Chris Joye of Coolabah with the note. his record on property prices is good:

Over a decade ago we argued that the community should come to expect much more volatility from residential property because of the huge increase in the household debt-to-income ratio, which had made borrowers far more sensitive to interest rate changes. At the time, we asserted that this would generate a more frequent boom-bust cycle in prices as a result of variations in borrowing rates.

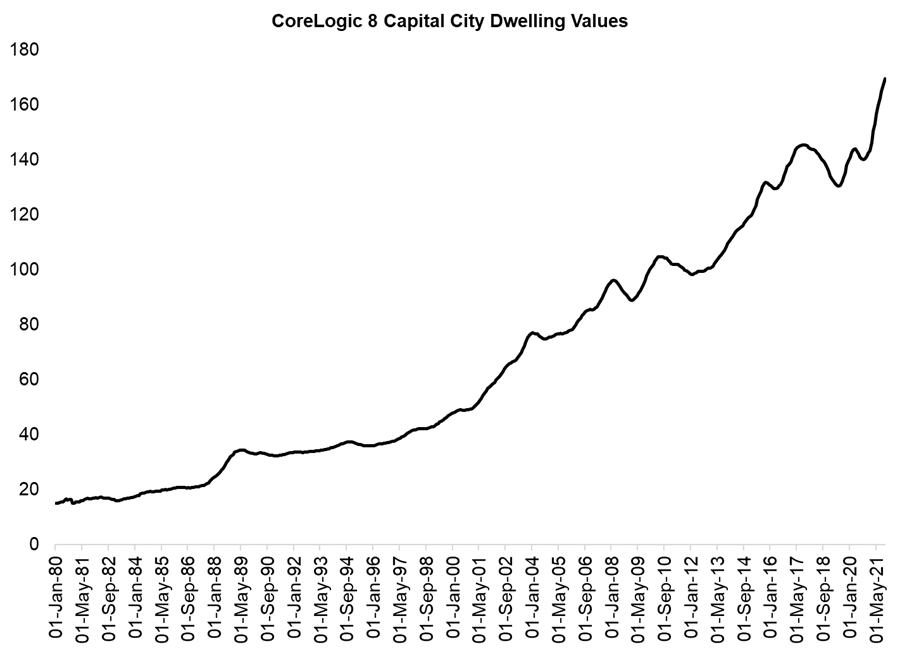

If you look at the enclosed chart of CoreLogic’s 8 capital city hedonic index, you can see that substantial drawdowns in prices were relatively rare between 1980 and 2003. And yet since 2003, there have been six distinct episodes in which prices have declined with what appears to be increasing severity. It might come as a surprise that the single biggest fall in Aussie house prices over the last 40 years was the innocuous episode between September 2017 and June 2019 when capital city values dropped by a record 10.2% care of the imposition of APRA’s macro-prudential constraints on lending. The losses at this juncture were, in fact, much worse than those experienced during either the GFC or the COVID-19 induced recession.