In the wake of last week’s data showing New Zealand house prices plunging at their fastest pace on record in the six months to August, ANZ’s economics team has aggressively raised its interest rate forecasts.

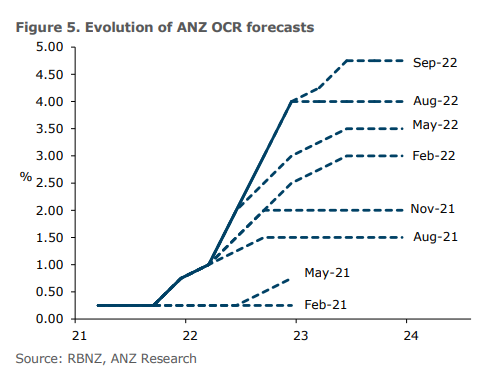

ANZ now believes the Reserve Bank of New Zealand (RBNZ) will lift the official cash rate (OCR) to a peak of 4.75% (previously 4%), with 25bp hikes added to its profile in February, April, and May next year:

ANZ tips more rate hikes from the RBNZ.

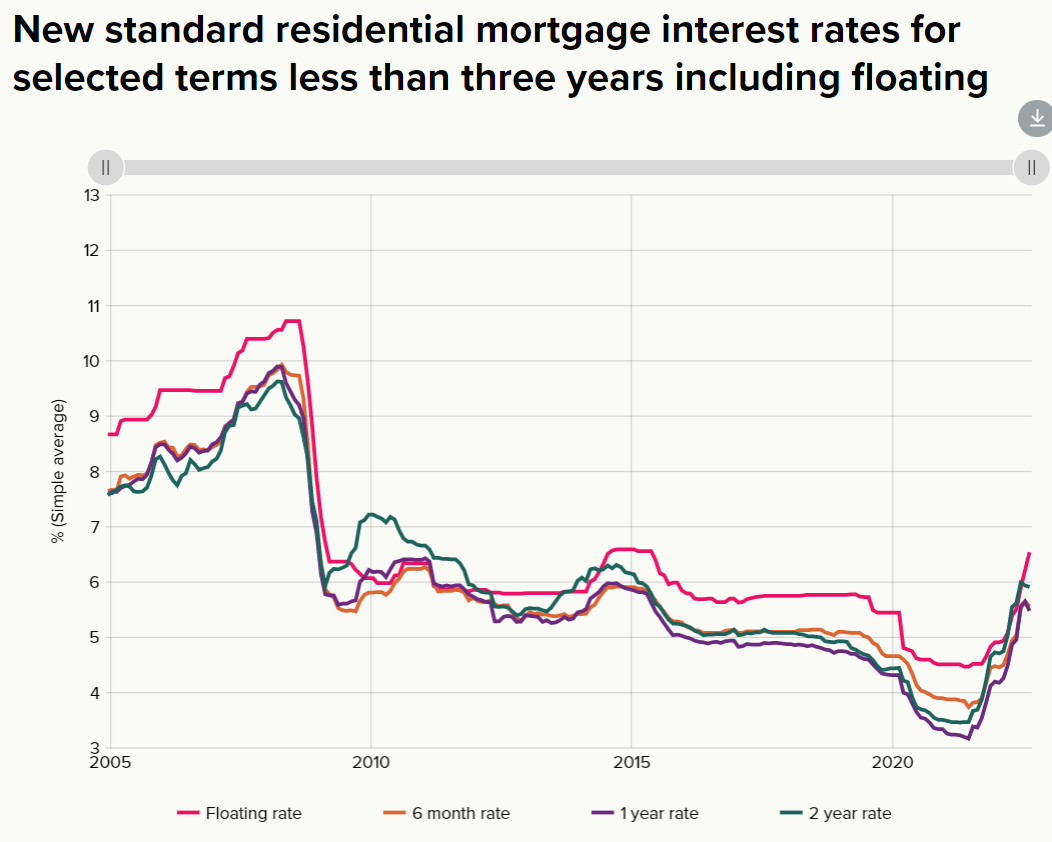

As illustrated in the next chart from the RBNZ, Kiwi mortgage rates have already increased by around 2.5% from their pandemic lows across the various loan terms:

New Zealand mortgage rates are already up around 2.5% from their 2021 lows.

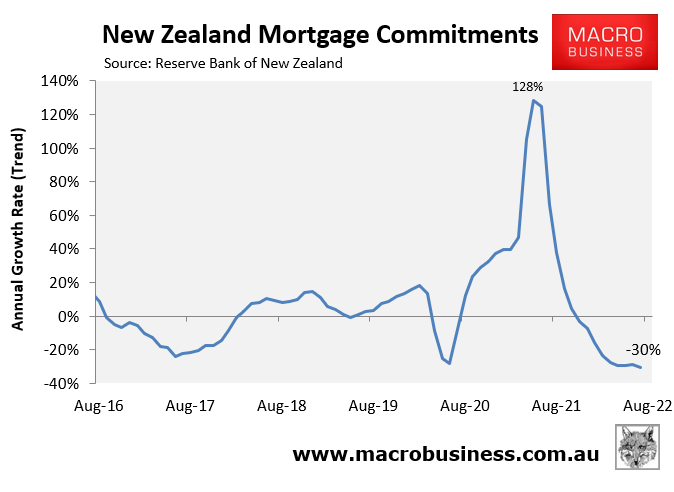

These rate rises have reduced borrowing capacity by around 30% from their pandemic lows, which has driven the sharp contraction in mortgage demand, and with it house prices:

New Zealand mortgage demand collapses.

If ANZ turns out to be correct, and the RBNZ hikes interest rates more aggressively than is anticipated, then it will lift mortgage rates higher and further shrink borrowing capacity.

The only logical outcome is further house price falls, which are already nearing 10%.

After experiencing one of the world’s biggest price booms over the pandemic, New Zealand now faces one of the biggest busts.