Rabobank with the note:

Summary

- Since the summer of 2021 China’s real estate sector is facing strong headwinds.

- The recent mortgage boycott has increased the risk of contagion to other sectors.

- Policies should be focussed on the current oversupply, a more centralized approach is needed and preventing contagion risks is key.

Introduction

Take a juicy sweet water melon, add some wheat and a few toes of garlic. Doesn’t sound to appealing? It is indeed how one recipe of disaster could start, leaving the cook with (as the Dutch saying goes) baked pears; meaning you are in trouble. However in this case we are talking about the means of payment that some Chinese real estate developers accept as down payments some of their residential real estate in order to prop up liquidity ratios in order to stay afloat.

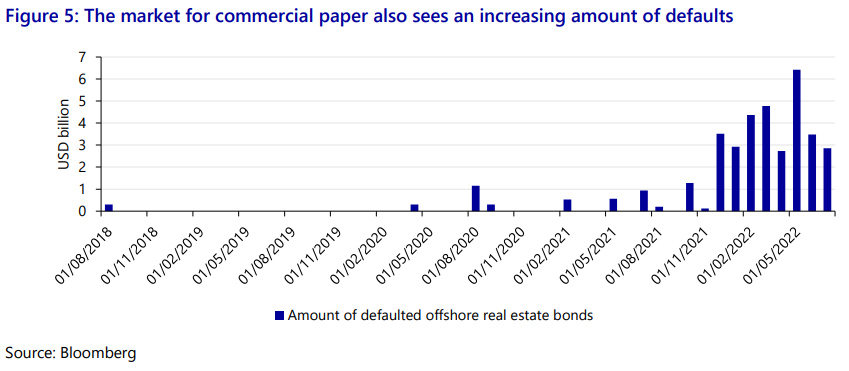

Where tulip bulbs could buy you a comfortable house in 17th century Holland, watermelons will get you property in 21st century China. However it was tulip bulbs that where in a bubble back then and it is real estate bubbling in China (and in many Western countries alike). In the last couple of months, an increasing amount of China’s real estate developers have defaulted mainly on offshore debt leaving foreign and local investors worrying.

Mainly offshore debt indeed but, a unit of the real estate developer Evergrande – were problems started last summer – named Hengda Real Estate Group Co defaulted on an onshore bond after it already received a waiver for 6 months after a put event that had to take place on the 8th of January this year. This report provides a broad overview of the current situation on China’s real estate market and how these head winds will negatively affect (potential) economic growth.

What happened?

Real estate has been one of the key drivers for China’s growth in the last decades and local governments that would struggle meeting their growth targets where eager to provide the real estate sector with (financial) incentives to build in order to report favourable growth figures. This has gradually lead to oversupply in the real estate market. Equally if not more important however is how the presale system works in practice.

In the presales system home buyers pay an amount upfront (which is often around 30% of the value of the home) before it is build. Both local authorities as well as banks have to monitor the use of these funds by real estate developers. Only after real estate developers completed predetermined milestones they can access these funds. However in practice it happens that banks already give access to these funds before the milestones are hit. Real estate developers have used these proceeds to acquire new land which they would use as collateral to obtain new loans from banks to start projects. Then real estate developers would receive new down payments after which the process just described starts again.

This system therefore increasingly had features of a Ponzi scheme since only a portion of down payments were actually being used for the construction of the building the down payment was meant to fund. The three red lines (discussed below) though necessary further destabilized the sector.

