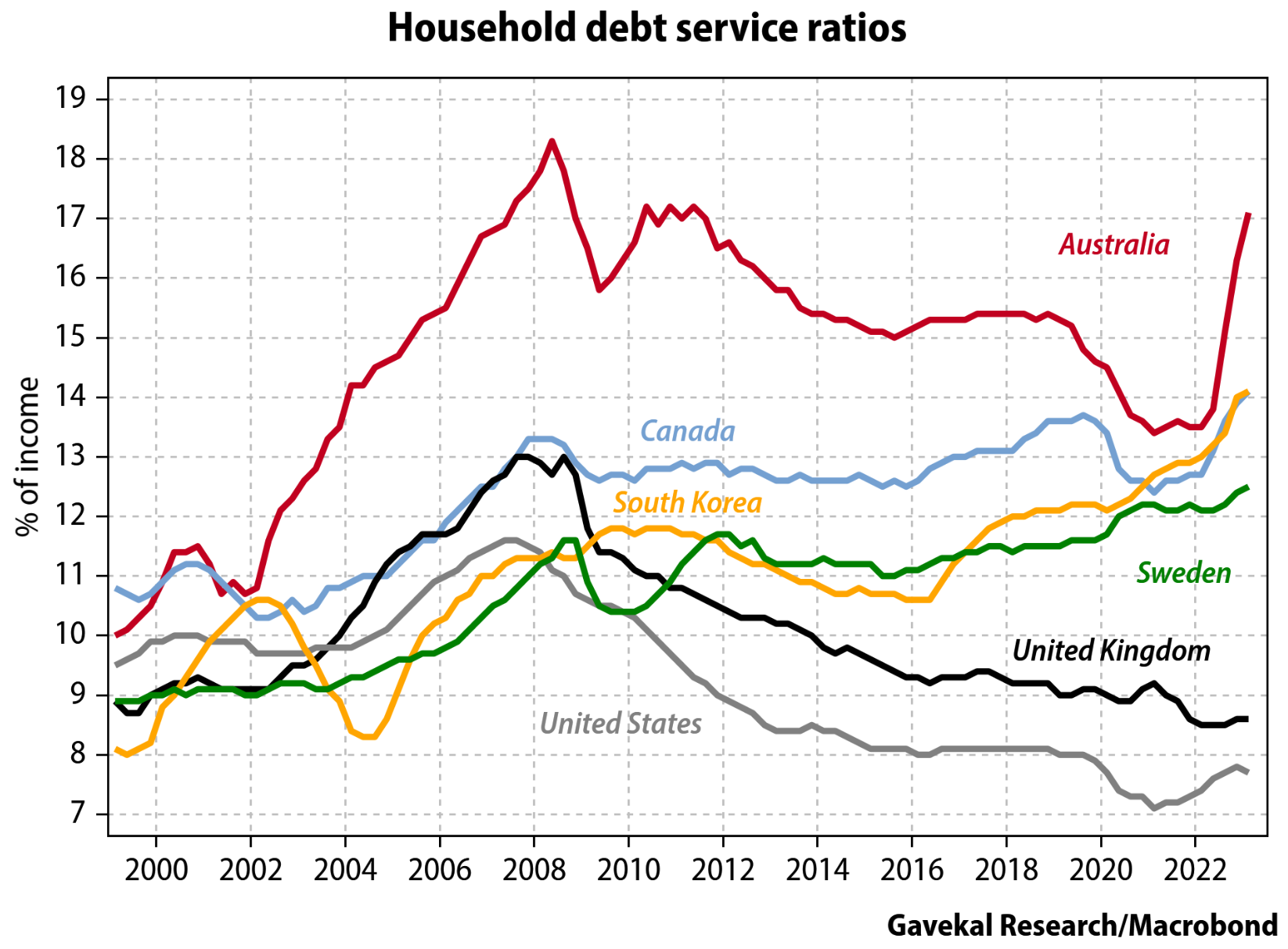

Independent economist, Tarric Brooker, posted the above chart on Twitter (X) showing how Australian households are spending a far higher share of their income on debt repayments than other advanced nations:

“Despite rocketing rates, Canada’s household debt service ratio now is similar to Australia’s when we had a 0.1% cash rate”, Brooker notes.

“Australia truly is worlds apart from most nations”.

