RBA rate hikes hammer consumer confidence

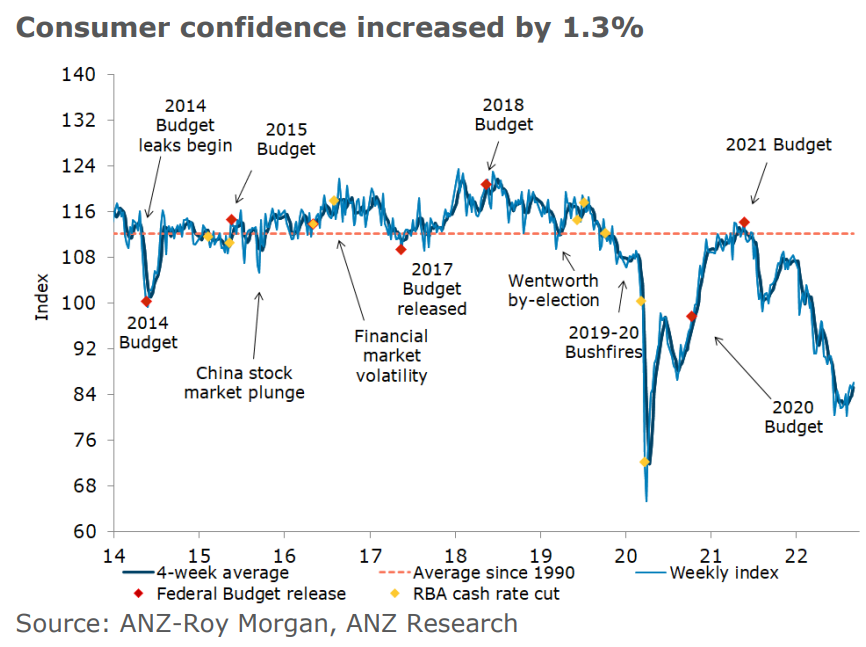

The ANZ-Roy Morgan consumer confidence index has been released, with overall confidence lifting another 1.3% to its highest level since early June:

Australian consumer confidence rebounding.

The key changes in the sub-indices are as follows:

- Consumer confidence increased 1.3% last week, reaching its highest level since early June. Across the major states confidence increased in Victoria, Queensland, SA and WA, but was flat in NSW.

- ‘Weekly inflation expectations’ rose 0.1ppt to 5.4%, though its four-week moving average was down 0.1ppt to 5.5%.

- Four of the five confidence subindices increased. ‘Current financial conditions’ rose 1.5%. ‘Future financial conditions’ fell for a second week in a row by 0.5%, however it remains above the neutral level of 100.

- Both ‘current’ and ‘future economic conditions’ increased for a fourth straight week, by 1.1% and 2.6% respectively. They’re both at their highest level since late May.

