The ANZ-Roy Morgan consumer confidence survey has been pulled into the gutter by expectations of rising interest rates.

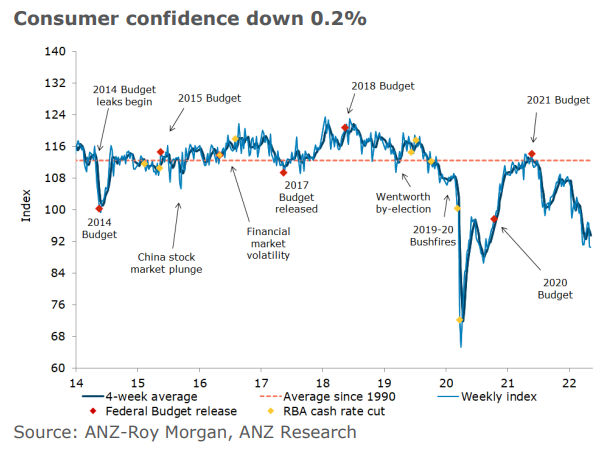

Last week, the consumer confidence index fell another 0.2%, which follows the previous week’s 6.0% plunge:

Australian consumer confidence plunges.

The consumer confidence index is now tracking at its lowest level in 20 months having plunged over 2022.

According to ANZ’s head of Australian economics, David Plank, the dive in consumer confidence has been driven by mortgaged households fearful of rising interest rates, of whom confidence plunged by nearly 15% over the past two weeks:

Consumer confidence dropped by just 0.2% last week after a 6.0% drop the week before. This suggests that consumers had anticipated the likely increase in interest rates by the RBA. Still, the rise was not entirely without impact.

Confidence among people who are ‘paying off their home loan’ dropped by 5.0%, reinforcing the 9.6% drop in the previous week. This was partially offset by the increase in confidence for those who already own their home or are renting by 1.3% and 2.6% respectively. Household inflation expectations

dropped 0.2ppt to 5.1% despite a slight increase in petrol prices last week.

REA Group’s Cameron Kusher summed up the situation with the below tweet:

Does anyone else feel like consumer confidence readings have become mostly about future mortgage cost expectations?

— Cameron Kusher (@cmkusher) May 9, 2022

With interest rates tipped to rise sharply, consumer confidence should slide deeper into the red on the back of Australia’s fearful and indebted mortgage holders.