Goodbye and Amen. Westpac with the note. What’s worse than either a collapsed global financial system or global pestilence? Falling house prices…

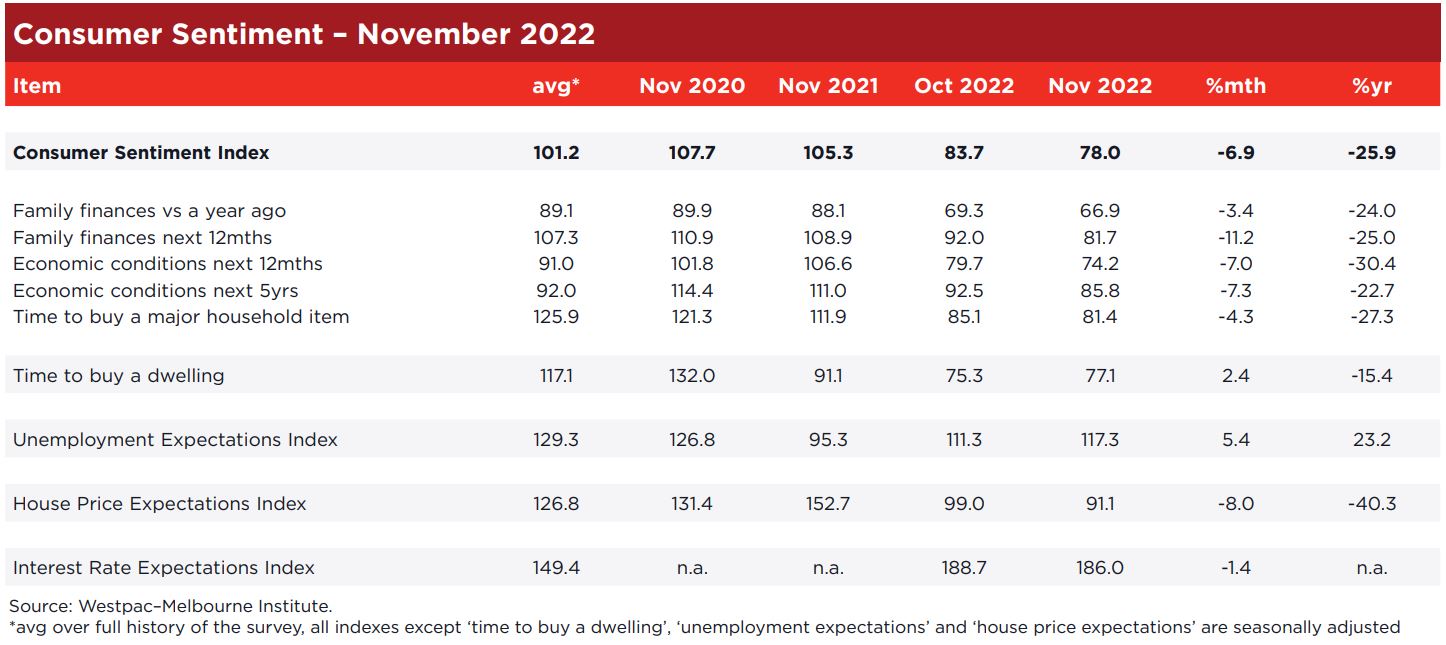

- Consumer Sentiment tumbles 6.9% to 78.0, pointing to spending slowdown.

- Inflation and interest rates weighing heavily on family finances.

- Poor response to Federal Budget highlighted by inflation concerns.

- Nearly 40% of consumers, a record high, looking to cut Christmas spending.

- Confidence in house prices heading towards 2018/19 lows.

- Confidence in labour market starting to weaken.

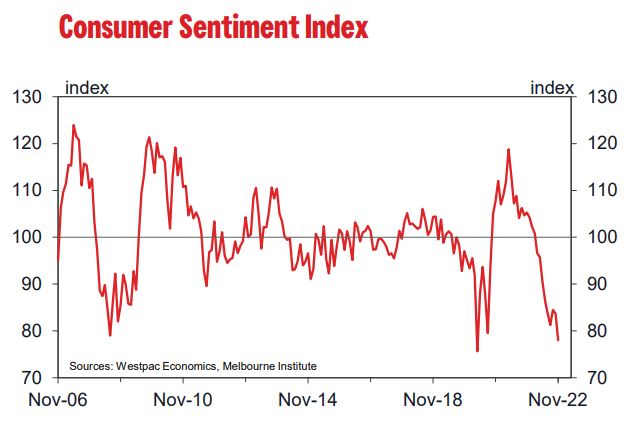

Sentiment continues to plumb historic lows. This print of 78.0 is now below the low point of the GFC (79.0) and only slightly higher than when the COVID pandemic first hit in April 2020 (75.6). Prior to that, we need to go back to the deep recession in the early 1990s to find a weaker read.

The latest sentiment decline follows ABS figures showing inflation surged from 6.1% in June to 7.3% in September, with official forecasts for inflation to go even higher by the end of 2022 and to remain relatively high through 2023.

Consumers would also have been unnerved by forecasts in the Government’s October Budget showing electricity prices are expected to increase by 56% over the next two years.

