Deutsche Bank economist Philip O’Donaghoe says the latest inflation data shows that its previous forecast that official interest rates will peak at 3.35% is insufficient.

Deutsche now expects the Reserve Bank of Australia (RBA) to increase the cash rate in February, March, May and August. The four increases of 25 basis points apiece would lift the official cash rate (OCR) from 3.1% currently to 4.1%

Deutsche Bank’s new OCR forecast follows US investment bank Goldman Sachs, which has been forecasting a cash rate peak of 4.1% since November.

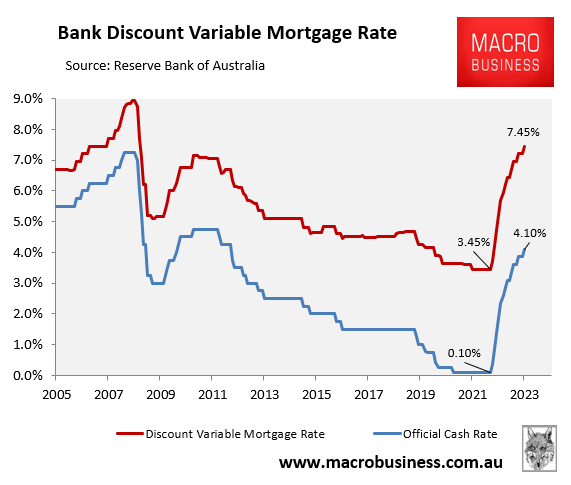

Deutsche Bank’s forecast came to fruition, it would lift the OCR to its highest level since April 2021, with Australia’s average discount variable mortgage rate lifting to its highest level since October 2008:

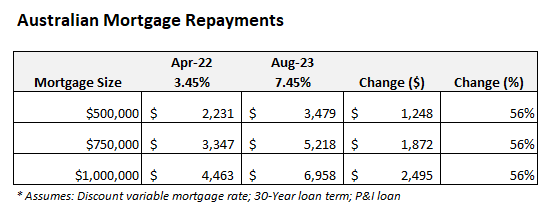

The impact on mortgage holders would be brutal, with variable mortgage repayments lifting 56% above their level in April 2022 immediately prior to the RBA’s first rate hike:

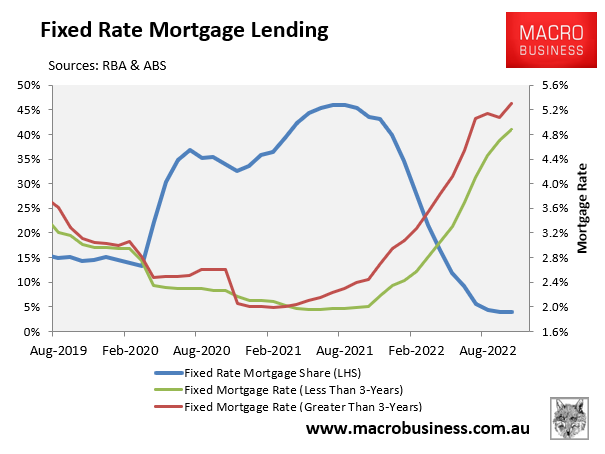

The situation would be made worse by the fact that nearly one quarter of Australian mortgage holders (by value) will this year switch from ultra-cheap fixed rates of around 2.25% to rates that are double or triple this level:

The likely outcome from Deutsche’s and Goldman’s OCR projection is a massive house price crash alongside a nasty consumer-led recession.

Would the RBA be that foolhardy? Pass the popcorn.