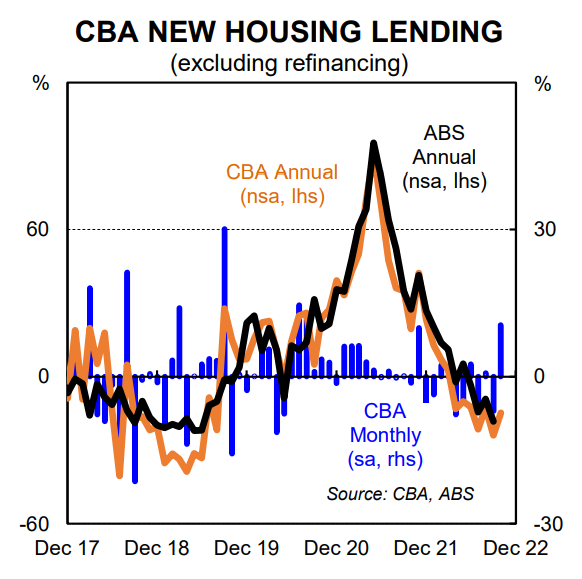

CBA economist Stephen Wu has released data analysing the bank’s mortgage lending, which shows that mortgage lending has fallen sharply on an annual basis, indicating further falls in the Australian Bureau of Statistics’ mortgage data when it releases next month:

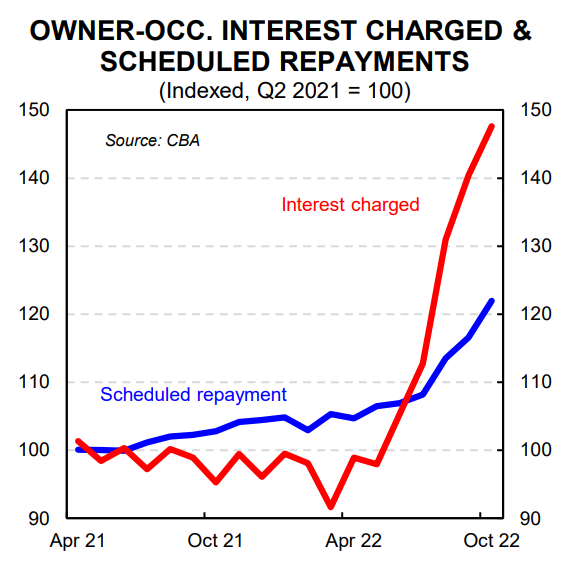

Scheduled mortgage repayments also continued to rise in October, “but this only partly reflects the RBA’s rate hikes to date”. Wu notes that “rate hikes take time to hit household cash flows, and together with the expiry of fixed rate loans means repayments will continue to rise into 2023 even if the RBA is on hold”:

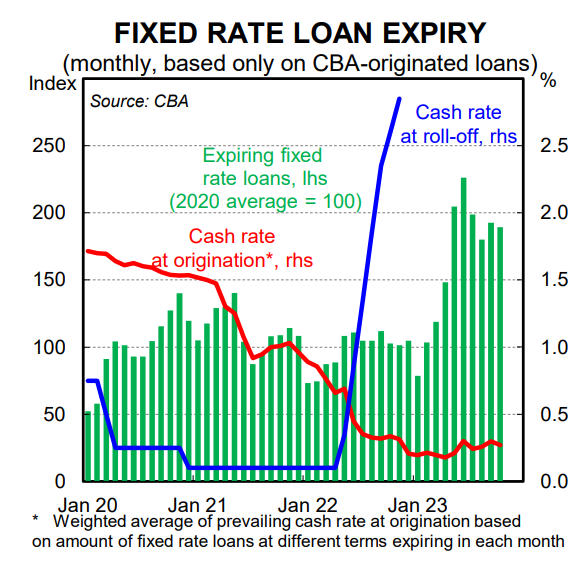

According to Wu, “there is a large stock of fixed rate loans expiring in 2023 that were issued when the cash rate was at very low levels”. And “these borrowers when rolling off these loans will see large step changes to their repayments, even if the cash rate remains at its current level (we expect one further 25bp hike to 3.10%)”:

As shown above, huge numbers of cheap fixed rate mortgages will expire next year, which will more than double mortgage rates for many borrowers and act as a further drain on household finances and consumption.

For this reason alone, monetary policy will continue to tighten next year even without rate rises from the Reserve Bank of Australia (RBA).

Accordingly, the RBA won’t need to hike rates to slow the economy, as it will happen automatically via the massive fixed rate mortgage reset.