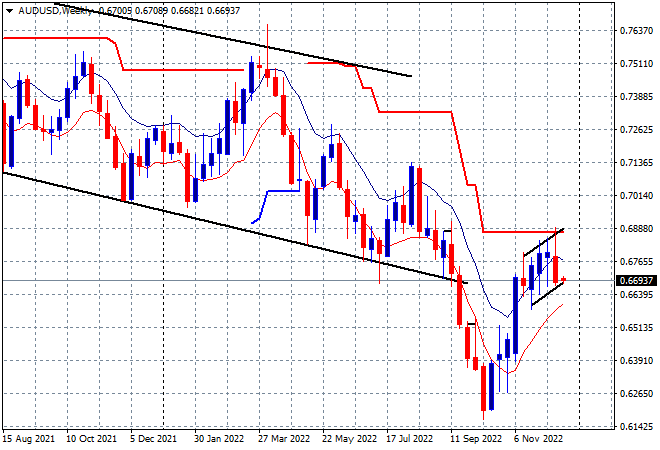

It’s been a wild and woolly year for the Australian dollar, about to finish around the 66 cent mark versus the USD, after almost cracking through the 60 cent level, having started the year above 72 cents. The current trajectory shows a classic bearish flag pattern that has failed to breach overhead resistance at the 69 cent level and is more likely to rollover in the short term:

Some so-called market economists get excited when they see a breakout like in early March or the breakdown in September but as always confuse intra-month volatility – which can be as high as 4 cents or more on average – for a new direction. A quick technical look at the chart from a longer point of view shows a wide band that has been trending down since the post-COVID surge in 2020.

Where to from here?

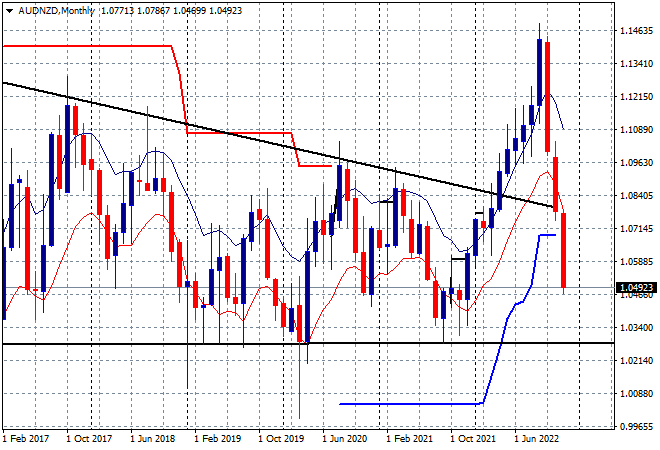

I would contend it is still down as my favourite correlated cross. The Aussie-Kiwi continues to show a major reversion back to the long trend of support just above parity at the 1.02 level, some 300 pips away:

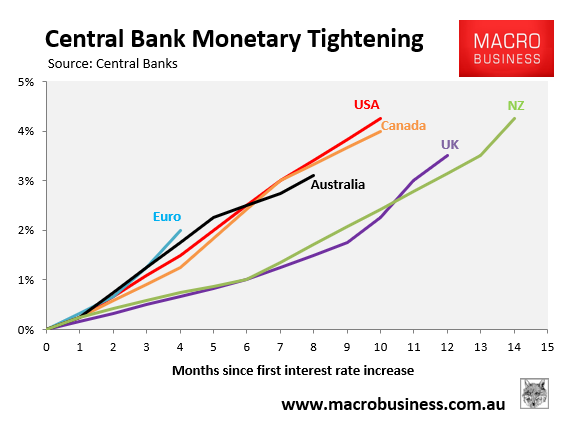

Given that the RBA is going to do little about the interest rate differential between the current cash rate and the burgeoning rates overseas from the Fed, BOE and others until February, there is likely to be more downside for the Australian Dollar until the end of the first quarter of 2023 when the RBA may or may not play catchup: