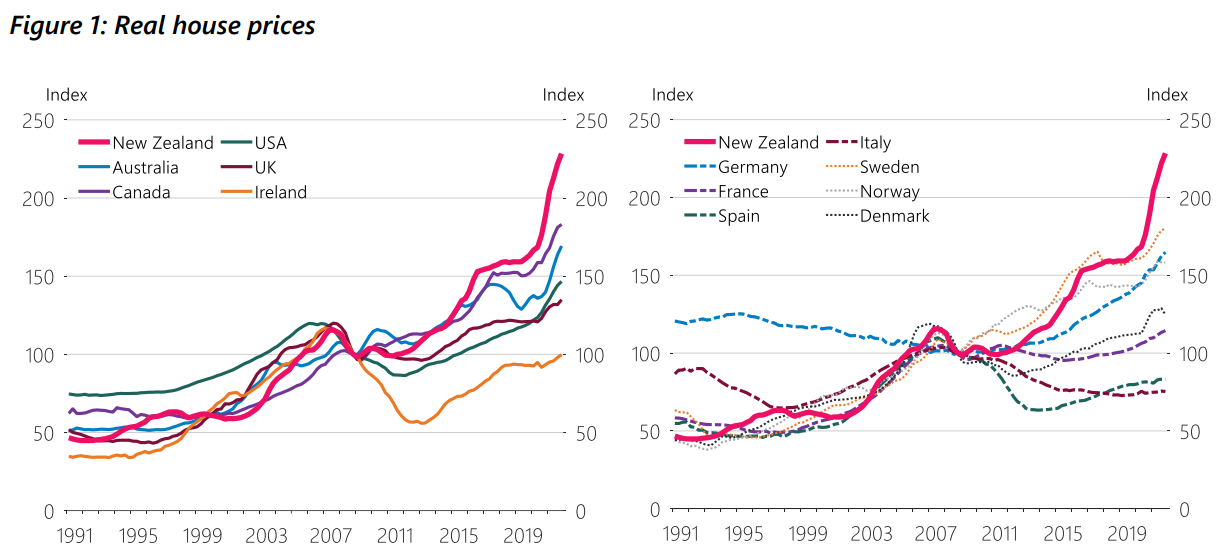

The Reserve Bank of New Zealand (RBNZ) has released research showing that New Zealand experienced the sharpest appreciation in real house prices across the developed world between 2008 and 2021:

New Zealand the house growth leader.

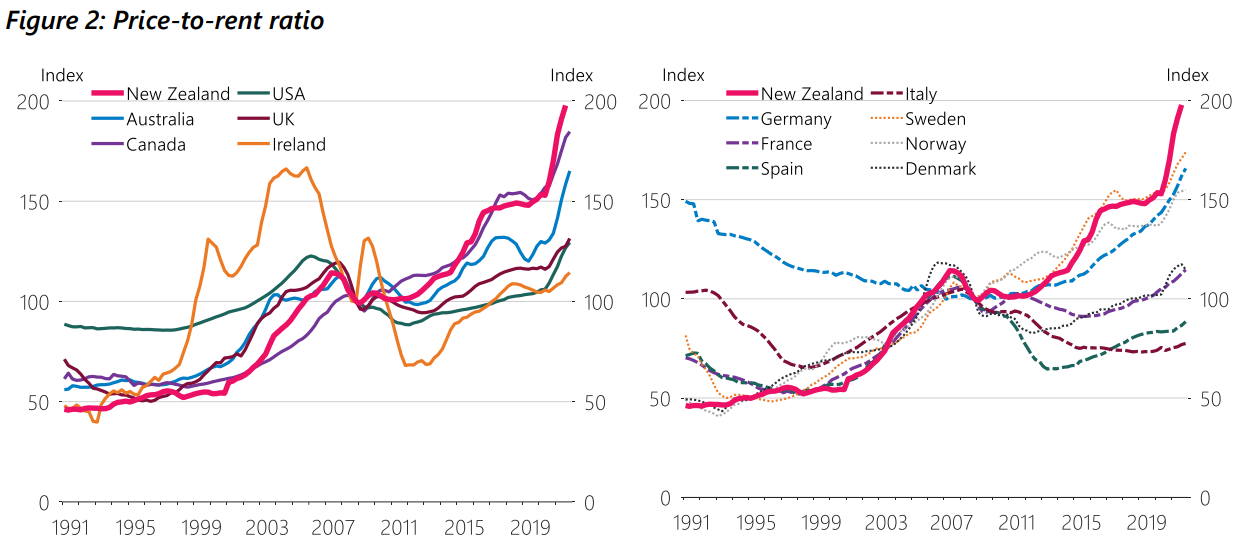

New Zealand’s house price-to-rent ratio also rose the most across developed nations, meaning “the growth in house prices since the GFC has outpaced the growth in rents in New Zealand, more so than other countries in our sample”:

New Zealand housing most expensive relative to rents.

