Mercer Pacific president David Bryant has suggested that people with large superannuation balances should be paying a higher tax on their earnings. At present all earnings are taxed at a flat rate of 15%, regardless of the account balance.

Bryant, who is the chairman of the Financial Services Council, contends that the current superannuation system is an equal one but not an equitable one, and needs reform:

“Does it need to be a flat tax system, or could people with bigger … balances pay maybe a little bit more?” Mr Bryant told The Australian Financial Review.

Mr Bryant said a progressive tax would still have to reward people for putting money aside for retirement, meaning the tax rate on super earnings would have to be lower than a person’s marginal tax rate.

There are multiple reasons why Australia’s superannuation system is a tax dodge for the rich that actually drives inequality.

But the simplest reform that the new Labor federal government could make is to simply replace the 15% flat tax on superannuation contributions and earnings with a flat 15% deduction from one’s marginal tax rate for those earning above $90,000.

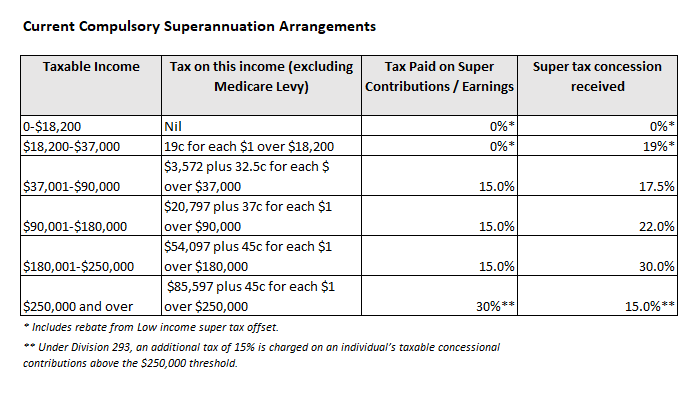

This reform would change the concessions received from superannuation from the current arrangement that favours higher income earners:

Superannuation tax concessions typically favour high income earners.

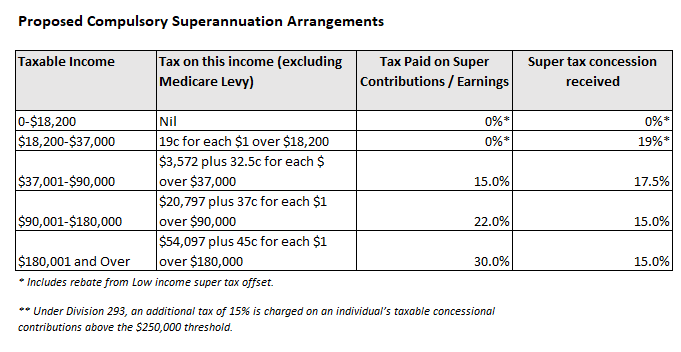

To one that spreads concessions more equally across the income distribution:

A more equitable arrangement.

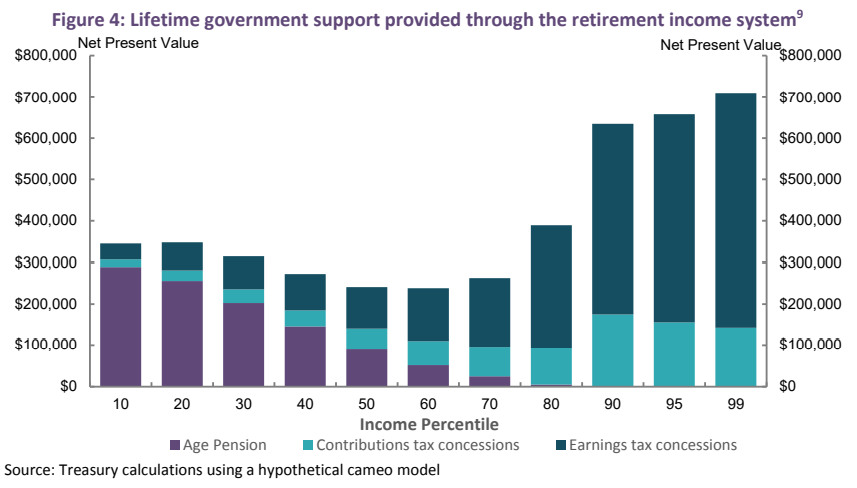

This simple reform would limit the obscene cost of superannuation concessions, which flow primarily to high income earners:

The wealthy enjoy far more retirement support than the poor, thanks to superannuation.

Thereby making the system fairer and saving the federal budget billions in foregone revenue.

Anthony Albanese should make this simple superannuation reform a priority in this term of government.