The Evergrande saga is intensifying daily. The firm’s equity is all but gone. Its debt barely trades. Its sales and assets are crashing in value. Its brand damage is ruinous:

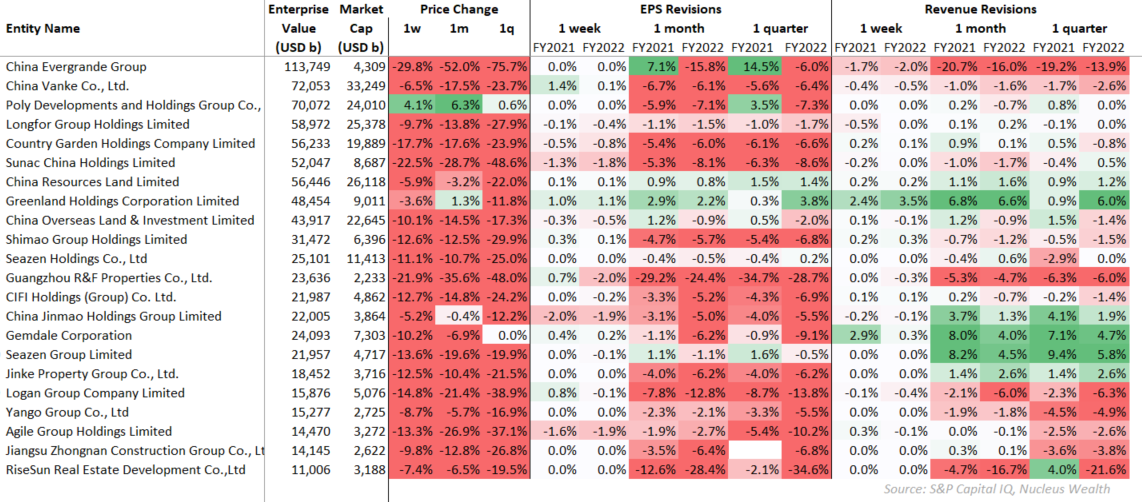

Moreover, we have now reached a point of open crisis for the entire Chinese property development sector. Funding spread blowouts are indistinguishable from being frozen. Good and bad equity is being priced for calamity. Market confidence is gone. Rumours of bailouts and hare-brained schemes for saves are rampant:

However, the signals coming from policymakers are serene. The “common prosperity” rhetorical umbrella that is covering a wave of regulatory interventions in China enables Bejing to justify hammering rentier billionaires, and no bailout for developers appears imminent.

Indeed, on Friday, the state-sponsored Global Times troll-in-chief declared that no support is coming:

The editor-in-chief of state-backed Chinese newspaper Global Times warned debt-ridden property giant Evergrande Group (3333.HK) that it should not bet on a government bailout on the assumption that it is “too big to fail”.

It was the first commentary to appear in state-backed media casting doubt on a government bailout for the country’s No.2 property developer, whose shares fell on Friday for the fifth consecutive day amid concerns it is heading for default.

Evergrande is scrambling to raise funds to pay its many lenders and suppliers and investors, with regulators warning its $305 billion of liabilities could spark broader risks to the country’s financial system if not stabilised. read more

Global Times’ editor-in-chief Hu Xijin said on his WeChat social media account on Thursday that Evergrande should turn to the market for salvation, not the government.

The base case for the Evergrande crisis has thus shifted to an enduring shakeout for Chinese property development. But of what variety?

Ruin or reform?

You could hardly be blamed for being reminded of other financial crises like the Lehman Brothers moment that triggered the Global Financial Crisis. The underlying imbalance is an immense property bubble. The leverage is terrifying. The players are too-big-to-fail and policymakers are wedged between moral hazard and catastrophe.

Or, is this the case? There is another way to look at this latest Chinese reform episode. This is the fourth instalment of Chinese attempts to rid itself of its troublesome property development sector. The first began in 2011. It was ramped up again in 2015 and 2019. Each time, the failing growth that followed has spooked policymakers into more stimulus.

