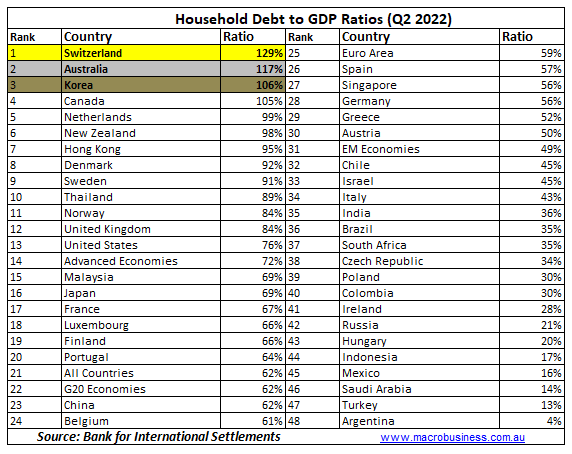

The Bank for International Settlements (BIS) has published global household debt statistics for the June quarter of 2022. This shows that Australia’s total household debt is the second highest in the world when measured against gross domestic product (GDP).

As shown in the table below, Australia’s debt-to-GDP ratio was 117% in the June quarter, behind only Switzerland at 129%:

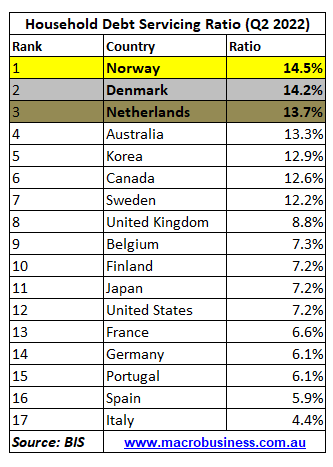

However, Australia’s share of household income used to service principal and interest debt repayments (13.3%) was only the fourth highest out of the countries surveyed, behind Norway (14.5%), Denmark (14.2%) and the Netherlands (13.7%):

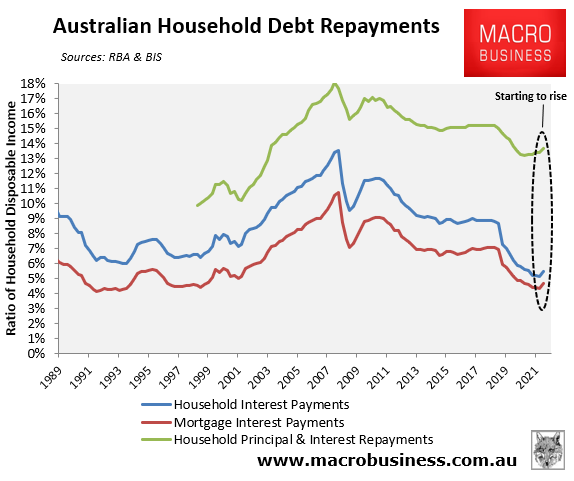

That’s where the good news ends. This BIS survey is only current to the June quarter, and thereby only captured the first two (0.75%) of interest rate increases by the Reserve Bank of Australia (RBA). As such, principal and income debt repayments had only just begun to rise:

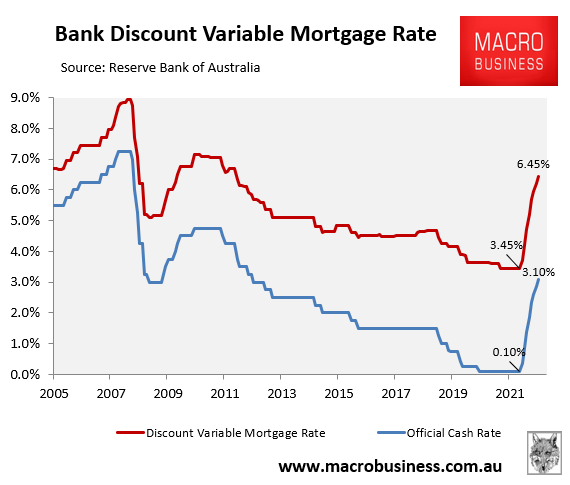

Since then, the RBA has delivered another 2.25% of rate hikes, which is the fastest rate of tightening in Australia’s history and has lifted variable mortgage rates to their highest level since April 2012:

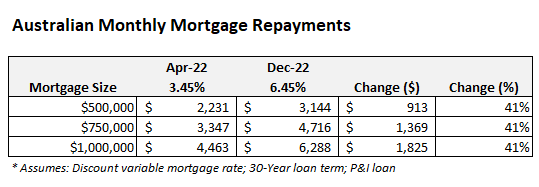

In turn, average variable mortgage repayments have risen 41% above their April pre-tightening level – an extraordinary increase in such a short period of time:

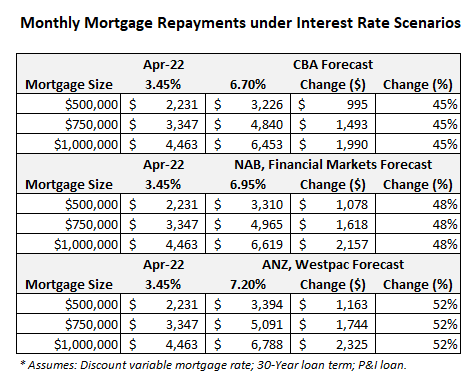

The current official cash rate (OCR) forecasts from the big four banks are as follows:

- CBA: 3.35% by February 2023, then dropping to 2.85% by December 2023.

- NAB: 3.6% by March 2023, remaining steady into 2024.

- Westpac: 3.85% by May 2023, then dropping to 2.85% by November 2024.

- ANZ: 3.85% by May 2023, then dropping to 3.5% by November 2024.

Financial markets are also tipping a peak OCR of 3.6% by August 2023.

Based on these forecasts, the OCR will rise by between 0.25% and 0.75% from its current level of 3.10%.

The impact on Australian mortgage holders from the above forecasts is illustrated in the below table, compared against interest rate settings in April 2022 immediately before the RBA’s first rate hike:

Average variable mortgage repayments will rise by between 45% and 52% from their April 2022 pre-tightening level, adding between $995 and $1,163 in monthly repayments to a $500,000 mortgage.

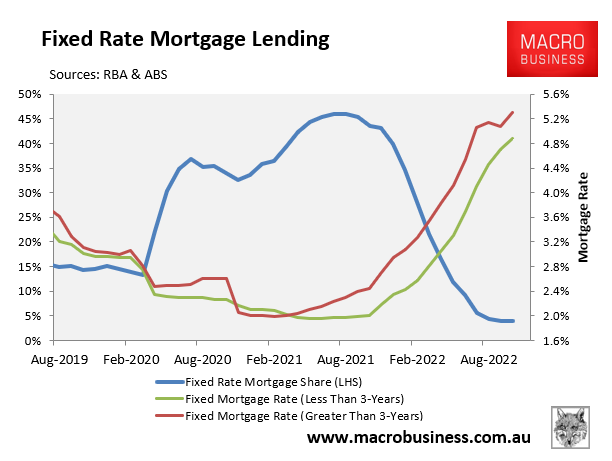

To make matters worse, the share of Australian home buyers that took out fixed rate mortgages surged over the pandemic from a long-term average of around 15% to an all-time high 46% in mid-2021:

Nearly one-in-four mortgages (by value) will switch in 2023 from ultra-low fixed rates originated at around 2% to rates that are more than double these levels.

Accordingly, the share of household income used to service principal and interest debt repayments will soar next year to its highest level in history.