Comparison site Finder estimates that the average mortgage interest rate would rise to 5.85% if the official cash rate (OCR) reaches 2.5%.

Finder’s Richard Whitten says recent home buyers, in particular, will struggle to make mortgage repayments if the cash rate continues to rise. A survey by Finder has found that one in five people with a mortgage – equivalent to 551,000 households – would find it hard to make repayments if their interest rate increased by 3%. Of those, 145,000 home owners would consider selling their homes:

“If home owners paying 3 per cent now were asked to pay 6 per cent, there’d be quite a few looking to sell,” said Richard Whitten, home loans expert at Finder…

“It’s clear that many borrowers have become accustomed to the low-interest rate world of the last few years”…

“Many borrowers are stretched, having bought properties at high prices with smaller deposits and larger loan sizes. It’s clear that a cash rate of 3 per cent is a threshold at which quite a large number of Australian borrowers would find repayments unsustainable”…

“It is home owners, especially recent buyers, who will struggle the most. And in this category it is borrowers with small deposits who have stretched their budgets the most, who are going to be worst hit by rising rates.”

Whitten cautioned that distressed sales would likely rise over the remainder of the year and that “those on fixed rates may not notice a difference now, but they’ll get a real shock once their fixed rate term ends”.

SQM Research Managing Director, Louis Christopher, agreed that if mortgage rates rose to 7%, we would see a sharp rise in distressed property listings:

“If we were to get a 7 per cent average variable rate, we’re going to see a lot more people in trouble because that is essentially above the serviceability test threshold”…

“We could start to see a significant increase in mortgage stress, which will then feed through into distressed sales activity”…

“if interest rates continue to rise at this rate, we could see a sharp jump in distressed listings.”

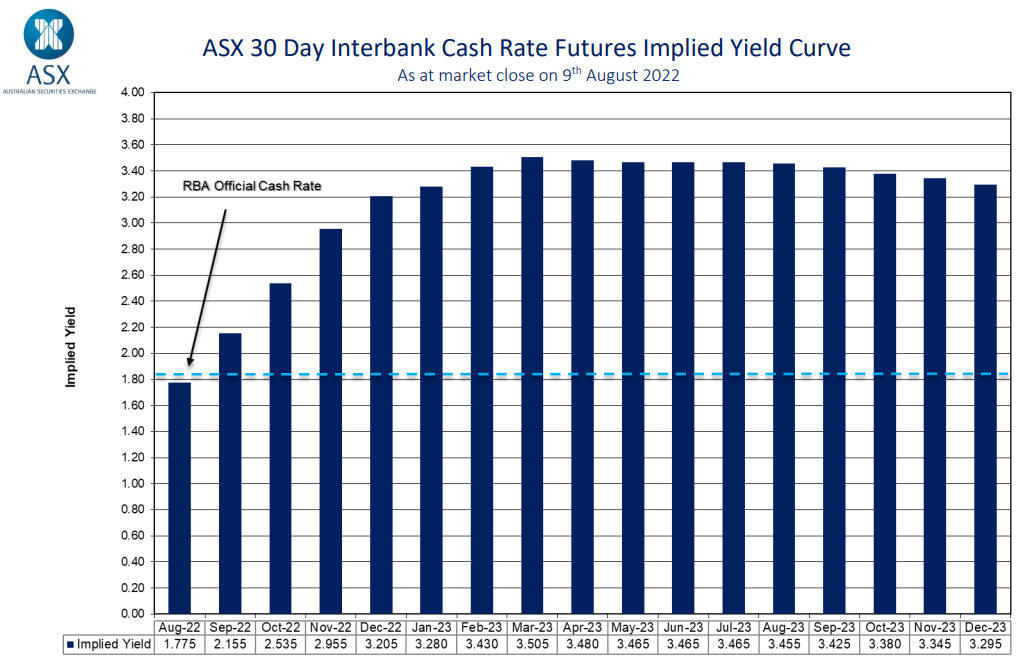

The futures market is currently tipping a peak OCR of 3.5% by March 2023:

Futures market tips further aggressive interest rate hikes.

If true, this would drive Australia’s average discount variable mortgage rate to 6.85% by March 2023, up massively from only 3.45% in April 2022 before the RBA’s first rate hike.

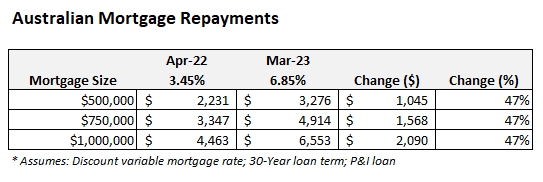

The impact on mortgage holders would be devastating, with mortgage repayments soaring by 47%:

On a modest 500,000 mortgage, this rise in interest rates would see monthly repayments soar by $1,045, in turn sending many recent buyers that stretched themselves to get into the market to the wall.