Yellow Brick Home Loans Executive Chairman Mark Bouris is “very worried” the Reserve Bank of Australia’s (RBA) aggressive rate hikes will break mortgage holders and the housing market.

Bouris noted that the Melbourne Cup Day 0.25% rate rise “won’t take effect until January or February because there’s a lag period”. He expects “all of those [seven] rate rises to take effect around February”, which will coincide with a bunch of household bills like insurances, school fees, school uniforms, etc.

Alongside another expected rate hike next month, Bouris expects the cumulative rate rises “to have a very serious effect on borrowers. Taking an average home loan of $750,000, which is pretty much average around Australia today, the repayments are an extra $1500 a month from where we were in April this year”.

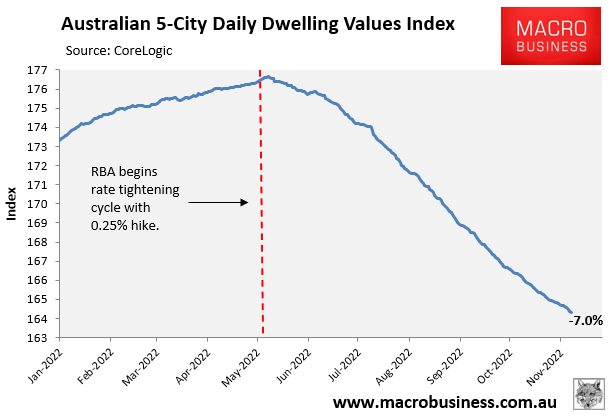

With regard to house prices, Bouris notes modelling from the RBA “predicting a decrease in Australian house prices of between 15% and 20% based on the current series of interest rate increases”. Bouris also noted modelling from Coolabah Capital predicting “somewhere above 20% house price reduction in values across Australia”, although he acknowledges “there’s a lot of conjecture among the leading economists”.

“But one thing is for sure. Right now, we are at a 10% reduction across the board. So, I would expect it to advance further from here once the lag effect of these interest rates starts to bite in”.

“So, I’m sort of looking at somewhere between 10% and 15% as a starting point in terms of house price reductions across the board”.

Obviously, Bouris’ claim that Australian house prices have already fallen by 10% is wrong, given CoreLogic’s daily dwelling values index is reporting a current decline from peak of 7% across the five major capital city markets (a little lower nationally):

Nevertheless, he is right to be “very concerned” given the lagged effect of rate rises, that the RBA is likely to continue hiking rates, in addition to the tidal wave of fixed mortgages set to reset to more than double their pandemic low rates in 2023.