The latest Statement of Monetary Policy (SoMP) from the Reserve Bank of Australia (RBA) noted that “housing mortgage payments were set to rise further in the period ahead” due to “the increase in home loan interest rates that had already occurred over the year” in addition to “the effect of fixed interest rate loans rolling off over time”.

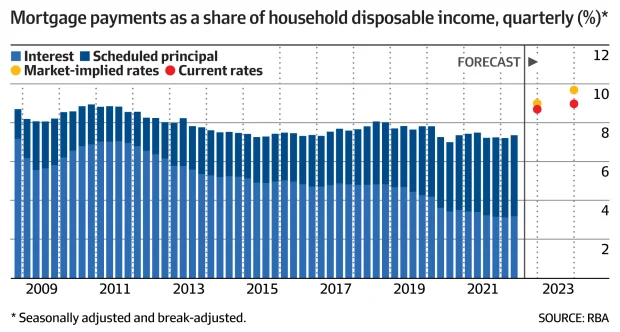

As shown in the below chart from The AFR, aggregate mortgage repayments will rise to around 9% of household disposable income by the end of this year, beating the previous high recorded 12 years ago:

Australian principal and interest mortgage repayments to hit record by end 2023.

Moreover, if futures market pricing for further official cash rate (OCR) increases comes to fruition, then principal and interest mortgage repayments could rise to almost 10%, according to the above chart.

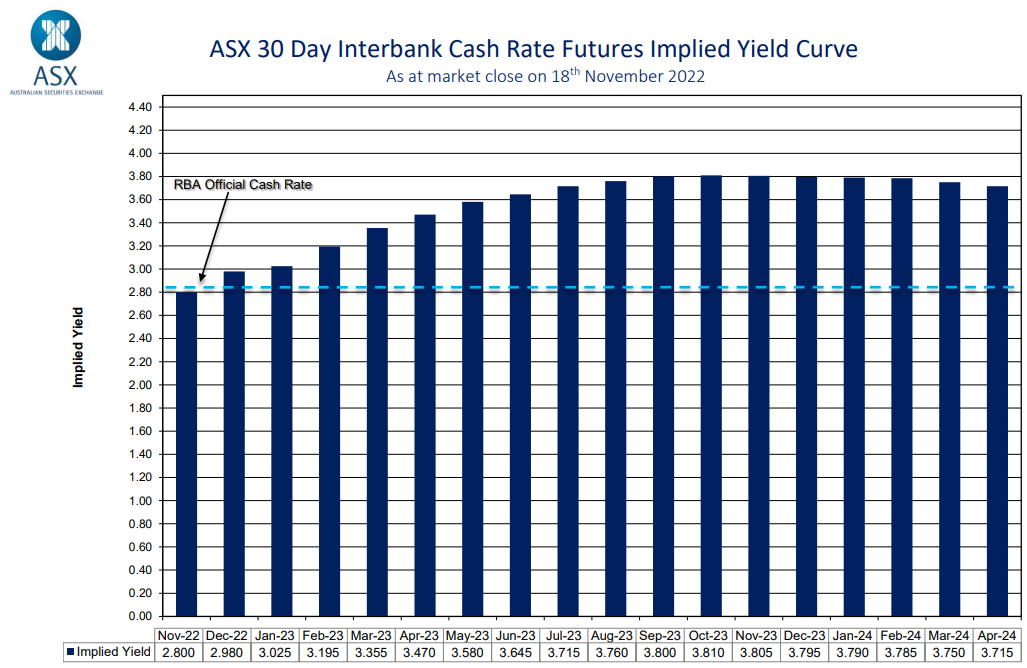

As shown below, the futures market is now pricing a peak in the OCR of 3.80% by September 2023:

Futures Market: OCR to peak at 3.80% by September 2023.

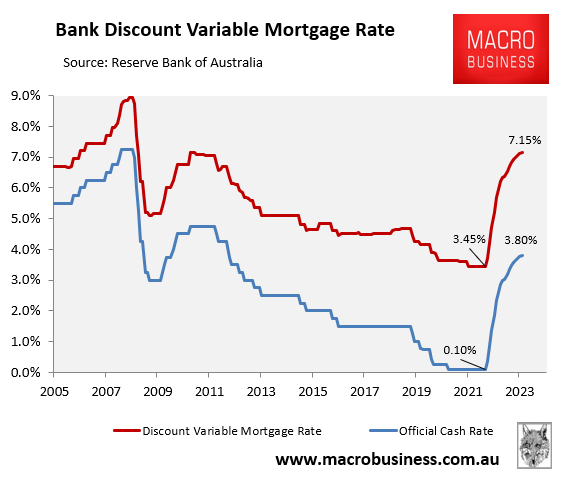

This implies a peak in Australia’s average discount variable mortgage rate of 7.15%, which is more than double the 3.45% level in April 2022 immediately before the RBA’s first interest rate hike:

Australian mortgage rates to more than double.

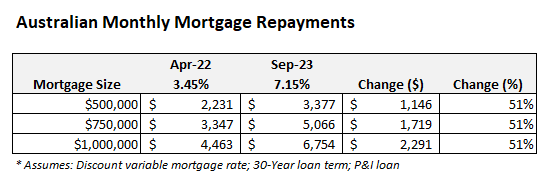

The impact on Australian mortgage holders would be immense, with average variable mortgage repayments rising by 51% under the futures market’s OCR forecast, adding around $1,150 in monthly repayments to a $500,000 mortgage

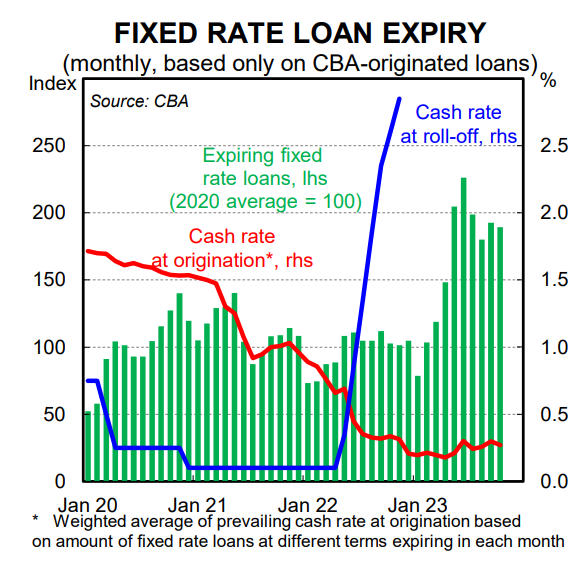

The impact would also be compounded by hundreds of billions of dollars’ worth of cheap fixed rate mortgages scheduled to expire next year, which will be reset to double or triple their current mortgage rates:

A fixed rate mortgage tsunami is approaching.

The pending fixed rate mortgage tsunami means there will be significant monetary tightening in the system even without further rate hikes from the RBA, which will push repayments to record levels against household income.

The futures market’s OCR forecast, which would see average variable mortgage rates climb another 0.95%, is a frightening prospect for Australian mortgage holders – especially those that purchased near the market’s peak in 2021 or early 2022.