Overnight share markets were relatively quite given the US Thanksgiving holiday with European shares finally putting in a decent positive session, while bond market volatility was lower due to the closed markets. The USD was down slightly against the majors although the Australian dollar remained below the 72 cent level, while gold continues to struggle and also stayed below the $1800USD per ounce level. Oil prices haven’t followed through on their sharp bounce back with WTI and Brent crude basically unchanged, while copper and iron ore dropped slightly.

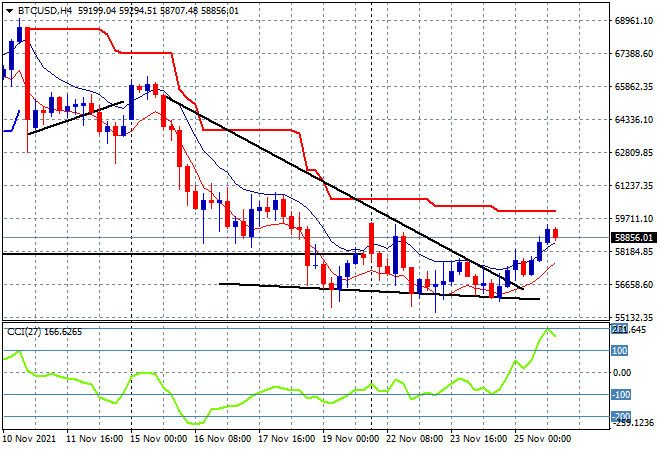

Bitcoin is seeing a pre-Thanksgiving breakout as it built up support at the $56K level mid-week as the four hourly chart showed price tightly coiled up with a falling bullish wedge pattern. This has turned into a low probability breakout almost up to the $59K level, but longer term readings indicate a rollover is possible, particularly if overhead resistance at the $60K level is not cleared in this move, with support at $55K critical:

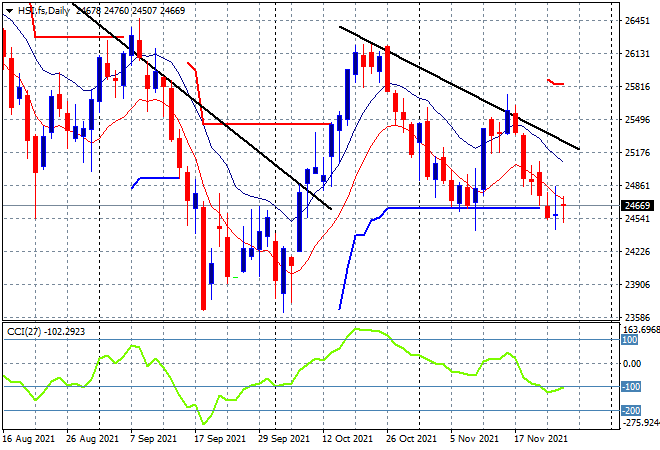

Looking at share markets in Asia from yesterday’s session, where Chinese shares diverged again but this time it was mainland shares that fell back with the Shanghai Composite closing 0.2% lower at 3584 points while the Hang Seng Index lifted again to be finish up 0.2% at 24740 points. Still not looking pretty on the daily chart with price action still below major short term ATR support at the 24600 point level as any failure to hold at this area will indicate a return to the September lows:

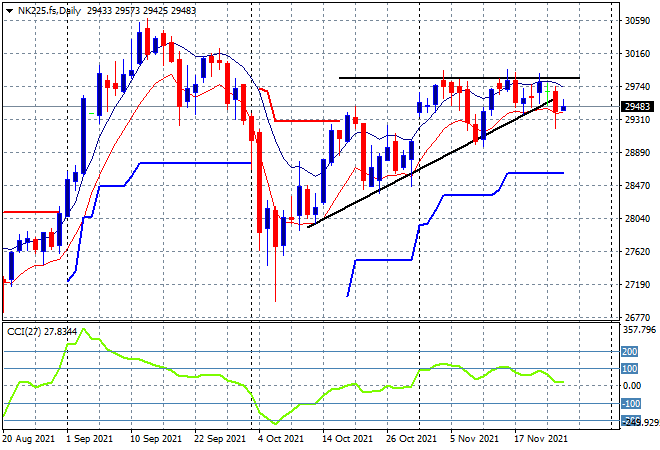

Japanese markets also had a bounceback with the Nikkei 225 gaining more than 0.6% to close at 29499 points. Futures are indicating some lower movement at these levels as the much weaker Yen is not really helping momentum pick up at all here, as price action remains tenuous around the daily uptrend line. Resistance overhead at 30000 points has not been under threat for sometime now, indicating the chances of a breakout are slimming:

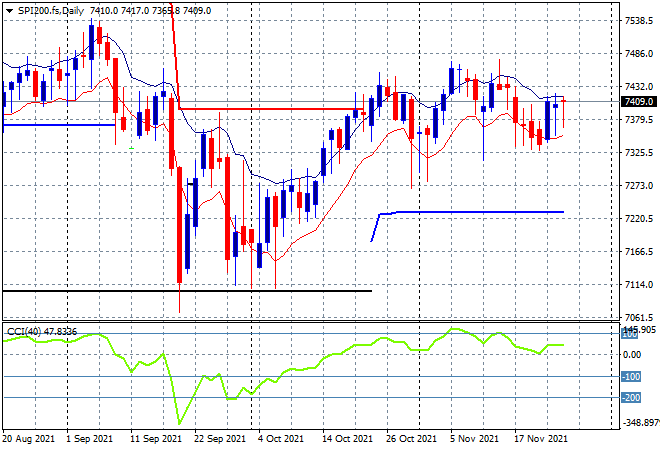

Australian stocks were listless with the ASX200 taking back the mild losses of the previous session to gain just 0.1% to close at 7407 points. SPI futures are up a handful of points in anticipation of Wall Streets positive return tonight, so consolidation at the 7400 point level is likely in this week’s final session, with the daily chart still lacking any direction. Buying support remains robust and while momentum is nominally positive, with probability of a breakout to the upside, support at the 7320 point support level must hold:

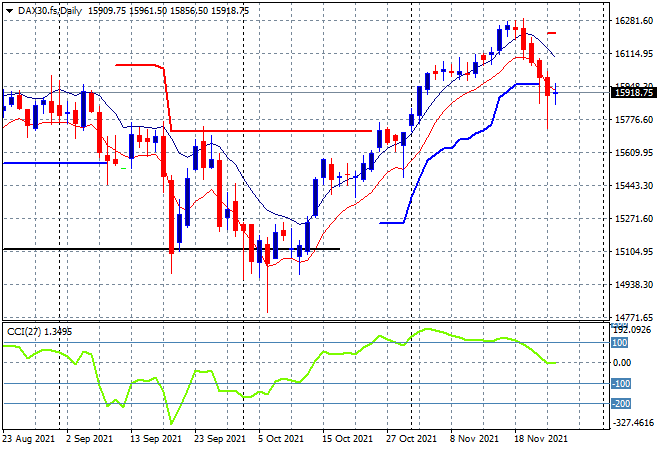

European markets finally had a good session, this time across the board with the German DAX lifting 0.2% to close at 15917 points, with other peripheral markets lifting twice as much. The DAX is still however closing below its own low moving average on the daily chart with not much evidence of substantial support building here again. Momentum continues to invert from its overbought status and remains neutral at best, so this dip has not yet widened into a correction. I would contend this is setting up for another leg down, with any COVID news acting as a catalyst:

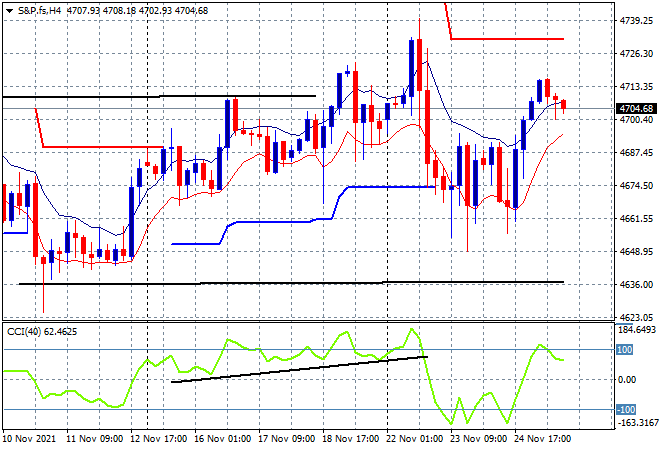

Wall Street was closed due to the Thanksgiving holiday as traders get ready for the retail orgy that is Black Friday. S&P500 futures are indicating a modest return in tonight’s one off session, hovering just above the 4700 point level. The four hourly chart shows price action has not yet engaged to the upside enough to get the entire BTFD crowd to move in, although support is quite firm at the 4670 point level. This bunching up of price action usually augers well for more upside, but I remain cautious here:

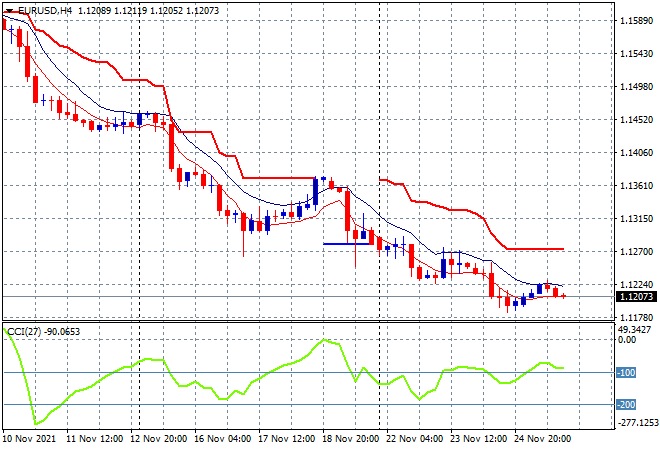

Currency market volatility remains in the USD favour even with limited volume overnight, with Euro stabilizing – somewhat – here at the 1.12 handle. Taking a step back and viewing the medium term charts, deceleration is definitely creeping in and while momentum remains nicely oversold, there is the growing potential here for a breakout back up to overhead trailing resistance at the 1.1270 level:

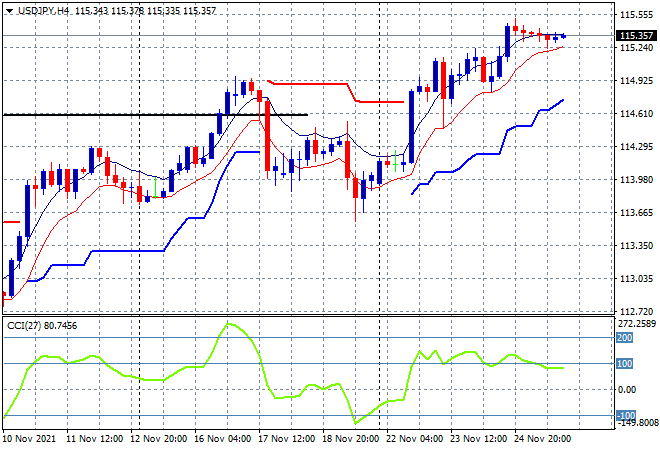

The USDJPY pair is also relatively listless after a series of stepups throughout the trading week, continuing to push above the 115 handle, making those new five years, with nothing on the radar to displace King Dollar at this stage. While this historic move could have extreme breakout potential, watch for a possible mild retracement on any risk off move in equity markets, with four hourly momentum retracing now from only slightly overbought settings:

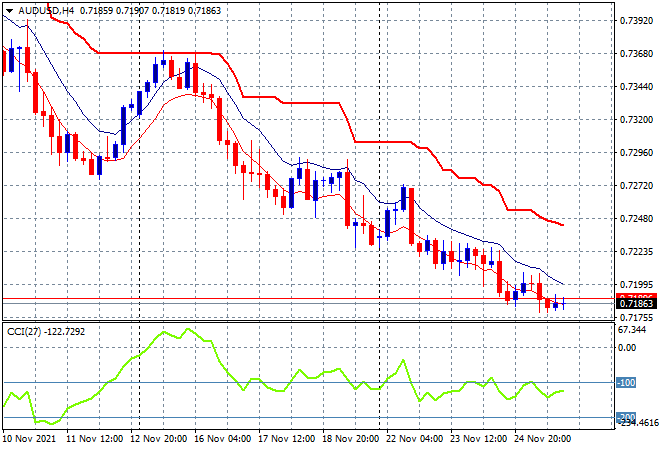

The Australian dollar however is unchanged on its great downtrend as it extended its push below the 72 handle overnight as any rebound in commodity prices – even iron ore – has not helped in the slightest. The stronger USD will continue to weigh heavily for the Pacific Peso, still setting up for more downside action as momentum remains quite oversold:

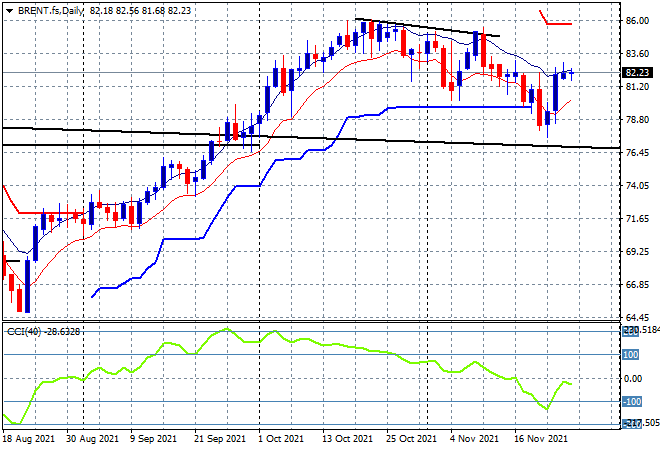

Oil crude futures reduced in volatility due to lower trading volumes in the US, with Brent again finishing above the $82USD per barrel level in a very muted session. This still keeps it above key daily ATR support but daily momentum remains negative as the previous one day surage requires a follow through above the high moving average or it sets up for a dead cat bounce and a further breakdown:

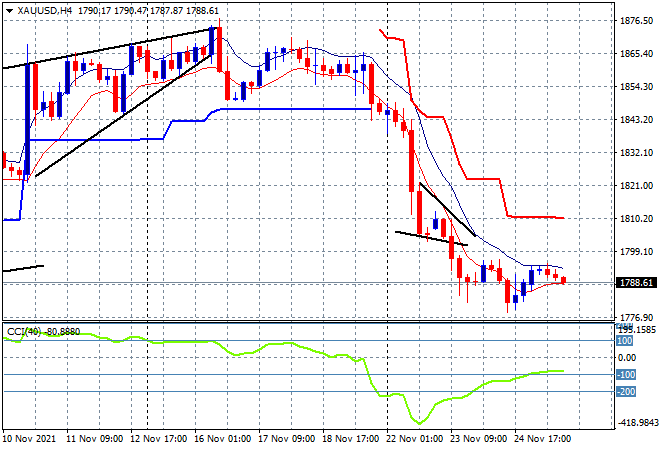

Gold is slowly rolling over again here, unable to get back above the key $1800USD per ounce level and retracing to the $1788 level instead. As I said previously, after not making a new daily or weekly high for some time and taking out short term support at the $1840 level the key psychological $1800 handle has fallen and sets up for more falls below. While there could be a violent rebound here on the oversold status, there are still no real signs of a swing play at hand:

Glossary of Acronyms and Technical Analysis Terms:

ATR: Average True Range – measures the degree of price volatility averaged over a time period

ATR Support/Resistance: a ratcheting mechanism that follows price below/above a trend, that if breached shows above average volatility

CCI: Commodity Channel Index: a momentum reading that calculates current price away from the statistical mean or “typical” price to indicate overbought (far above the mean) or oversold (far below the mean)

Low/High Moving Average: rolling mean of prices in this case, the low and high for the day/hour which creates a band around the actual price movement

FOMC: Federal Open Market Committee, monthly meeting of Federal Reserve regarding monetary policy (setting interest rates)

DOE: US Department of Energy

Uncle Point: or stop loss point, a level at which you’ve clearly been wrong on your position, so cry uncle and get out!