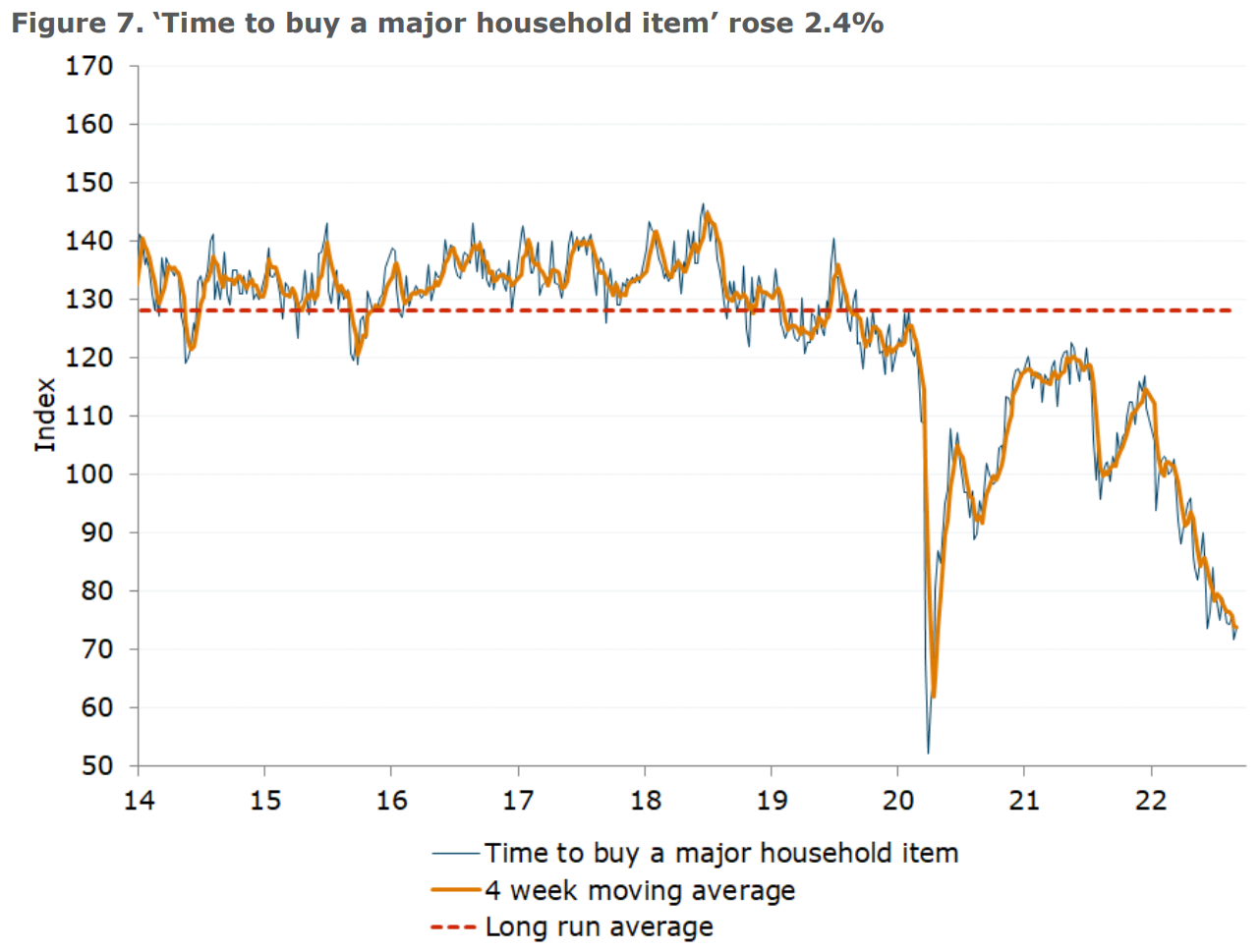

- ‘Time to buy a major household item’ rose 2.4% after a 5.5% drop the week before.

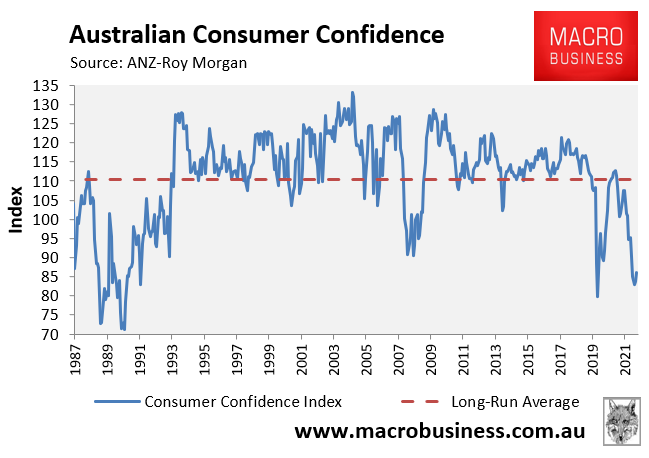

Taking a long-term view, Australian consumer confidence remains near recessionary levels still way below the trough of the Global Financial Crisis:

Consumer confidence still tracking near recessionary levels.

Commenting on the results, ANZ’s head of Australian economics, David Plank, noted that confidence is drastically lower among those paying off a mortgage, with confidence plunging following RBA rate hikes:

The confidence data by housing status shows that for people renting a home, confidence jumped last week and is now at a higher level than it was before the RBA started raising interest rates. However, for people paying off a mortgage and for those who own their home confidence is sharply lower by 19% and 13% respectively since the RBA’s first rate hike in May.

The recovery in consumer confidence is encouraging, but it remains in very negative territory despite the lowest unemployment rate in decades.

Arguably the most important sub-index is the ‘Time to buy a major household item’, since it correlates most closely with household consumption – the economy’s main growth driver:

Household consumption set to fall.

As shown above, this sub-index has plummeted, suggesting household consumption will fall too.