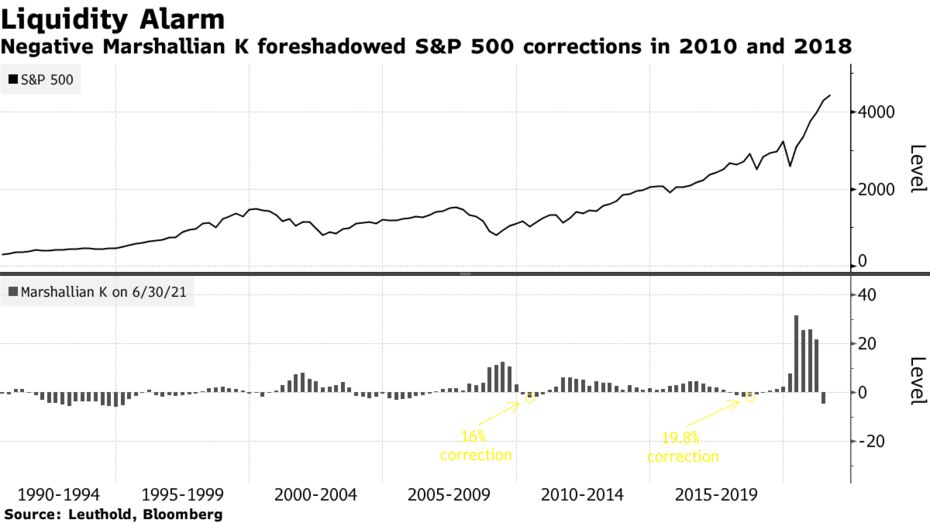

No, Marshallian K. is not an obscure planet in another galaxy. It is a sometimes useful signal that indicates when liquidity is growing less than GDP is rising. In short, it’s the gap between money supply and GDP:

“Put another way, the recovering economy is now drinking from a punch bowl that the stock market once had all to itself,” Doug Ramsey, Leuthold Group’s chief investment officer, wrote in a note last week. How big a threat is this? While stocks kept rising during frequent negative Marshallian K readings in the 1990s, the pattern since the 2008 global financial crisis — a period when the central bank was in what Ramsey calls a “perpetual crisis mode” — begs for caution.

“The Marshallian K now shows liquidity not only deteriorating but actually contracting — and at a time when hopes (as embedded in valuations) have never been higher,” Ramsey said. “If the Fed can drawdown QE in the next year without triggering a decline of those levels, it will truly have achieved something remarkable. But we’d rather invest based on the probable.”