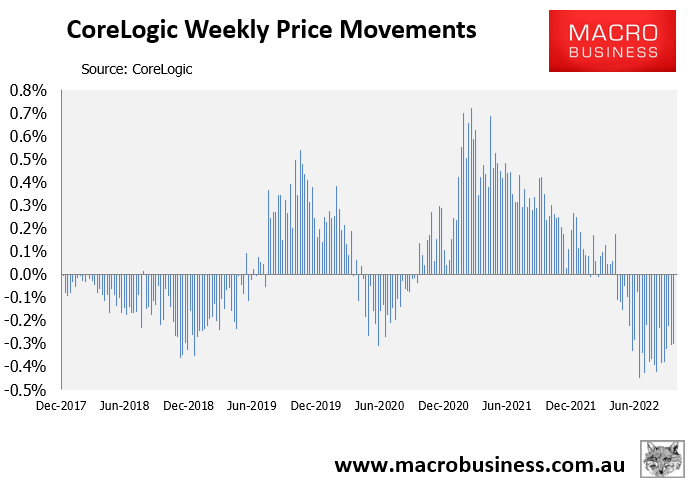

CoreLogic’s daily dwelling values index, which measures price changes across the five main capital city markets, fell another 0.30% in the week ended 20 October. This was the 24th consecutive week of decline.

24th week of decline.

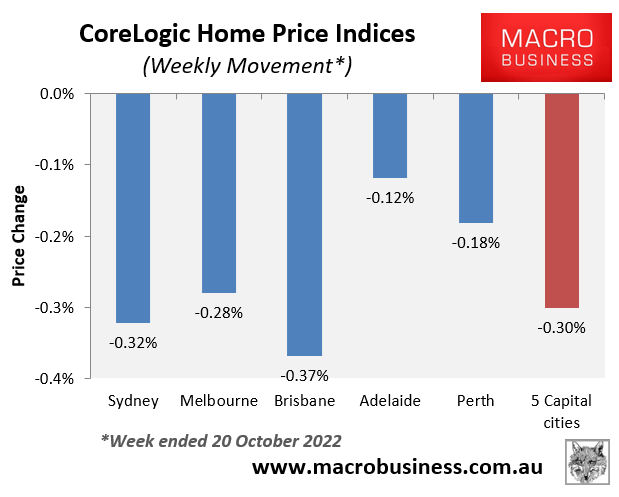

Home values fell across all major capital city markets, but were concentrated across the ‘big three’ – Sydney, Brisbane and Melbourne:

Coast-to-coast price falls.

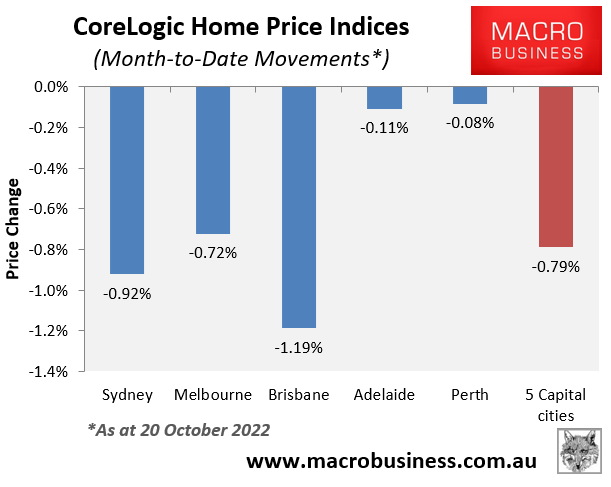

So far in October, home values have fallen 0.79% at the 5-city aggregate level. The big three markets of Brisbane (-1.19%), Sydney (-0.92%) and Melbourne (-0.72%) have fallen hardest, with Adelaide (-0.11%) and Perth (-0.08%) only suffering small declines:

Brisbane leads monthly house price falls.