China keeps returning to this program for one reason. Its property market excesses are the key threat to its economic development path. Property is both the source of its enduring catch-up growth and its doom if allowed to run too far. No other Chinese sector misallocates capital and kills productivity on such a massive scale. If not restructured it will drag China into the middle-income trap of weak income, stalled growth and declining efficiency.

If so, the key to understanding this crisis is that it is more deliberate than the Lehman Brothers episode. It probably doesn’t threaten the financial system. China owns its banks and can liquify credit any time it likes. It could bail out Evergrande and its property sector tomorrow if it wanted to. It has oodles of monetary space to play with and can, at any time, stimulate more property activity by loosening macroprudential controls. It is choosing not to.

That is not to say that no financial crisis is ahead. It is. But it is not so much for banks (which will see turbulence) as it is property developers specifically.

The implications of this are still very material, and in some ways even more so. A deep recession for Chinese construction will be a significant hit to overall Chinese growth, more than anybody is expecting in Q4 and 2022. This is owing to two factors:

- First, the direct impact of less construction will be exacerbated by a bad debt shock that will curtail some lending, and falling property prices (in some areas) will crimp consumption.

- Second, infrastructure will not rebound in its place as hoped. It is too closely linked to property in local government balance sheets.

Moreover, if economic restructuring is the goal then the recovery will look different as well. Stimulus will be slower to come than usual. And when the shakeout is complete, the recovery won’t be v-shaped. It will be L-shaped as property development grows via quality not quantity from a greatly diminished base.

Lehman or Greece?

If we’re seeking a historical analogy to make sense of such an intentional campaign of economic restructuring around the GFC period, then there is another episode to consider. In 2010, Germany took advantage of the post-GFC boom to lead Europe into a deleveraging and structural reform episode. The European debt crisis was allowed to run unabated by German authorities to reform economies running twin deficits. The “PIIGS” as we knew them.

That crisis could have been ended at any time, too. But it was only when Teutonic states were satisfied that the message to stop the waste have gotten through to the “PIIGS” policymakers that the ECB was allowed to print and restore order to yields.

Analogously, China has built out its urban environment sufficient to support its ongoing people movements up to 80% urbanisation in the 2030s. Doing more of it will only strangle the economy with unproductive debt. China only has another 200m people to shift and roughly 60m empty apartments have them covered already.

The breaking of Evergrande and its peers can thus be seen as an admirable undertaking to clean up wasted capital; a long-delayed but essential step if China is to springboard its economy beyond the middle-income trap via higher value-added growth.

The fallout

Yet, for everyone else, it is still the end of the greatest phase of Chinese catch-up growth.

If the Chinese reform effort base case transpires then it augers a global economic adjustment that will encompass everything from crushed commodity prices, challenged EM export-dependencies, competition with China on value-added output, a deflation tsunami akin to a global recession, and a reckoning for overvalued developed market assets.

Policymakers will be incrementally supportive in the form of a slow-motion restructuring of Evergrande and other distressed developers without obvious bailouts. Anne Stevenson-Yang summarises how it will likely happen.

There will be deep RRR and rate cuts in due course, as well as more fiscal support, though not in property.

That implies a big drop ahead for the yuan. This will export a lot of economic pressure to emerging market external balances as commodity prices crash and their competitiveness versus China erodes. If the Fed tapers at the same time and adds pressure to EM capital accounts, then an EM crisis looms as the greatest risk of international contagion.

Finally, there are two other risk scenarios to consider, one downside and one upside. It is still entirely possible that China loses control of the shakeout. China’s fantastically opaque daisy chains of finance may unravel and draw in the financial system. Policy error remains the outstanding risk of our time.

If that happens, and Chinese house prices follow Evergrande into the abyss, then the global economy may be witnessing the beginning of the end of the post-COVID cycle.

Which leaves us with the second risk case. That Evergrande panics policymakers into another round of broad stimulus and we do it all again in 18 months’ time!