The RBA released its monthly chart pack this week and its always a fun flirtatious flick-through!

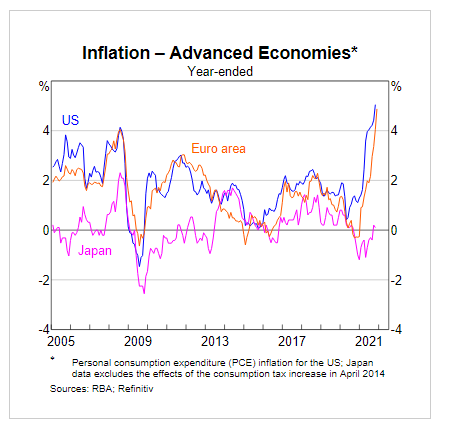

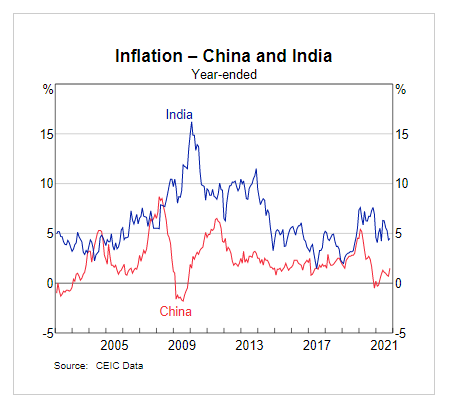

Let’s look at inflation first, which is either transitory or out of control depending on your point of view:

The US and Europe are seeing big changes in inflation as monetary policy to combat the COVID pandemic combined with supply constraints is pushing prices ever higher, but in China and India the inflation rate is somewhat nominal:

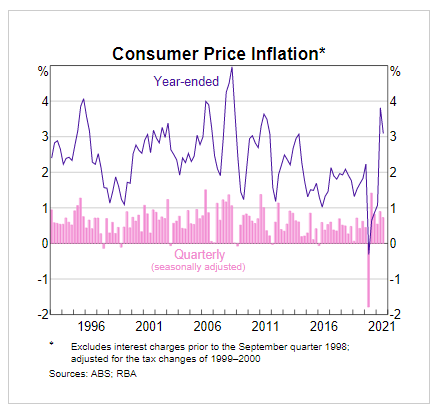

While local (flawed) measures of inflation are also benign albeit volatile, with the RBA still masters at sitting on hands:

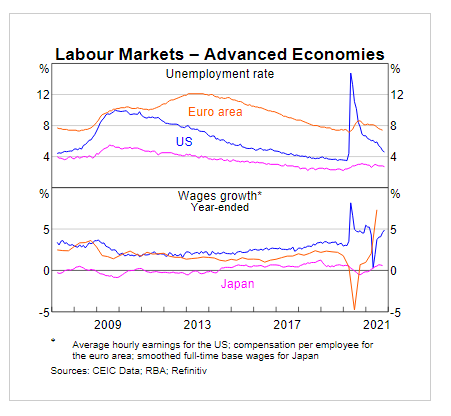

When it comes to labour markets, we can see the effect of the Great Resignation in the US clearly as unemployment rates retrace to pre-pandemic lows while wage growth zooms higher, even in Europe:

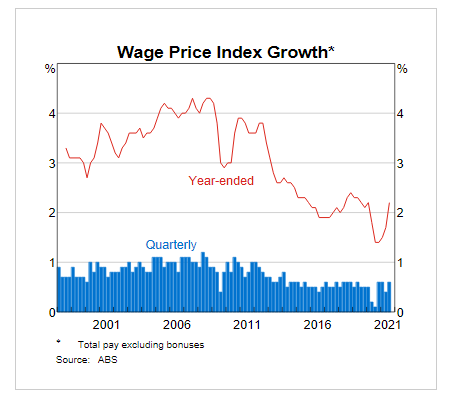

But locally, Australian workers seem to be missing out on any meaningful wage growth:

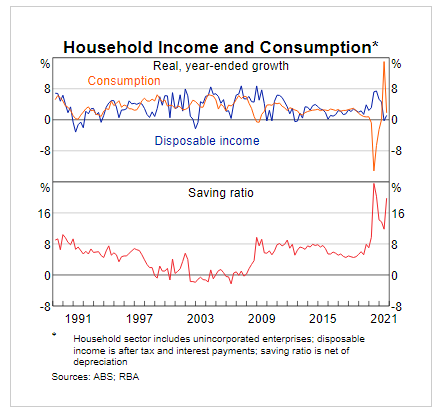

Switching to Australian households where savings are heading to new highs as the gorging of consumption goods reverts to the mean:

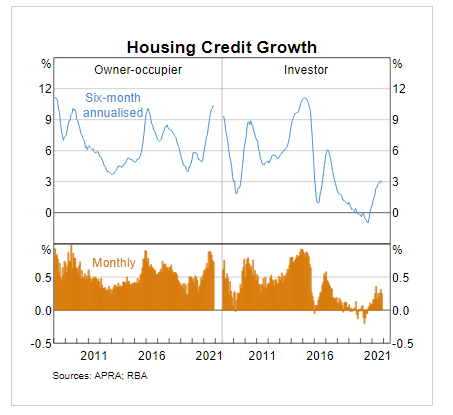

Speaking of gorging on an orgy of malinvestment, housing “investors” are back after a minor vacation, while all those savings are going to putting in new pools, deck extensions and trips to Bunnings:

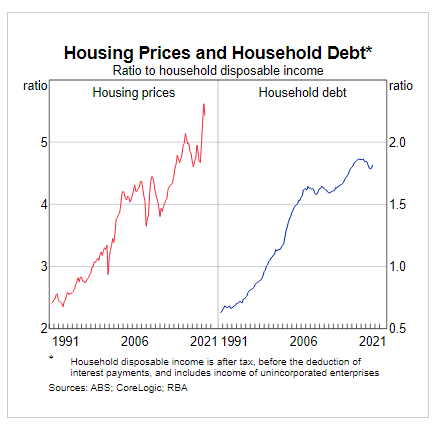

And my absolute favourite chart in the pack – house prices and debt. But I repeat myself. What a great legacy!

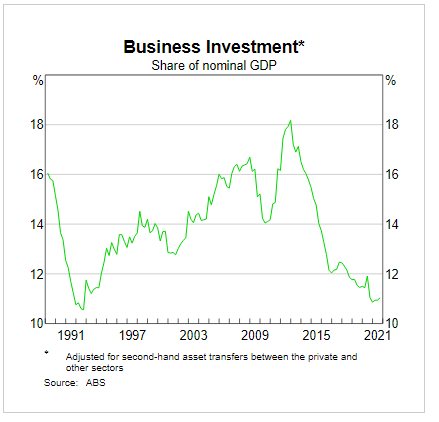

All that investment in houses is easy work compared to the hard slog of business investment – which continues to go nowhere:

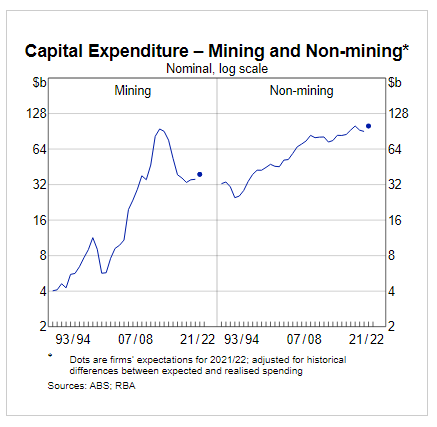

With capex also flat as a tack. Wonder why?

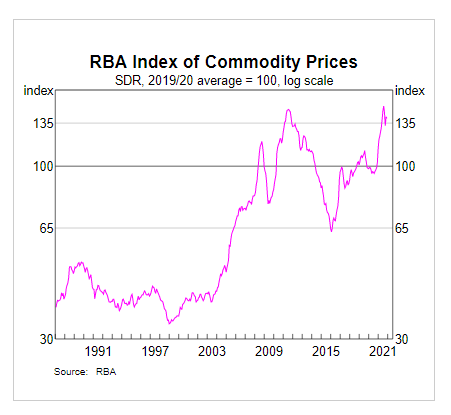

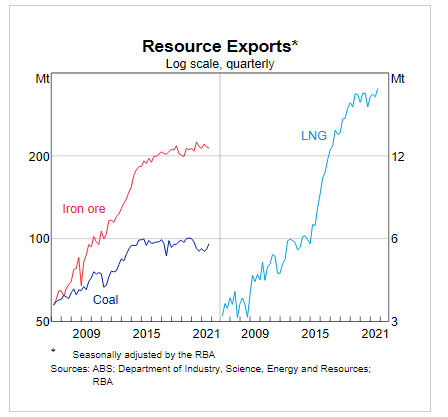

And where do Aussies get the wherewithal to borrow so much money? All hail the gods of iron ore and coal:

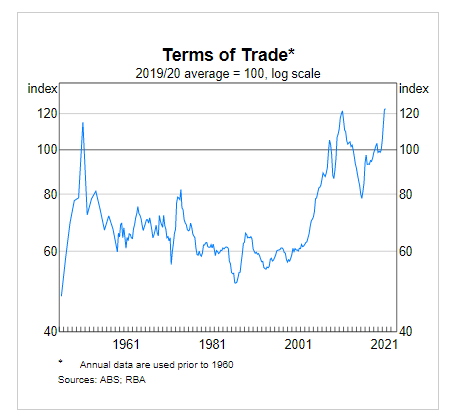

As the generational high terms of trade keep the Australian dollar so highly elevated, when its actually worth 2/5ths of you know what:

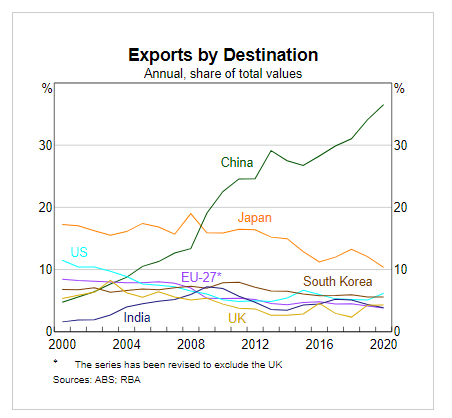

Just don’t upset China Mr Dutton – hand that feeds you and all that:

Speaking of stupidity and cruelty, witness the right hand chart of resource exports (beyond the potentially flat lining or even topping out of iron ore and coal on the left) – clearly showing the abject stupidity of LNG utilisation policy in Australia:

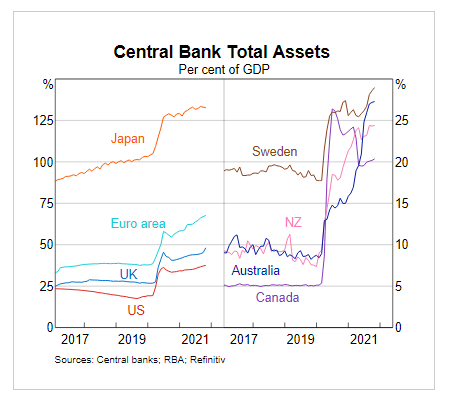

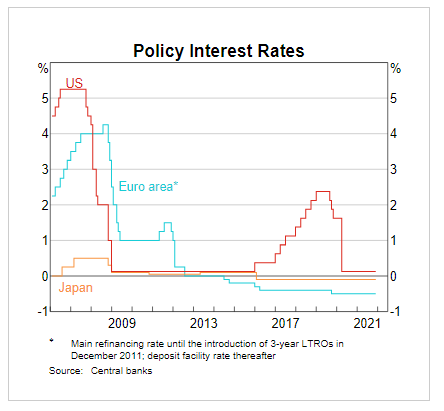

Moving away from real goods to unreal policy. Let’s print everybody. Brrrr….

And keep interest rates as low as inhumanely possible:

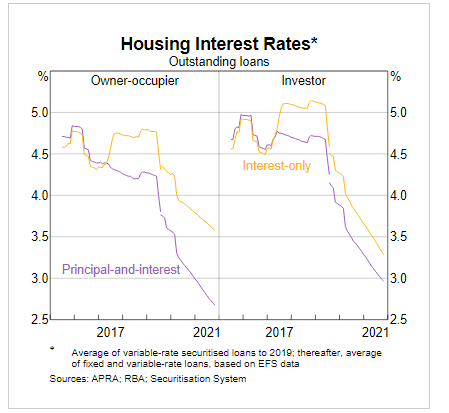

Which continues to translate into very low interest rates for property – these literally can’t go higher!

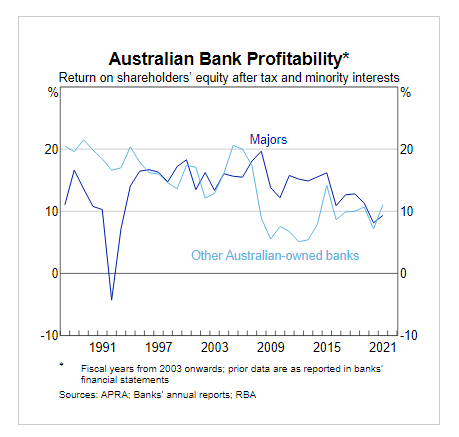

Finally we get to the banksters. If you’re new to this complex and wonder why house prices have been so high for so many decades, look at the bloated ROE on the major banks for the last 30 years:

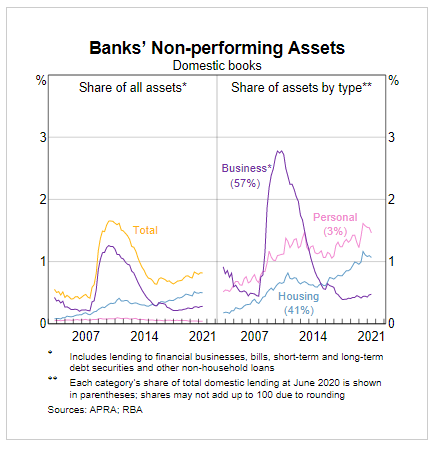

But is there trouble brewing? Non-performing assets – aka bad loans aka mortgage arrears – are steadily rising despite mammoth drops in interest rates and hence, repayments while “household savings” continues to climb.