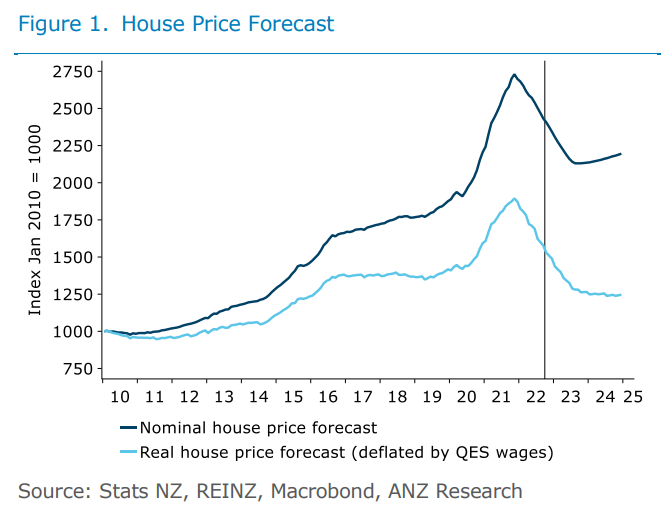

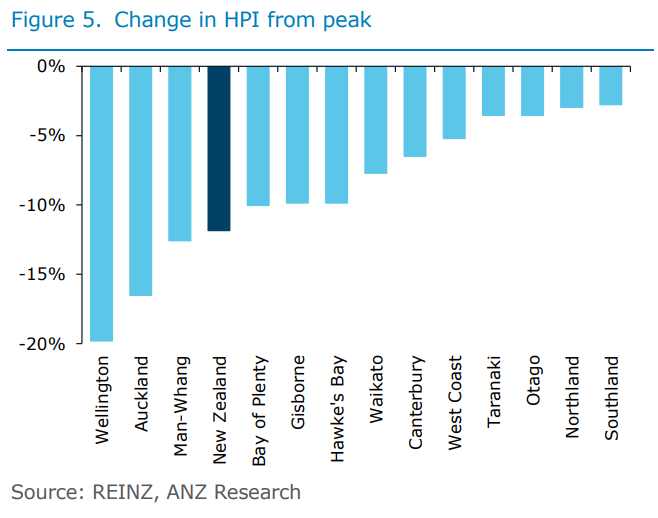

ANZ Economics has updated its forecast for New Zealand housing prices and now tips a 22% peak-to-trough decline, up from 18% previously:

When adjusted for wage growth, real house prices are forecast to decline by 32% peak-to-trough. This would take values 10% below their pre-pandemic level.

“The fact that prices are down around 12% already puts us just over halfway through our forecast”, ANZ says. And the bank sees “the level of house prices finding a floor in the third quarter of 2023 (not long after interest rates stop rising), with only very modest growth thereafter”.

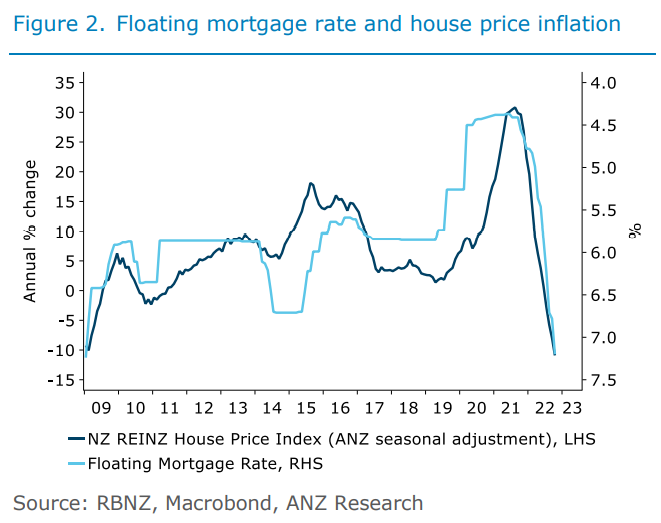

The downgrade in New Zealand house prices is on the back of more aggressive interest rate hikes expected from the Reserve Bank.

ANZ “now expect the OCR to peak at 5.75% (previous forecast peak: 5.0%) and that means a higher mortgage rate outlook and more downward pressure on house prices than otherwise”.

They are also “now forecasting OCR hikes will conclude in May 2023 (at 5.75%), with house prices finding a floor not long after that. That would imply higher floating rates ahead, but probably a little less upside on fixed mortgage rates (which are determined by wholesale markets, where a higher OCR over time is already factored in)”.

Given New Zealand experienced one of the world’s biggest house price booms over the pandemic, it makes sense that it should experience one of the biggest busts given the Reserve Bank has also lifted rates higher than anywhere else.