The bounce is in as dip buyers step in amid a snap correction in stock markets as the COVID-19 delta variant continues to wake up risk-takers if not policy makers. Wall Street saw a 1.5% or so bounce across the board while European bourses did about a third that level, but all remained in the green. Futures are pointing to a probable bounce of that latter relativity for local stocks, but commodity markets and commodity currencies remain under pressure, with the real market – bonds – still signalling more downside ahead.

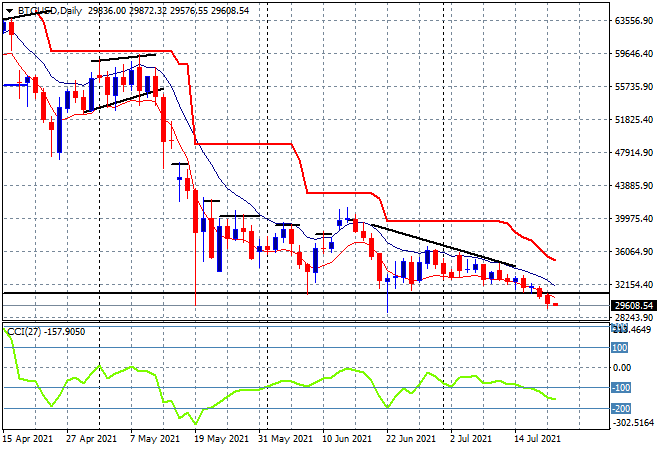

Bitcoin’s deflation continues with a key break below the start of year position at the $30K level as the daily downtrend line (upper black sloping line) turns sharply down – remember turn this chart upside down and you’d be buying as crypto currencies wipeout:

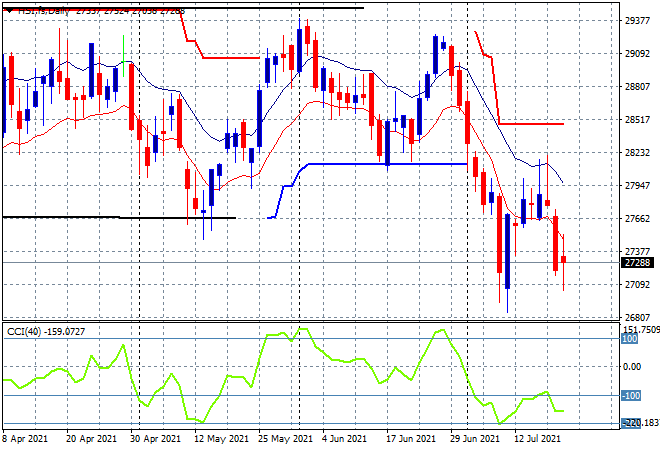

Looking at share markets in Asia from yesterday’s session, where the Shanghai Composite was down nearly 0.5%, but managed to finish with a scratch session at 3536 points while the Hang Seng Index continued its own correction, down 0.8% to remain well below the 28000 point level, closing at 27259 points. The daily chart is still suggesting this is a dead cat bounce as it begins to revisit the previous lows below 27000 points:

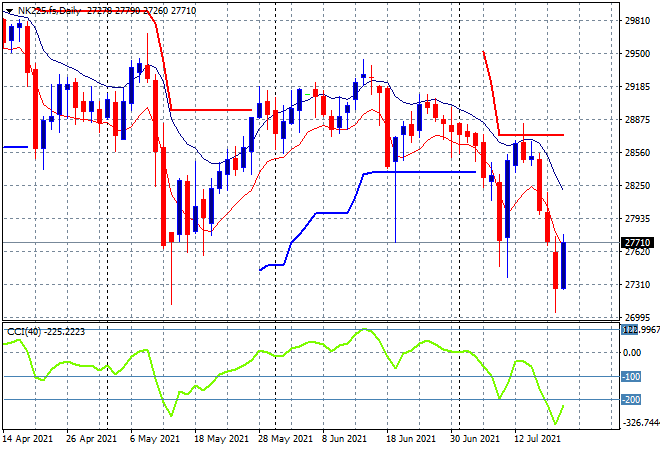

Japanese stocks remained in freefall with the Nikkei 225 closing 0.9% lower at 27388 points. Daily futures are suggesting a retracement of most of that move on the open today but concerns around COVID at the Olympics are not going away so I expect this to be short lived short covering as I continue to watch for a close below the previous daily lows at the 27000 point level to signal a new downtrend:

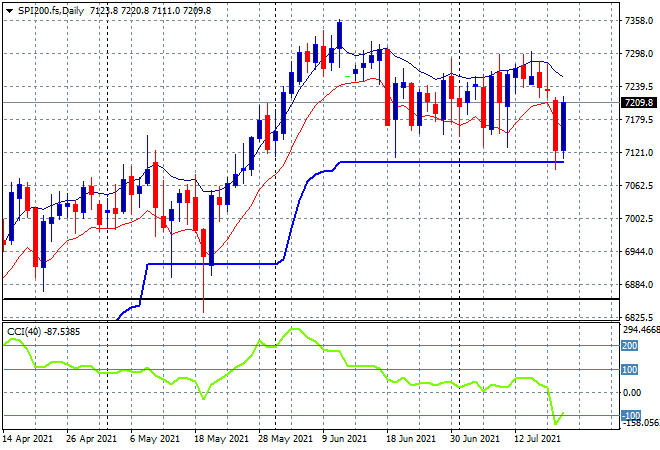

Australian stocks almost escaped the risk off mood with the ASX200 but sold off towards the close to finish 0.6% lower at 7252 points. SPI futures however are pointing to a recapture of most if not all of that down move so for now ATR support at the 7150 point level should hold but again, this could be just short lived as we could see the 7000 point psychological level breached sooner rather than later:

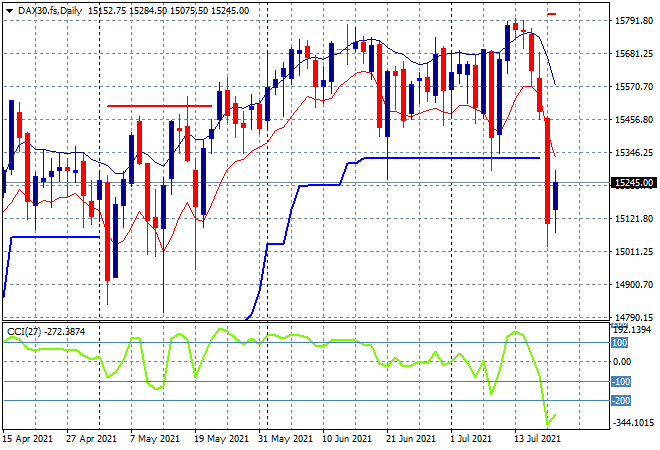

European markets were the first to put in a co-ordinated bounce on selling exhaustion with the German DAX illustrative of all continental markets, lifting 0.5% to finish at 15216 points. This still keeps it well below daily ATR support at the 15300 point level with momentum still deeply negative and nowhere near signalling a sustained swing move higher:

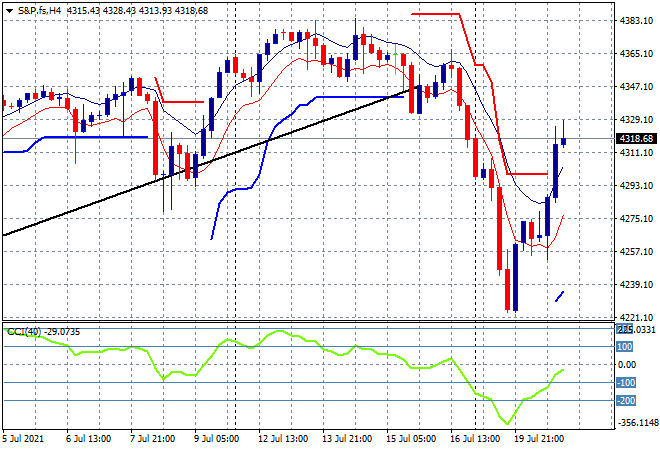

Wall Street however fought back harder with a near 1.6% increase across all three markets with the S&P500 taking back its previous losses to finish at 4323 points in a big surge. The four hourly chart shows this bounce very clearly off oversold momentum but the last few candles indicate it may be temporary with not much buying support above the key 4300 point level:

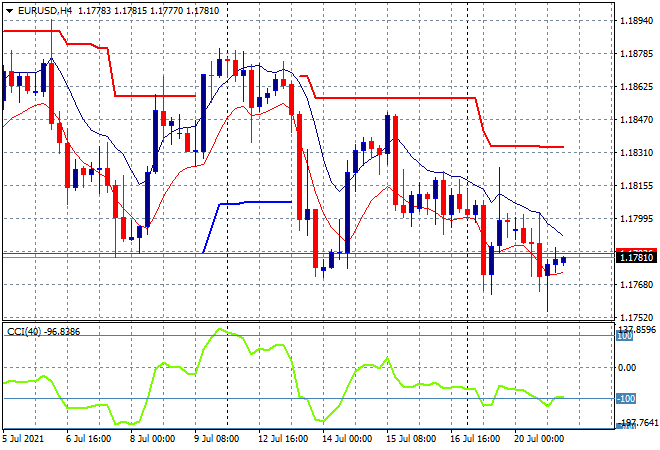

Currency markets were fairly stable overnight with US strength still dominating although Pound Sterling continued to fall to new lows for the year. Euro stabilised just under the 1.18 handle again with a potential short term bottom put in mid session but there’s still a lot of selling pressure with price unable to get anywhere near the high moving average on the four hourly chart with momentum remaining in the negative zone:

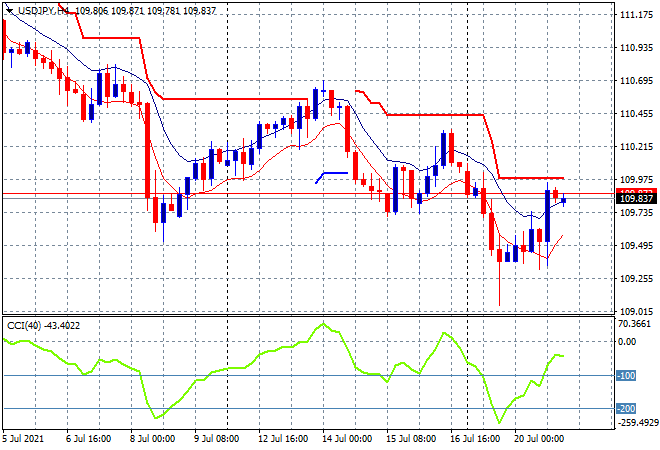

The USDJPY pair was able to to bounce a little alongside stocks as Yen safe haven buying slowed down somewhat overnight but it remains just below the key 110 level. Trailing ATR resistance and four hourly momentum needs to be breached here for any short term swing rally as the medium term trend remains decisively down:

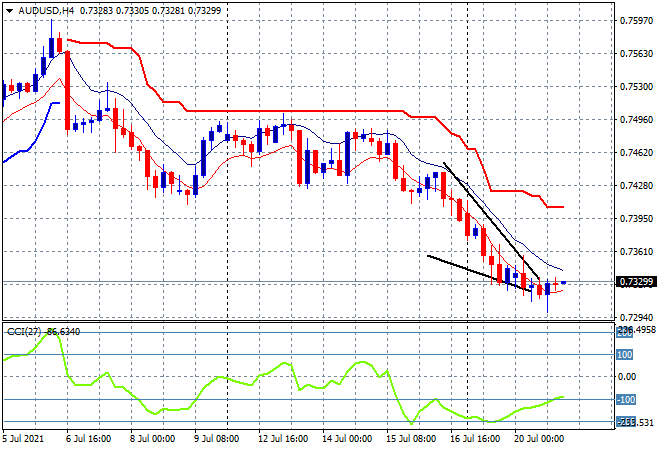

The Australian dollar was able to stabilise in the bounceback last night as some commodity prices came back but remains depressed here just above the 73 handle. The four hourly chart is putting in a possible bullish falling wedge pattern but this would require an explosive move above the high moving average at the 73.50 level at a minimum to get going again:

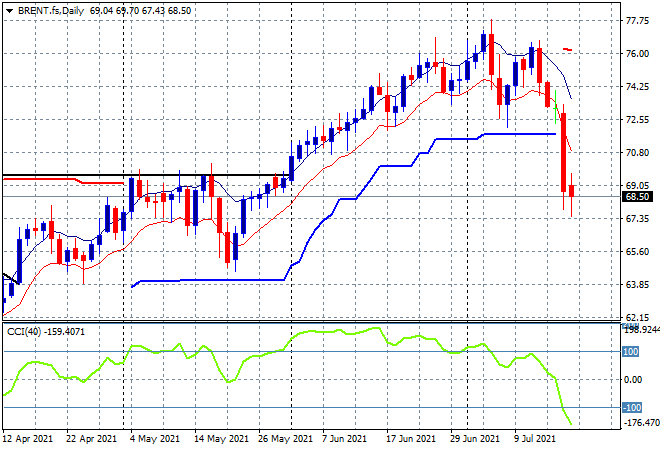

Oil remains under pressure with Brent crude putting in another new daily low, remaining under the $69USD per barrel level overnight. This breakdown continues to spell more trouble ahead with the May lows around $63 the possible next target if momentum goes into further oversold readings:

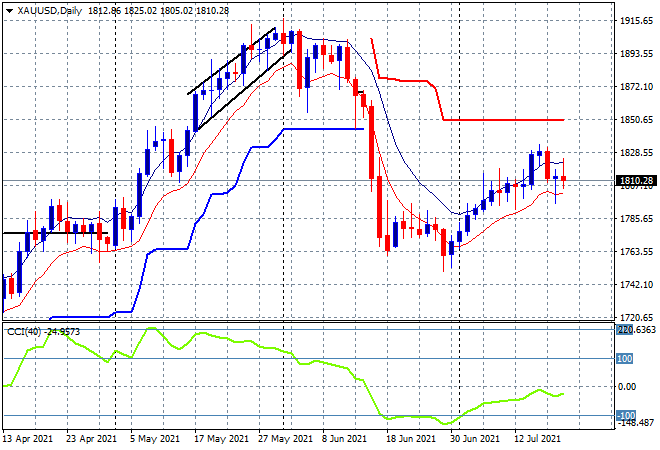

Gold was again able to hold on above the $1800USD per ounce level overnight after a brief dip below amid the resurging USD with a finish at the $1810USD per ounce level. While daily momentum is not yet positive, its nowhere near oversold levels but it needs more internal buying support to turn this into a stabilisation instead of a pause before another leg down alongside other undollars:

Glossary of Acronyms and Technical Analysis Terms:

ATR: Average True Range – measures the degree of price volatility averaged over a time period

ATR Support/Resistance: a ratcheting mechanism that follows price below/above a trend, that if breached shows above average volatility

CCI: Commodity Channel Index: a momentum reading that calculates current price away from the statistical mean or “typical” price to indicate overbought (far above the mean) or oversold (far below the mean)

Low/High Moving Average: rolling mean of prices in this case, the low and high for the day/hour which creates a band around the actual price movement

FOMC: Federal Open Market Committee, monthly meeting of Federal Reserve regarding monetary policy (setting interest rates)

DOE: US Department of Energy

Uncle Point: or stop loss point, a level at which you’ve clearly been wrong on your position, so cry uncle and get out!