Current market trends

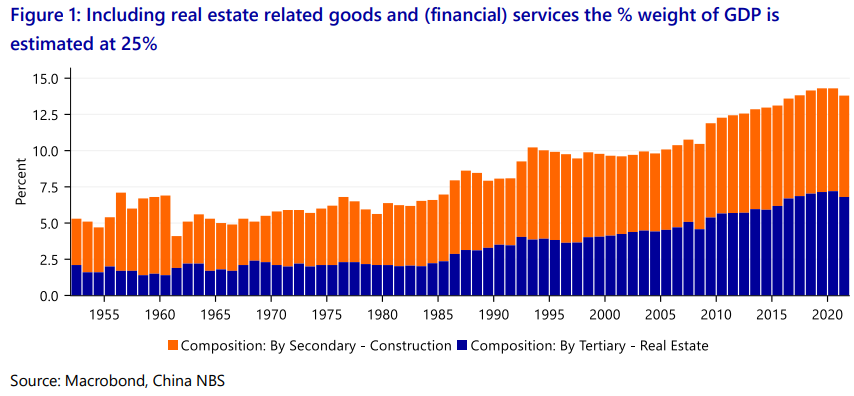

After the value of many Chinese real estate bonds dropped to record lows in March, we entered a period of relative calm. However, at the moment of writing, worries seem to have fully returned and both bonds and share prices of many Chinese real estate developers are under heavy pressure. China’s real estate sector has been one of the most important drivers of economic growth in the past but estimates about the total share of real estate-related activities of GDP differ. Because data regarding the relative size of the real estate sector are unavailable we stick to Rogoff’s estimate of 29% (2016) but apply a small correction given recent developments and estimate the share at 25%. One thing is clear however, over the years and especially since the privatization of China’s real estate sector in 1990, this share has increased over the years until recently. While the graph below shows a much lower percentage, our estimate also includes the production of goods (furniture, home textiles, interior decoration etc.) and services that can directly be related to the real estate sector like legal and financial services and the construction sector.

Another example is China’s steel sector that is suffering from a steep drop in demand. Li Ganpo, chairman of Hebei Jingye steel group recently voiced concerns stating that no less than a third of China’s steel mills could file for bankruptcy and predicted that the current real estate crisis could last for no less than 5-years. It is estimated that a third of domestic demand for steel originates from the real estate sector. No surprise therefore that the PMI for China’s steel business fell another 3.2 point from June falling to a level of only 33 points indicating dire prospects for China’s steel industry. Hence, for market participants it is crucial to take second round effects into account because many other sectors will be effected by the real estate crisis.

Still, it should be obvious that not all construction related activities (as shown below in figure 1) can be attributed to the real estate sector. Infrastructure entails another important share of the construction sector. Still, the total value of China’s property market (homes and developers’ inventory) at the end of last year was estimated to be around $55 trillion! This means that the Chinese real estate sector is also the biggest asset class in the world. Needless to say that severe problems in the real estate market will have a severe impact on economic growth.

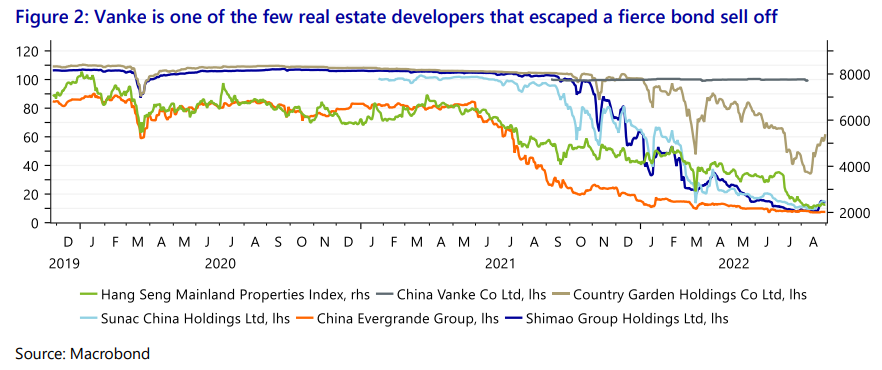

The crisis in China’s real estate sector has a huge impact on share and bond prices alike. With some exceptions – like the second largest real estate developer Vanke – many (offshore) bonds of Chinese real estate developers are trading below 10 cents a dollar which indicates that investors hardly expect to see anything back from their investments. With (foreign) investors escaping China’s real estate bond market, any funding for the real estate sector would have to come from the financial sector or the (local) government. It should be obvious that the financial sector is not jumping at the opportunity to (re)finance the real estate sector; despite repeated calls from regulators to step up lending. Moreover, sales of residential mortgage-backed securities have fallen 92% this year to only 24.5 billion yuan, reflecting weak mortgage origination.

More recently, an increasing number of home buyers stopped paying on their mortgages for unfinished real estate projects. What started with a small group of rebellious citizens refusing to pay back their mortgages, has spread to at least hundreds of projects in no less than 100 cities. This is clearly aggravating the already precarious situation. It is therefore no surprise that on the 3 rd of August the Hang Seng Mainland properties Index hit a fresh new low. Especially the provinces of Henan and Hunan are affected.

The spreading of the mortgage boycott quickly got the attention of Beijing leading president Xi Jinping’s politburo calling upon local governments to ensure completion of housing projects and that banks would be stimulated and supported to provide the real estate sector with much needed funding. To make matters worse, hundreds of contractors joined ranks and refuse to pay back on their debts because of outstanding amounts owned to them by real estate developers.

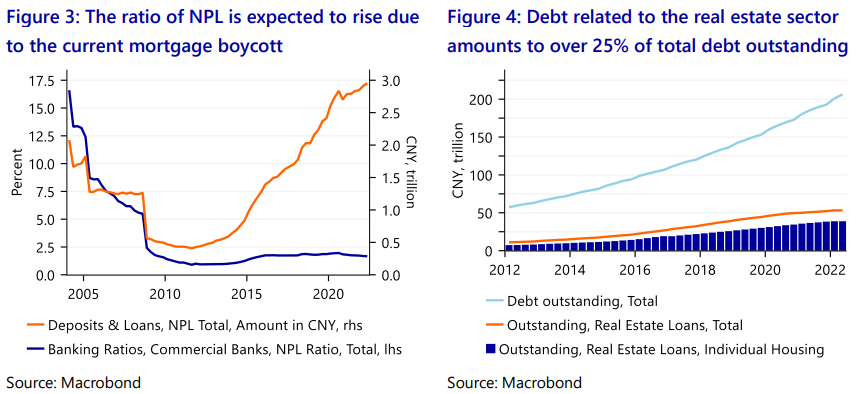

While Chinese banks claim their current credit at risk amounts to 2.1 billion yuan and as such would controllable, this figure likely severely underestimates the true size of the problem. If only 1% of outstanding real estate loans for individual housing would be at risk of non-payment, this figure would already be at 388 billion yuan (total outstanding debt. Some estimate that 2 trillion of mortgages could be impacted. The total amount of non-performing loans currently stands at 2.85 trillion.

Even if we would assume an even distribution of NPL overall debt categories, then over 25% of NPL could be attributed to the real estate sector which would amount to about 750 billion yuan ($110 billion). The market is currently pricing in $130 billion of losses and two thirds of offshore dollar bonds are now trading below 70 cents a dollar.

If we would look at the total ratio of NPL ( approximately 1.70%) and assume a similar NPL ratio for the real estate sector we would still look at an amount of about 660 billion yuan ($98 billion) (outstanding real estate loans amount to 38.8 trillion yuan as illustrated in figure 4). This would of course mean that we would assume that the ratio of NPL would remain constant. In case we would observe a ratio similar of 2008 (5,50%) we would be looking at slightly over 2.1 trillion yuan at risk ($310 billion).

Not only does China’s real estate sector face significant challenges regarding funding, contracted sales have dropped dramatically. Looking at the top 10 developers (based on the value of contracted sales) in May 2021 and in May 2022 the dramatic drop in sales can be illustrated. In May last year Sunac China reported 70.8 billion yuan in sales topping the list. Now Sunac finds itself at number 8 reporting 12.9 billion yuan in sales representing a drop of no less than 82%. All top 10 real estate developers saw their sales dropping in May this year. The largest real estate developer (again measured in contracted sales) in May 2022 was Poly Development reporting a value of 38 billion yuan (a decline of 36% YoY).

All of this has significantly impacted the amount of unfinished real estate projects. As long as the problem of unfinished real estate is not solved, a return of demand for real estate property seems highly unlikely. It is therefore no coincidence that the China Banking and Insurance Regulatory Commission (CBIRC) called for banks to provide funding when developers’ needs are reasonable. It further declared that it would strengthen coordination with other regulators to ensure the delivery of homes. The government has stepped up efforts to contain the current situation but until now, the market has not been convinced that current measures are sufficient as figure 2 above clearly shows.

