NSW Premier Dominic Perrottet has recommitted to abolishing stamp duty in favour of land taxes, but only if the federal government provides the state with transitional funding:

The Premier confirmed next week’s state budget would include announcements and proposed changes relating to housing affordability, but clarified that no agreement had been reached with the Commonwealth.

“The reality is state governments can’t do away with stamp duty without support from the federal government,” he said.

“This is a moment for the federal government and state governments to work together to unlock economic opportunity for people going forward.”

Mr Perrottet is due to meet with the Prime Minister on Friday.

Perrottet’s argument around federal government assistance is sound.

The federal government collects around 80% of the nation’s tax revenues, with the states and local government’s collecting the remainder via a narrow base of taxes, like stamp duties.

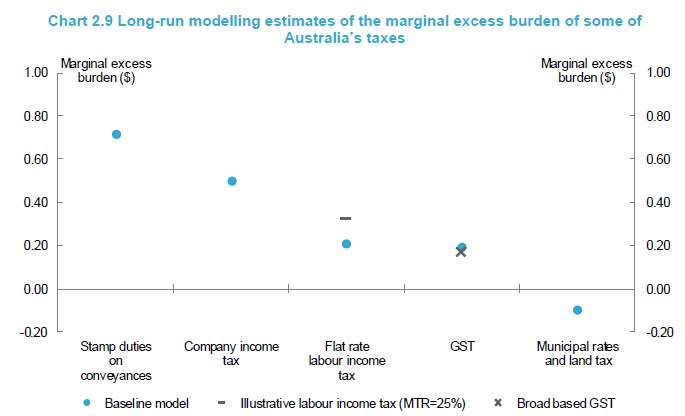

Given that the abolition of inefficient stamp duties in favour of land taxes would generate significant productivity benefits to the national economy (see next chart), and the federal government would monetise these benefit via an uplift in personal and income tax receipts, the federal government should encourage the reform process via incentive payments to the states. Doing so would enable the states to share in the revenue uplift that would arise from the resulting economy-wide productivity growth.

There are big national productivity gains from shifting from stamp duties to a broad-based land tax.

This is how ‘cooperative federalism’ should work – the federal and state governments sharing in the fruits of reform.

Sadly, Treasurer Jim Chalmers suggests that he is not prepared to compensate states which go down NSW’s path:

Dr Chalmers raised the hopes of states in March by saying he was “prepared to lead a conversation” on swapping stamp duties for land taxes if Labor won the May election…

But on Monday, he almost ruled out compensating the states for property tax reform…

“These are ultimately matters for the states,” Dr Chalmers said. “We want to work with them to address the substantial challenges we all confront in the economy, and in our budgets.”

Without the federal government’s active participation in the reform process, important productivity-lifting reforms like shifting from stamp duties to land taxes will remain in the ‘too hard’ basket.

The federal Labor Government must provide financial incentives to the states to encourage them to transition to more efficient tax bases. Otherwise, meaningful tax reform will forever remain in the ‘too hard’ basket.

Treasurer Jim Chalmers spent a lot of time talking up productivity reform leading up to the election. Now he is talking the opposite. He’s clearly not up to the challenge.