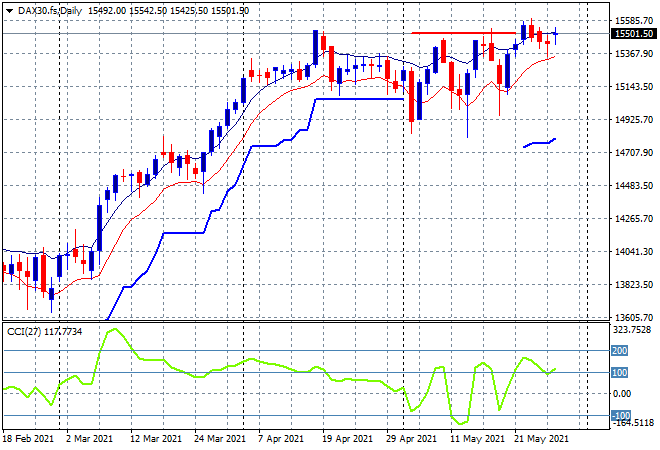

European markets were more upbeat to finish their trading week with only the FTSE unchanged, the German DAX finally putting in a positive session to finish up 0.7% at 15519 points. Sentiment is still slowly moving to a more bullish phase but actual price action has yet to confirm this breakout through overhead resistance and the previous April high:

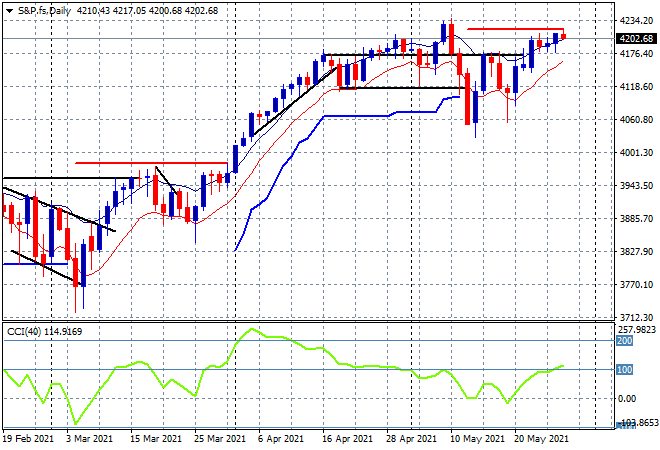

Although the three bourses on Wall Street all finished in the green it was a case of scratch sessions for most of them as the NASDAQ was up only 0.1% as was the S&P500 for a second session in a row, just getting above the 4200 point barrier. Price action on the daily chart is still showing an inability to decisively clear that 4200 level with momentum wanting to get back above overbought readings, this is all looking like a stretch. Watch for support to possibly fold here at the low moving average level:

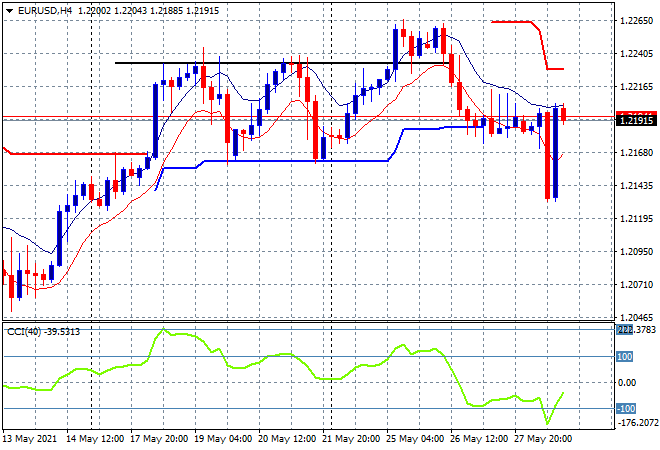

Currency markets experienced some end of week/month volatility with the release of the US PCE inflation figures but in the end returned to normal with USD still firm against almost everything. Euro remains depressed at just under the 1.22 handle and I’m watching for a move below support at the 1.2150 level if the current session lows are no longer defended:

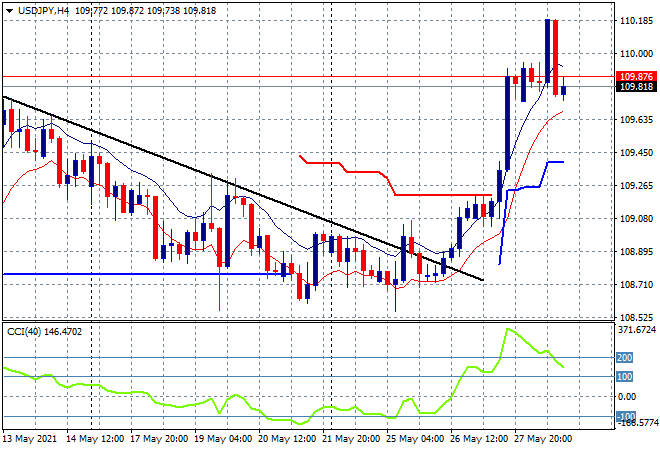

The USDJPY pair was looking to extend its breakout even higher, after previously clearing overhead resistance at the 109.20 level but came back to finish the week just below the 110 handle still looking extremely overbought. A lack of direction with the US Memorial holiday tonight but prove a little sticky here but overall the trend is back up as Japanese stocks remain well supported:

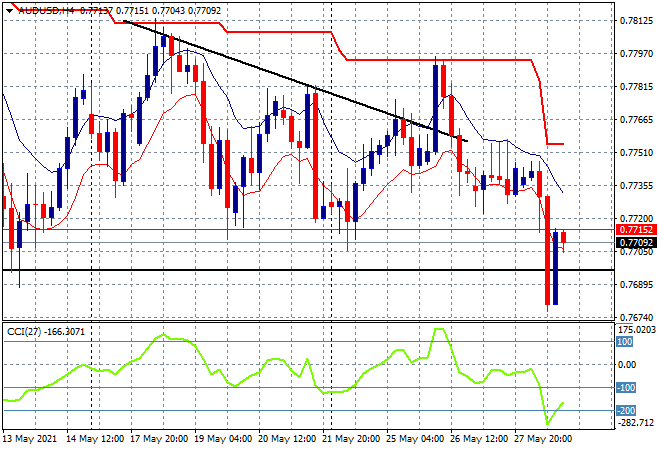

The Australian dollar however suffered a clear breakdown on Friday night and while half of it was captured back like most currency pairs, this is extremely telling, having broken below the 77 handle that has held as support since early April.So despite rising commodity prices, the interest rate differential and inflation concerns in the US continues to point to a complete capitulation below the 77 cent level proper:

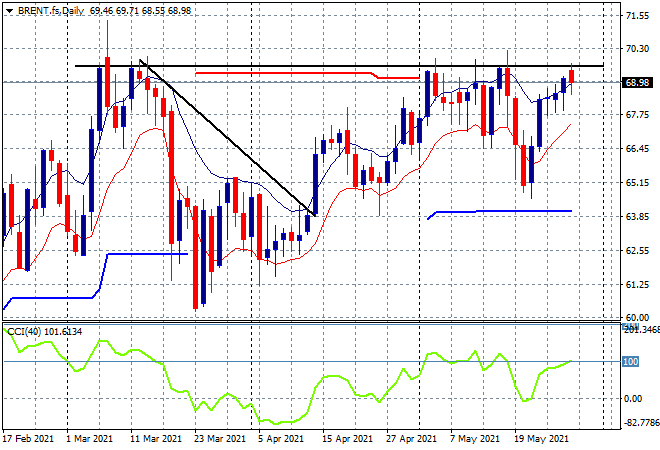

Oil prices came back slightly on Friday night with Brent crude pushed back up to but not over the $69USD per barrel level to almost get back to its previous weekly high. The current price action is still firming as price is able to get back above the $67 support level but it still has to clear the $69 to $70 zone so watch daily momentum readings for signs of an inversion:

Gold is pushing ever higher, now extending just above the $1900USD per ounce level, despite the ever stronger USD, which continues to show the internal strength of this new uptrend although daily momentum is slightly decelerating. The next level to reach are the November 2020 highs at the $1960 level, with a clear uncle point at the low moving average to continue to add to positions, but watch for any pullback on profit taking:

Glossary of Acronyms and Technical Analysis Terms:

ATR: Average True Range – measures the degree of price volatility averaged over a time period

ATR Support/Resistance: a ratcheting mechanism that follows price below/above a trend, that if breached shows above average volatility

CCI: Commodity Channel Index: a momentum reading that calculates current price away from the statistical mean or “typical” price to indicate overbought (far above the mean) or oversold (far below the mean)

Low/High Moving Average: rolling mean of prices in this case, the low and high for the day/hour which creates a band around the actual price movement

FOMC: Federal Open Market Committee, monthly meeting of Federal Reserve regarding monetary policy (setting interest rates)

DOE: US Department of Energy

Uncle Point: or stop loss point, a level at which you’ve clearly been wrong on your position, so cry uncle and get out!