The Budget looks to have been poorly received in terms of its immediate support for household finances. After every Federal Budget we ask consumers what impact they expect it to have on their family finances over the next 12 months. The proportion responding that the October Budget has worsened their financial outlook was a historically high 35%. While that is well short of the 58% recorded following the newly elected Coalition government’s ‘horror’ budget of 2014, it is the second highest since then and well above the 14-year average of 30%.

This is to some extent a high inflation story as well, with the government taking a restrained approach to fiscal policy so that it does not stoke inflation pressures.

Interest rate rises were a clear factor weighing on confidence in the month. The RBA raised the official cash rate by a further 0.25ppts at its November meeting, the announcement coming mid-way through the survey week. Sentiment amongst those surveyed before the decision showed a steady 83.1 but sentiment amongst those surveyed after showed a steep fall to 75.6.

Given that the move was widely anticipated, the negative response likely reflects the clear signal from the Governor that further increases can be expected.

Certainly, more consumers expect substantial follow-on rate rises. Amongst those surveyed after the RBA decision, nearly 60% expect rates to increase by 1ppt or more over the next year, up on 54% in the October survey.

The November sentiment print is particularly important given the lead-in to the Christmas shopping season. To expand on this, our November surveys include an additional question about Christmas spending intentions, asking consumers whether they plan to spend less, the same or more on gifts than last year.

Not surprisingly, Christmas spending plans are very subdued this year. Nearly 40% of consumers expect to spend less on gifts this year – the highest proportion planning cutbacks since we started asking the question in 2009, the average being 33%.

The index components showed particularly big falls in the near-term outlook for family finances and expectations for the economy.

The ‘family finances, next 12 months’ sub-index recorded a steep 11.2% fall to 81.7 – the monthly decline comparable to that seen when the RBA began the current tightening cycle in May. The fall takes finance expectations to their lowest level since 2014, following that 2014 ‘horror’ budget.

Views around current finances were more settled but still running at exceptionally weak levels, the ‘family finances vs a year ago’ sub-index down 3.4% to 66.9 – the second weakest read since the GFC.

Confidence in the economy also deteriorated. The ‘economic outlook, next 12 months’ sub-index fell 7% and the ‘economic outlook, next five years’ sub-index was down by 7.3%.

Expectations for the economy showed a particularly sharp deterioration following the RBA decision, both sub-indexes dropped nearly 10% between pre- and post-RBA samples.

Attitudes towards major household purchases continue to show a clear sensitivity to rising prices and interest rates. The ‘time to buy a major household item’ sub-index declined 4.3% to 81.4, well below the long run average of 126 and, outside of the initial COVID shock in 2022, the weakest monthly read since the GFC.

The sub-group detail highlights many of the key themes. Consumer sentiment fell particularly heavily amongst consumers with a mortgage, down 15.7% to just 68.4. Retirees – a group with high exposure to the rising living costs and often dependent on government support – also recorded a steep 14.9% decline to 67.3. Those in older age groups more generally recorded steeper declines, sentiment amongst all consumers aged over 45 fell to just 66.6. Only ten of the 90-odd subgroups we track recorded sentiment gains in the month.

November has also seen a marked deterioration in consumer expectations for the labour market and for house prices.

Consumers are becoming less confident about the jobs outlook.

The Westpac-Melbourne Institute Unemployment Expectations Index increased by 5.4% from 111.3 to 117.3 (recall that a higher index means more consumers expect unemployment to rise in the year ahead). While the index remains well below the long run average of 129, it has jumped sharply, by 17.8%, over the last two months, consistent with labour markets nearing a turning point.

Around housing, buyer attitudes remain near historical lows. The ‘time to buy a dwelling’ index edged up 2.4% in November but is still in deeply pessimistic territory at 77.1. This Index has been stuck in the 75-80 range since March this year, 40-45% below the most recent peak in November 2020.

Meanwhile house price expectations have become clearly pessimistic. The Westpac Melbourne Institute House Price Expectations Index posted a further sharp fall, declining 8% to 91.1, a new cyclical low albeit still above the weakest reads seen during the initial onset of the pandemic and the 2018-19 market correction.

The RBA’s interest rate decision had a significant negative impact on housing-related sentiment. Responses on house price expectations deteriorated sharply, falling by 13.6%, after the decision was announced.

The Reserve Bank Board next meets on December 6. We expect the Board to raise the cash rate by a further 0.25%. With no meeting in January the next Board meeting is not until February 7.

Overall, we expect it will be necessary to raise the cash rate by an additional cumulative 0.75% out to May next year.

To date, consumer spending has been quite resilient to these recessionary confidence levels due to record low unemployment and the pandemic-related accumulation of household savings.

However, we expect spending to slow markedly in 2023, something that is necessary to ensure inflation comes back to the Reserve Bank’s 2-3% target.

If that economic slowdown is sufficient to ‘wring-out’ high inflation and the associated inflationary psychology, then the Reserve Bank will have done its job. With inflation back on target, it will then have scope to respond to the weak economy with lower rates.

But if inflation remains elevated despite an economic slowdown it will not be appropriate for the Bank to provide relief and any recovery will necessarily be delayed.