More government support is needed

The first government intervention to rain in the increasingly leveraged real estate market was the introduction of the so called three red lines. These red lines set a framework for real estate developers that want to (re)finance themselves. These three red lines are: The liabilities should not exceed 70% of the value of its assets, Net debt shouldn’t exceed equity and directly available liquidity should equal short-term borrowings. However, regulators have stopped short of providing the exact methodology of calculating these levels. Moreover, a company that would cross all red lines would only be limited to increase its maximum debt level with 15% the next year. It should be clear however that these redlines were only introduced after home prices surged six-fold from 2005 until 2020. By then the market total for offshore bonds already reached a size of $870 billion. The real estate sector bond market size is somewhat over $200 billion.

While China’s debt is expected to climb to a new record this year, the PBOC’s policy is still bend on increasing the balance sheet meaning that leverage will increase further. According to the director of the National Institution for Finance and Development Zhang Xiaojing the ratio of debt to GDP is estimated to rise with more than 11% which would take the total amount of debt to approximately 275% of GDP. On the 25th of July the CCP announced setting up a real estate fund that could reach 300 billion yuan which would support a dozen of real estate developers including Evergrande. The People’s Bank of China (PBOC) will support the new fund with 80 billion yuan and China Construction Bank will put in another 50 billion yuan. However the Politburo was clear in its June meeting that the main responsibility for stabilizing the situation on the real estate market lies with local governments.

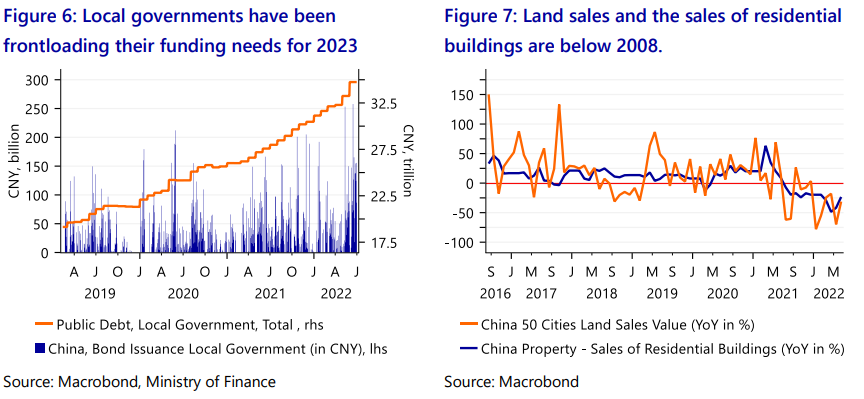

So despite guidelines from Beijing, the task of dealing with the real estate crisis is largely on the plate of local governments. As such, the number of cities implementing policies to stabilize the situation has increased. At this stage local governments focus much of their efforts on land sales which are a crucial source of income for local governments as well. There are some signs that sales and acquisition of land by real estate companies are stabilizing. Still, from figure 6 it becomes clear that it is far too early to say that the worst is over. The sales of both land and residential building are still in decline. Furthermore, the absence of further nationwide policies and the wide range of local measures which often leave room for interpretation, make it hard for investors to get a clear overview of what exactly can be expected from policies.

Additionally, local governments are considering issuing more so called special bonds. These bonds raise cash for particular projects or policies. In the first half of this year China issued 3.41 trillion yuan which comes close to the full quota for 2022 of 3.65 trillion yuan. Additionally, local governments are pressed to fully use the amounts raised by the end of August.

Furthermore local governments are expected to frontload their bond issuance for 2023. However, the majority of this will be used for infrastructural projects that generally see diminishing marginal returns compared to earlier investments in infrastructural projects. Markets so far reacted with disappointment and continued to sell real estate stocks and bonds alike.

More forceful action from the central government?