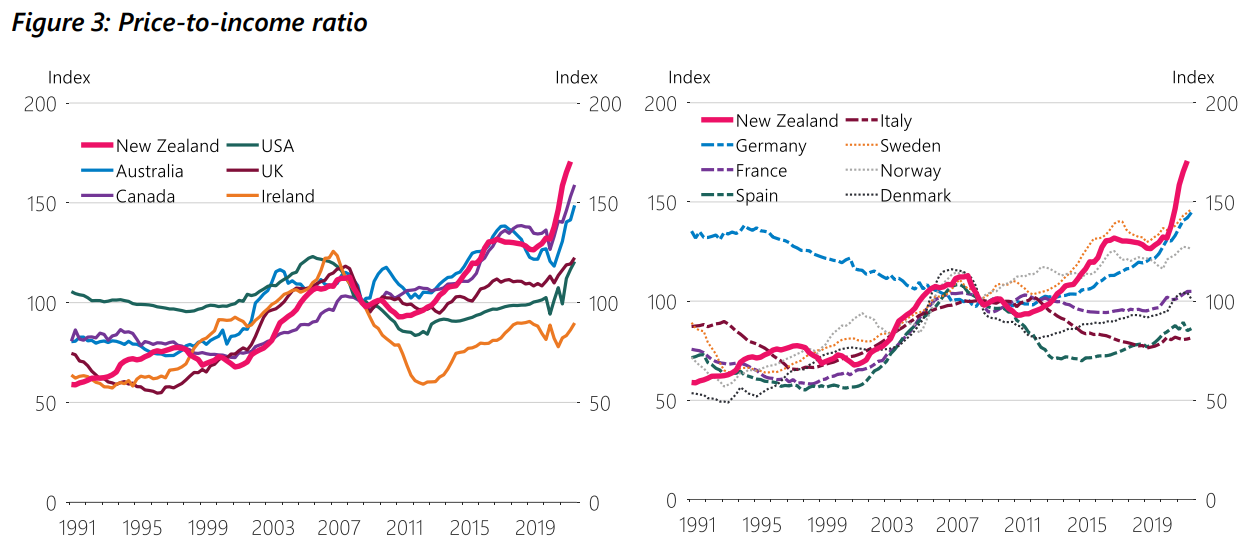

In a similar vein, New Zealand’s house price-to-income ratio rose the most in the developed world:

New Zealand housing most expensive relative to incomes.

Together, figures 2 and 3 indicate that New Zealand has one of the world’s most overvalued housing markets.

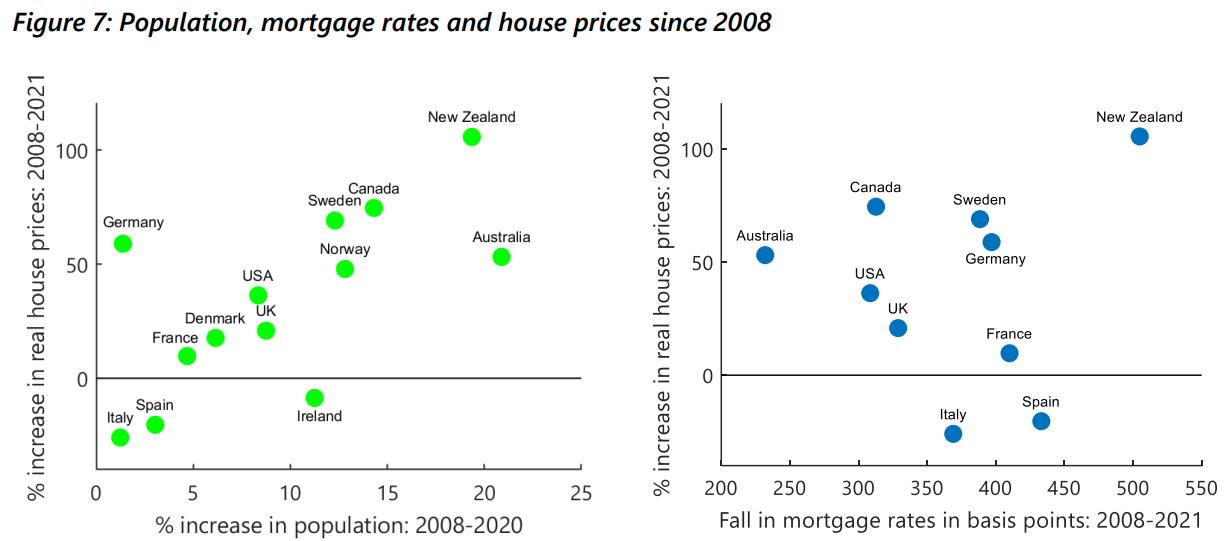

The RBNZ believes two factors explain the extreme growth in New Zealand house prices relative to the other developed nations.

First, New Zealand’s population growth was the second strongest in the developed world, behind Australia’s, due to its mass immigration policy:

New Zealand has been at the upper end of the range for much of the past 3 decades when it comes to population growth… New Zealand’s population, buoyed by high immigration, has grown rapidly…

Population growth in other economies has been relatively weaker, and even negative in Germany, France and Italy during several episodes in the last 15 years.

Second, and more importantly, New Zealand experienced the sharpest reduction in mortgage rates following the Global Financial Crisis in 2008:

The New Zealand mortgage rate started at a higher level than those in other economies in 2008… By 2021, the New Zealand rate appears to have fallen the most in our sample; about 500 basis points.

Putting both factors together produces the next scatter plot chart:

High population growth and falling mortgage rates fueled New Zealand’s house price boom.

According to the RBNZ:

Not merely has New Zealand experienced the strongest house price increase since the GFC, it has also been accompanied by almost the steepest increase in population and the strongest decline in mortgage rates across our sample economies.

The implications going forward should be obvious.

The RBNZ has commenced an aggressive monetary tightening cycle, already increasing the official cash rate (OCR) by 2.25%. It has also flagged further aggressive rate hikes, promising “to maintain its approach of briskly lifting the OCR until it is confident that monetary conditions are sufficient to constrain inflation expectations and bring consumer price inflation to within the target range”.

Given falling mortgage were a key driver of New Zealand’s unprecedented house price boom, it stands to reason that aggressive increases in mortgage rates will necessarily have the opposite effect of driving house prices sharply lower.

Interest rates are a double-edged sword for the housing market.