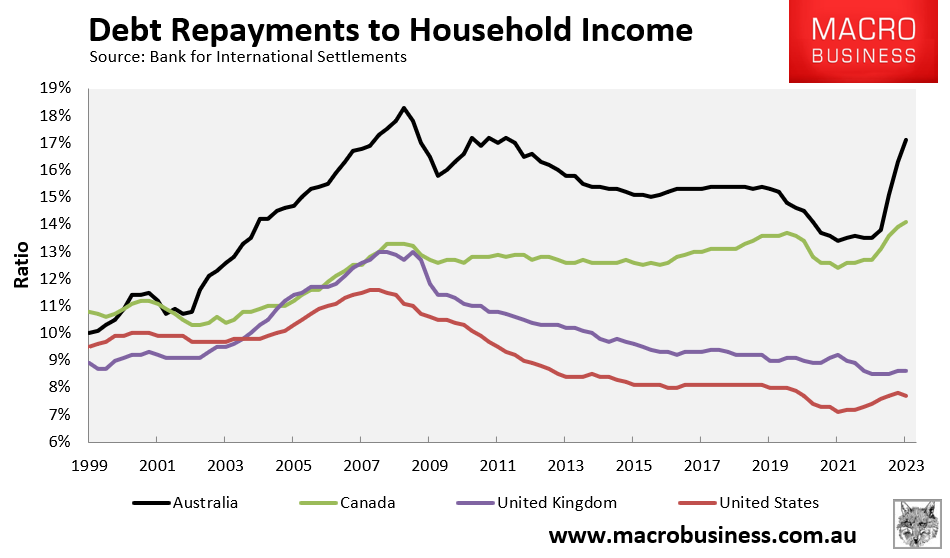

The above chart is backed up by data from the Bank for International Settlements, which shows that Australia’s debt service ratio is the highest in the world:

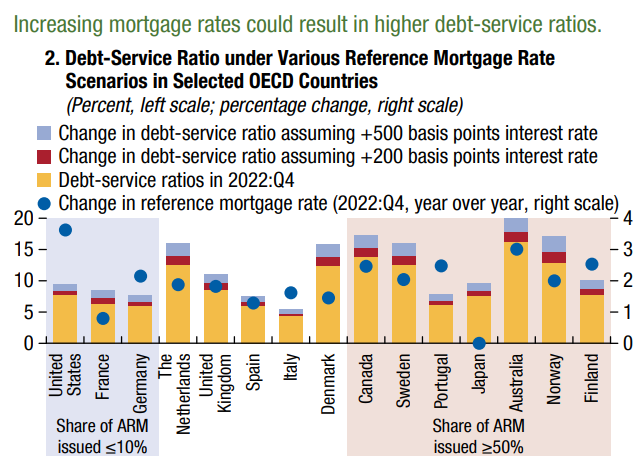

Meanwhile, the IMF’s latest Global Financial Stability Review revealed that Australian households are experiencing the highest mortgage stress in the world with 15% of income devoted to paying off loans:

There are two primary reasons why Australian mortgage holders are suffering the most.

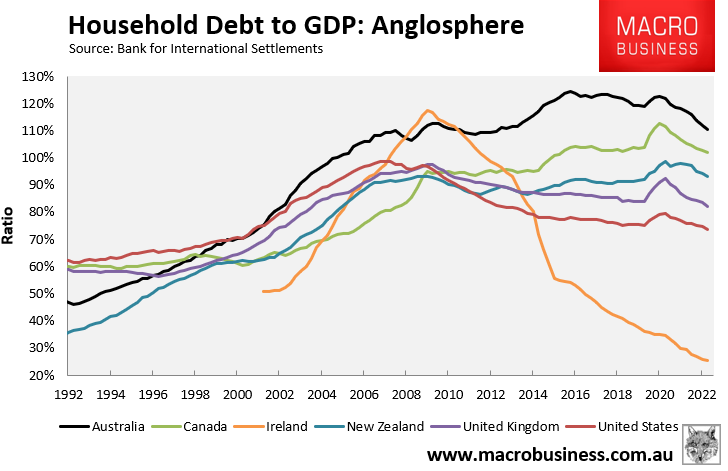

First, Australia has the second highest household debt load in the world (behind Switzerland) when measured against GDP:

Second, and more importantly, Australia has one of the highest shares of variable rate mortgages in the world, with the vast majority of fixed rate mortgages also having durations of less than three years.

Accordingly, changes in official interest rates are passed on far more quickly to mortgage holders in Australia than elsewhere.

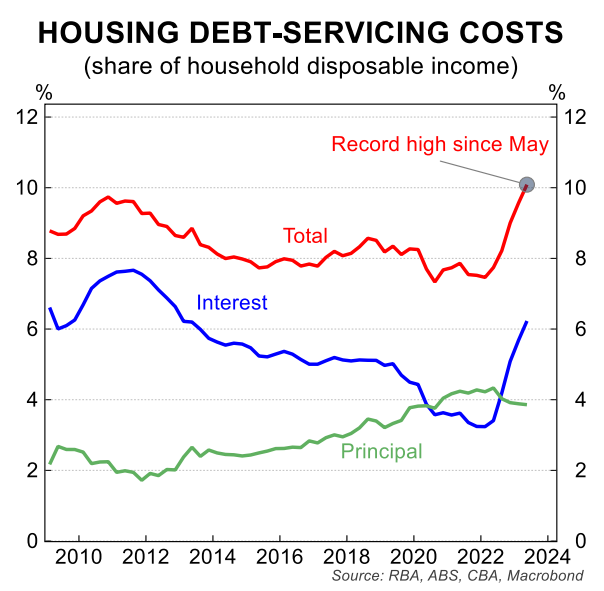

Australian households were already paying a record share of their incomes on debt repayments:

The debt repayment burden will rise further following this month’s increase in the official cash rate by the RBA, along with the further expiry of cheap pandemic fixed-rate mortgages.

This is why Australia is the worst country in the world for mortgage holders.