More recently Beijing seems to step up support for the real estate sector and seeks for a is now considering a mortgage grace period for home buyers in case of stalled property projects. This, after tens of thousands of homeowners have stopped paying back on their mortgages while demanding that developers should finish their building projects first before they start paying off their mortgages again. that these home buyers won’t see their credit score negatively affected and won’t have to pay fines for delayed payments. Although this plan is designed to support and stabilize the property sector it clearly stops short of a (long term) solution. Quite the contrary since currently it is estimated that homeowners have refused to repay an amount between $150 – $370 billion. This will put additional pressure on the banking sector that is in some cases already struggles with meeting their obligations.

On the 15th of August the People’s Bank of China (PBOC) surprised markets by lowering the 1-year Medium-Term Lending Facility Rate (MLF) from 2.85% to 2.75%. Previously commercial banks lowered the 5-year MLF (which is a benchmark rate for mortgages) in April and July in order to stimulate, stabilize and support consumers, this latest hike is clearly aimed at businesses and to tackle increasing liquidity risks for the business sector in general and more specifically the real estate sector. Additionally, Beijing seeks to set up a 1 trillion yuan loan facility ($148 billion) for stalled property developments which is the most bold move to turn the tide in the real estate sector yet. According to the plan which has been approved by the state council, the PBOC will provide a 200 billion yuan ($30 billion) low interest loan against a 1.75% interest rate which banks will use together to leverage this amount 5 fold (which would bring the size of the fund to 1 trillion yuan) with their own funds to finance stalled real estate projects against market rates. All these measures seem to be a sign that Beijing realizes that the current size of the real estate crisis is simply too big for local governments to solve and that bold action is needed to prevent events from spiralling out of control.

The latest stimulus package with a size of 1 trillion yuan was launched on the 25th of August which amounts to less than 1% of GDP. With capital requirements for infrastructure at 20%-25% per project this fund could be leveraged approximately 5 times which would be about 5% of GDP. Including this latest stimulus package will increase this year’s budget deficit to 6.2%. This package is on top of the 33 policies announced 3 months earlier and which we discussed here. However like the earlier stimulus package it lacks decisive action directed to the real estate market. Again the ball is in the court of local governments. Furthermore, the fact that cities are permitted to implement city specific measures does not provide (foreign) investors with much needed clarity. This legitimizes the question whether all of this will this be enough to get China’s real estate

sector out of the woods.

What now?

Estimates by Beijing-based Everbright Bank indicate that at the moment of writing, developers have stopped construction work on 8 million homes and that kick starting these projects would require 2 trillion yuan (close to 300 billion dollars). This means that state owned commercial banks would require an additional 1 trillion yuan of their own funding in order for real estate developers to complete unfinished projects (remember the loan facility described above has a size of 1 trillion yuan).

However, since real estate developers stopped repaying their creditors before they stalled construction projects, simply funding real estate developers could lead creditors (like contractors) to demand repayments on their unpaid loans. Moreover, finding real estate projects with any value will prove to be highly complex since most projects have been sold out and many unfinished projects are located in tier 3 cities where rentals are weak and purchases have fallen sharply. Support measures from local governments have not been able to turn the tide.

This means that for a successful intervention authorities somehow would need a way to find out which unfinished real estate projects can expect healthy returns from sales or rents and which not. Additionally, a more centralized approach is needed to provide more clarity for (foreign) investors. The current jungle of local support measures only contributes to the already huge uncertainty plaguing the real estate sector. Aside from determining the proper mechanism that is needed to control and eventually end the real estate crisis, the other big question is who should pay the bill.

Given Xi’s common prosperity policy, it is unlikely that the burden will be placed on home owners. As has been described above, offshore bond holders are expected to suffer additional losses as more real estate developers are expected to default on their bonds. Onshore bond holders will also certainly have to accept more haircuts on their investments. The main problem seems to be how to deal with the banking sector that provided the vast majority of loans to home owners and that face a mortgage payment boycott.

