The Foreign Investment Review Board (FIRB) has released its 2020-21 Annual Report, which shows that the number and value of purchases of Australian residential property by foreign buyers fell to its lowest level in at least 15-years amid the closure of Australia’s international border to immigration.

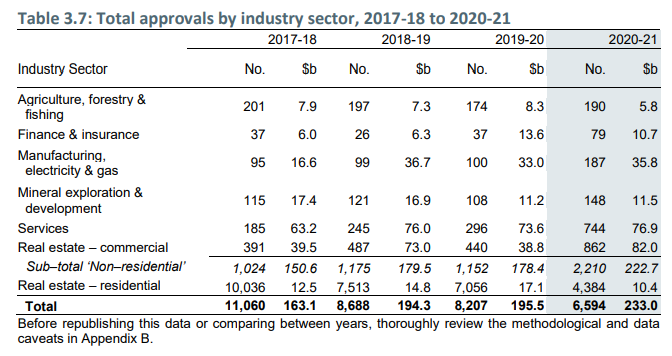

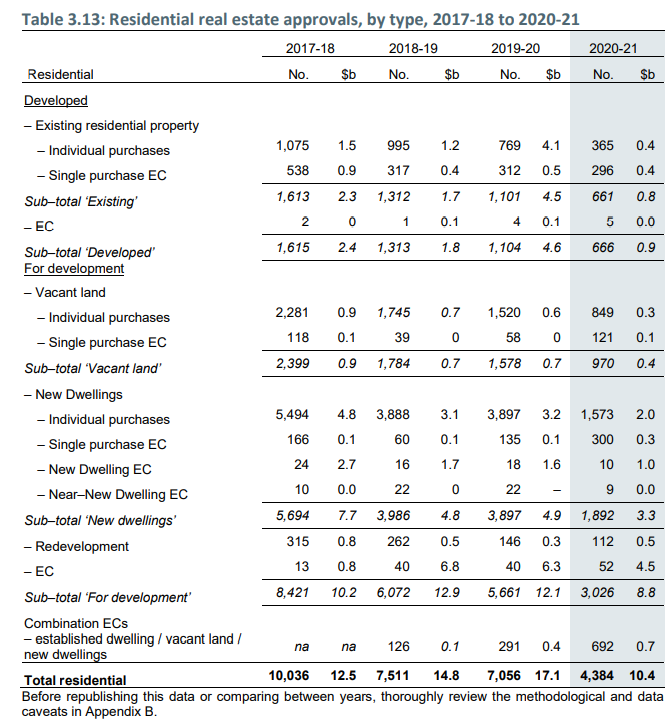

As shown in the last row in the table below, a total of 4,384 residential real estate proposals worth $10.4 billion were approved in 2020-21. This represents a 37.8% decrease in the number of approvals from 2019-20 and continues a trend seen since 2015-16.

In fact, the last time foreign buyer demand fell to similarly low levels was the 2005-06 financial year when the FIRB annual report showed just 4,648 approvals totalling $11.6 billion.

The value of proposed investment in residential real estate in 2020-21 also decreased by $6.7 billion compared to 2019-20, as illustrated below:

Factors contributing to the reduction in foreign demand include:

- Tighter domestic credit and increased restrictions on capital transfers in home countries (especially China);

- Imposition of state taxes and foreign resident stamp duty increases; and

- Increased foreign investment application fees.

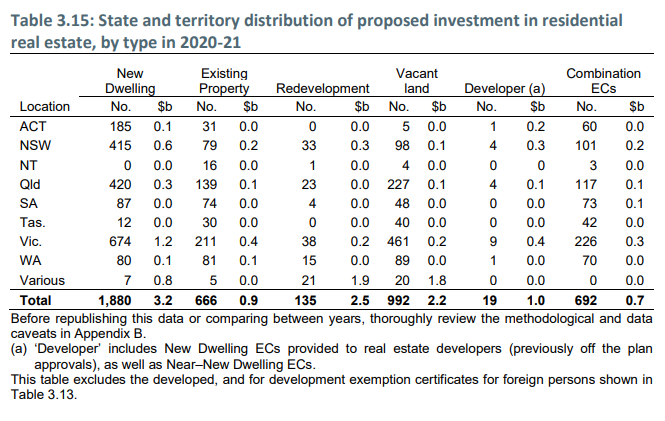

In 2020-21, Victoria and Queensland received 58% of residential real estate approvals (both developed and for development) for proposed investment (see table 3.15 below). This presents a shift in the majority share of approvals compared to 2019-20 where 62% of approvals were received by Victoria and New South Wales.

The sharp reduction in foreign buyer demand obviously relates to the closure of Australia’s international border to immigration over the pandemic, since overseas buyers typically visit the country first before purchasing. The sharp reduction of international students would similarly have reduced demand.

Now that immigration and foreign student flows are being rebooted by the federal government, foreign buyer demand should also rebound.