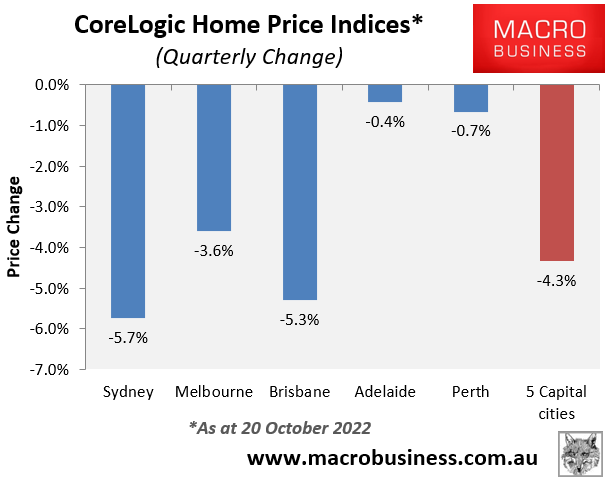

The quarterly rate of decline is 4.3% at the 5-city aggregate level, with Sydney (-5.7%), Brisbane (-5.3%) and Melbourne (-3.6%) leading, and Perth (-0.7%) and Adelaide (-0.4%) only falling slowly:

Sydney leads quarterly declines.

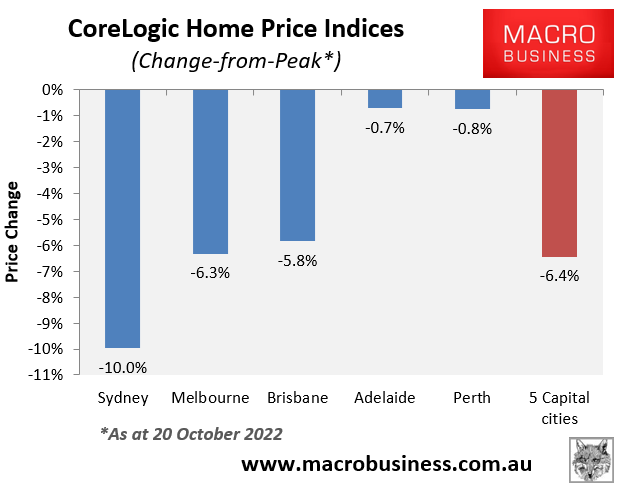

Dwelling values at the 5-city aggregate level have now fallen 6.4% from peak, with Sydney down 10%, Melbourne down 6.3% and Brisbane down 5.8%. Perth (-0.8%) and Adelaide (-0.7%) have only suffered minor falls:

Heavy house price falls for Sydney.

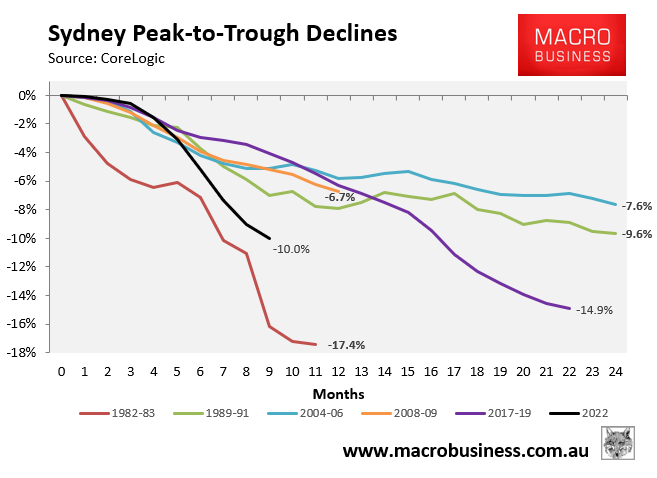

Finally, the next chart compares Sydney’s current housing correction (in black) against prior corrections based on CoreLogic records dating back to 1980:

Second fastest correction on record.

Sydney’s current correction (10% over nine months) is the second fastest on record, behind the 1982-83 bust.

Given the aggressiveness of the Reserve Bank’s monetary tightening, and the fact that more interest rate hikes are expected, it is highly likely that this current correction will end up passing the record 17.4% bust of 1982-83.