The ABC published an article neatly explaining why rising interest rates necessarily means that house prices will fall.

To cut a long story short, a higher interest rate lifts monthly mortgage repayments, which in turn limits the amount that a prospective home buyer can borrow.

The ABC cites the real world experience of the Chamberlain family who were pre-approved for a $975,000 mortgage in late 2020, but have since had their borrowing limit cut back to $750,000 due to the Reserve Bank of Australia’s (RBA) rate hikes:

The Chamberlains weren’t expecting their estimated loan amount to drop down from $975,000 to below $750,000 when they went back to their broker last month.

The couple’s deposit hasn’t changed since late 2021 and Mr Chamberlain actually received a slight pay raise recently.

“(Our broker) was pretty open with us about saying it was all down to interest rates,” Mr Chamberlain said…

“Clearly, higher interest rates are eroding borrowing capacity,” CoreLogic’s Tim Lawless told ABC News…

Mortgage broker Bruce Carr describes the current property market situation as a “feedback loop” where it is not necessarily easier for people to buy a home as their borrowing capacity diminishes.

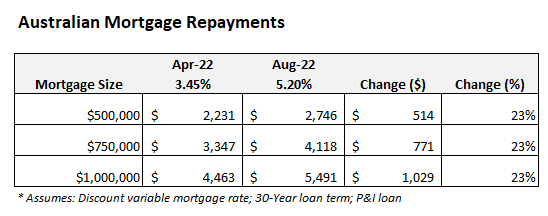

The reduced borrowing capacity can be illustrated via a mortgage calculator.

Before the RBA began its monetary tightening cycle in early May, Australia’s average discount variable mortgage rate was 3.45%.

After yesterday’s 0.5% official cash rate (OCR) increase from the RBA, the discount variable mortgage rate will rise to 5.20%, which implies a 23% increase in mortgage repayments versus their level in April before the first rate rise:

Debt servicing levels have already lifted by nearly one quarter.

Put another way, the increase in mortgage rates has already reduced borrowing capacity by 23%, other things equal.

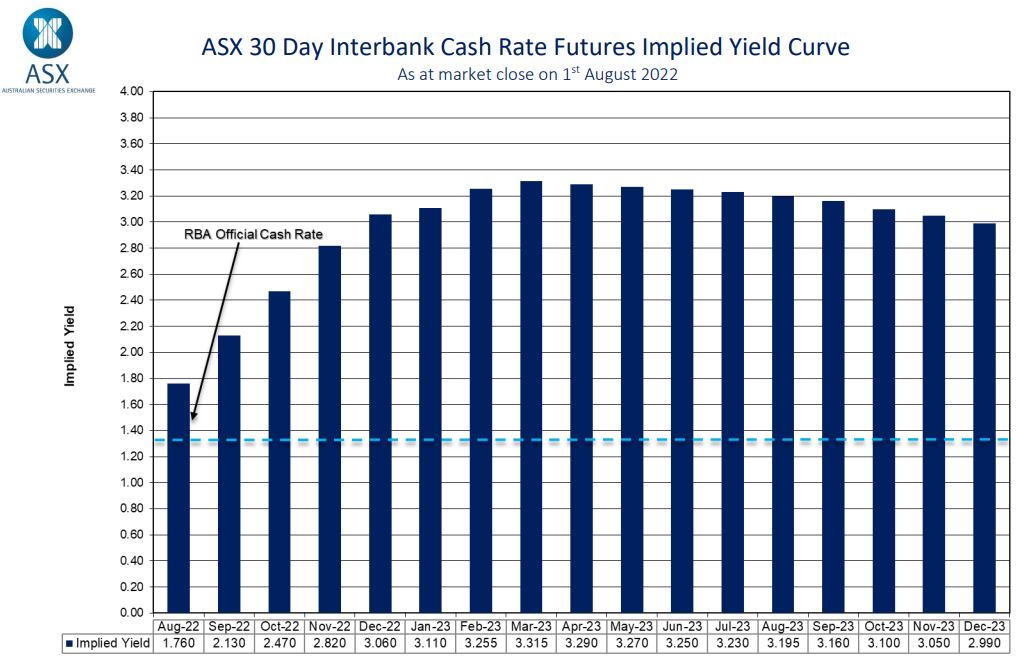

The ANZ, Westpac and the futures market are tipping the RBA to hike the OCR to around 3% by year’s end (latest futures market forecast below):

Futures markets are still tipping aggressive interest rate hikes.

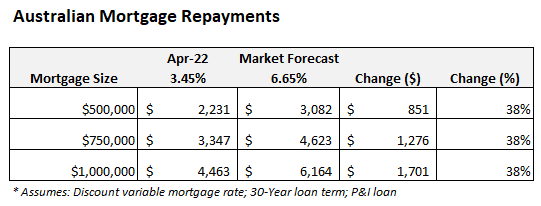

If the futures market’s peak OCR of 3.3% came to fruition, this would imply an average increase in mortgage repayments of 38% versus their level in April 2022 before the RBA commenced its tightening cycle:

Debt servicing cost to rise further.

The above data illustrates why interest rates are the biggest short-term driver of house prices, and why the aggressive monetary tightening from the RBA will necessarily drive Australian house prices sharply lower.

Interest rate hikes raise the cost of debt, lower borrowing capacity and in turn stymie buyer demand. No other factors come close.