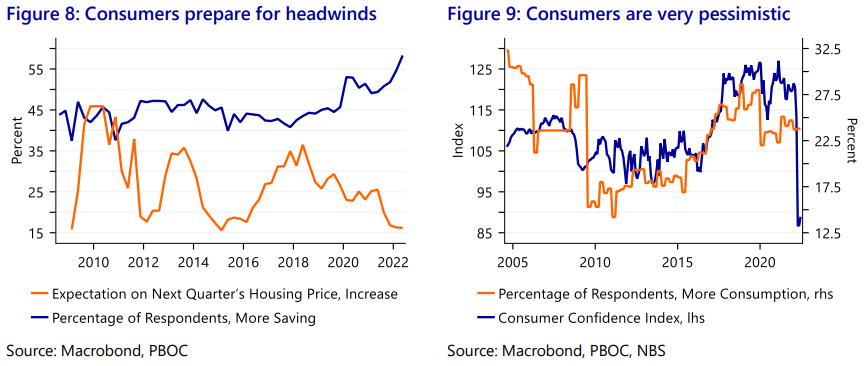

If homeowners would not pay back those loans then banks will be the owners of many unfinished real estate projects; implying huge losses on their loan portfolio. But even if unfinished real estate projects would be finished it would mean that the already existing oversupply will be increased further. Since unoccupied houses will only be a burden for homeowner,( 70% of Chinese household wealth is already invested in real estate and trust in the real estate sector runs low) it seems unlikely that measures designed to increase aggregate demand will be successful. Indeed, the role that house prices play when it comes to consuming (known as the wealth effect) has been found in China as well.

This partially explains why recent retail figures have been disappointing and savings have gone up since hardly anyone expects housing prices to go up in the short term (see figure 8 below). With income- and economic growth slowing, inflation slowly rising and record high youth unemployment, stimulating consumer demand is tempting but likely to be ineffective since it is the real estate crisis which is heavily contributing to the current negative consumer sentiment. Despite retail sales having picked up after the contractions we saw this spring, retail sales growth is still far below pre-pandemic levels. Furthermore, consumer confidence dropped to a record low in May and few consumers expect to spend more in the short term (see figure 9).

If Beijing would still would want to focus on the demand side of the real estate sector it would make sense to abandon the current Hukou registration restrictions for rural citizens. However as we outline above we think the main solutions should be found at the supply side. Much demand for housing originates from a desire to have passive income on top of governments pensions when reaching retirement age. Offering more possibilities for China’s middle class to invest in would also reduce the inherent concentration risk of an investment portfolio which is invested for 70% in China’s real estate.

The role of local governments should also be taken into account. Currently local governments are too much dependent of local land sales for their income. Moreover, local governments also have to comply with economic growth targets set in Beijing. Both these factors creates incentives for local governments to sell land to real estate developers despite the obvious risks that these policies can easily create a potential for oversupply.

Regulators should intensify supervising the banking sector in several areas. Switching from a recourse to a non-recourse model would leave banks with only the home as collateral for the mortgages they extent. This would create a strong incentive for banks to apply proper eligibility criteria for mortgage applicants and enhance due diligence.

Paying up seems unavoidable

Still a lot of damage has already been done more defaults are expected. This means that somewhere, somehow somebody needs to pay the price. As mentioned above it is unlikely that the bill will be paid by those who purchased unfinished buildings since it would go against the idea of common prosperity and would certainly lead to increasing social unrest. Since troubled real estate developers won’t be able to make up for the losses incurred, it will be investors, the banking sector and or the government. It should now be clear that therefore the real estate crisis has the potential to lead to a systemic crisis. It would therefore be recommendable to centralize coordination of the real estate sector and come up with a convincing plan in order to assure market participants that contagion risks have been contained.

Since banks are unlikely to be able to absorb all the financial losses from NPL the government will need to realize that it will have to provide guarantees for certain loans to real estate projects that hold some value. Additionally the government will likely have to take over many mortgages that will never be paid back which basically means setting up a bad bank. State guarantees for new bonds issued by real estate developers is another way to ensure that real estate developers continue to have access to much needed funding. Friday the 26th saw the first issuance of such a bond. All in all the current path will not lead to much needed return of confidence in China’s real estate market. The longer it takes to come up with a grand plan to effectively deal with the spreading real estate crisis, the more likely it will become that China will have to deal with a hard landing of their economy. This will imply that a significant portion of bad debt will end up on the balance sheet of the government.