Westpac with the note.

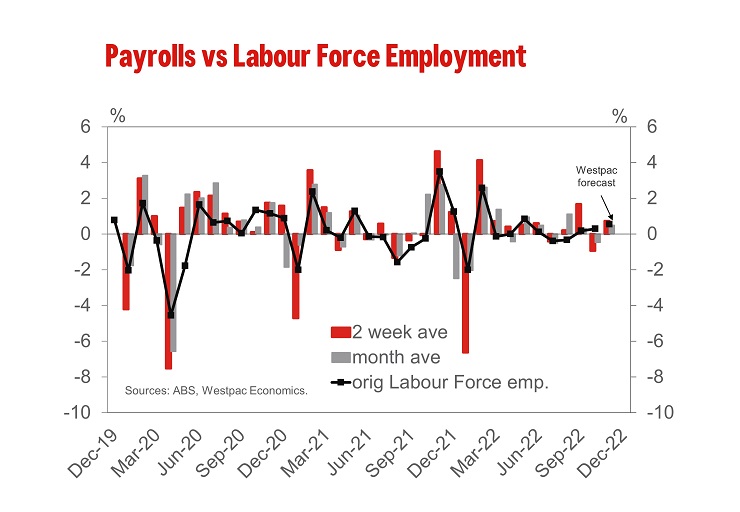

Comparing Payrolls based on the Labour Force Survey reference weeks Payroll jobs increased 0.7% in November following a 0.9% contraction in October. In original (not seasonally adjusted) terms employment lifted 0.3% in October.

Our current forecast for a 27k rise in employment in the November Labour Force Survey is a 0.5% increase in original terms.

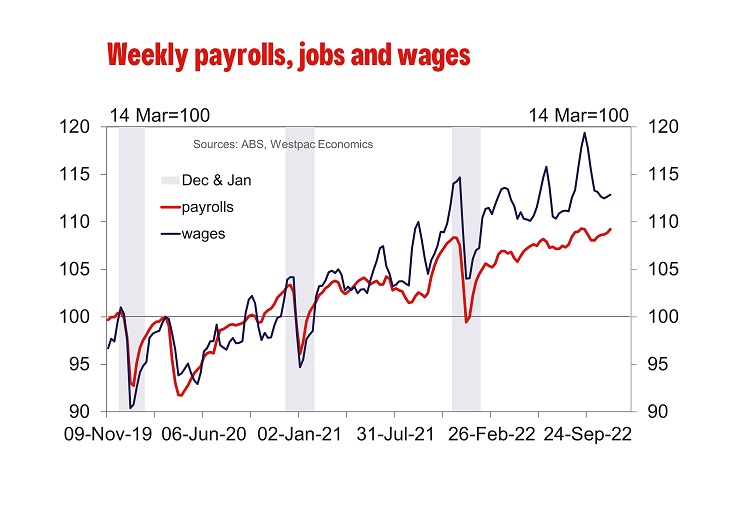

We now have almost three years of Payroll jobs data and can see some recurring weekly seasonal changes in the labour market. The most recent changes in 2022 are more like those seen back in 2020 than 2021, given the labour market was recovering from the Delta period lockdowns at this time last year.

The latest Weekly Payrolls release covers the period before the labour market hits its annual seasonal peak in Payroll jobs, which is usually around the first half of December. That period will be covered in the next release.

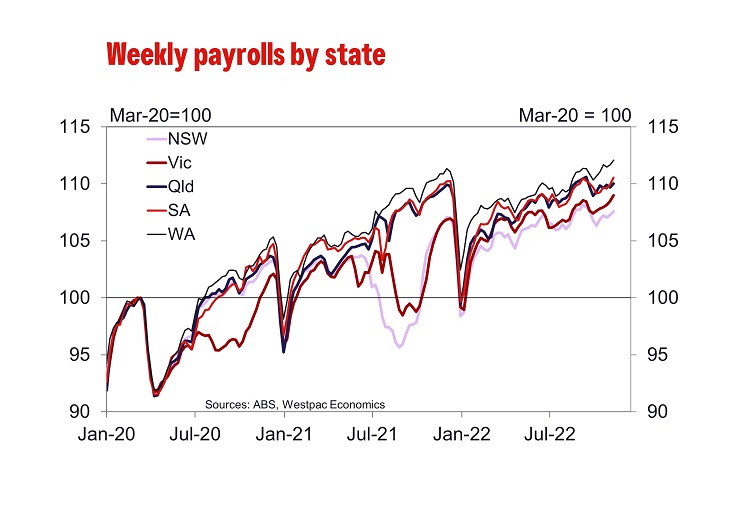

A quick look at the state data Payroll jobs rose in all states and territories between mid-October and mid-November 2022, with the largest increase in South Australia (1.2% per) reflecting a slightly late start to the school term with jobs in education & training accounting for over 40% of the gain. The smallest gain was of 0.2% was in Queensland.

WA continues to lead it terms of the magnitude of the recovery from the Covid lockdowns while South Australia and Queensland are tied in second position. Victoria has now moved ahead of NSW which is lagging the recovery in job in the other mainland states.

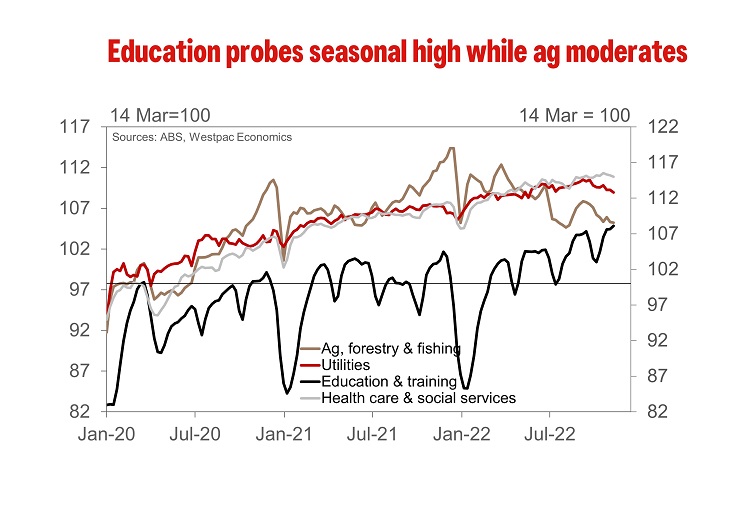

Nationally, 10 out of 19 industries saw a rise in payroll jobs in the month to mid-November. The strongest gain was in education & training where jobs lifted 3.5% and accounted for 42.7% of increase in Payroll jobs in the month.

The rise in Payroll jobs in the education & training industry aligns with the seasonal pattern seen in previous years. Jobs in education & training fall away in original terms as we move into the Christmas/Summer Holiday period.