After all seven of his properties sold on Saturday – his best result since May 2022 – leading Sydney auctioneer and Real Estate Influencer, Tom Panos, declared “the market correction is coming to an end”:

In his YouTube report following the auctions, Panos noted that “vendors are listening to the market”.

In fact, he’s “never ever seen a market where the vendors don’t need that much convincing” because the media has done the job in managing price expectations down.

“They’ve scared everyone, and so has Mr Arrogant Dr Lowe from the Reserve Bank”.

Despite Tweeting above that “the market correction is coming to an end”, Panos said in his video that “it is too early to call” that the market has turned.

“But one thing’s for sure, there’s a lot of buyers out there… at opens and at auctions than there was. They’re not pulling the trigger… but they’re doing their due diligence”.

“Because I think the public knows that we are in the afternoon of the rate rises, even if there’s another four”.

“People are going out there and they’re sussing things out because they know the end is near”.

Panos also noted that buying capacity has dropped by 27% since the RBA’s first rate hike, which logically suggests prices need to drop further.

“So if you had $1 million to spend in May, you’ve got roughly $750,000. The issue we have is that the $1 million house hasn’t dropped to $750,000. So, borrowing capacity has dropped more than houses have dropped”.

“If vendors want to sell their property, they are going to have to meet what borrowers go up to. That’s logical”.

That said, Panos notes that there is “not a lot of stock on the market and people don’t have to sell” because “at the moment there’s no distressed selling”.

“So, the lack of distressed selling and the lower supply of stock is keeping prices at a higher level than what borrowing capacity has dropped”.

“And that’s why I think to myself we aren’t going to get much of a price drop from here on”.

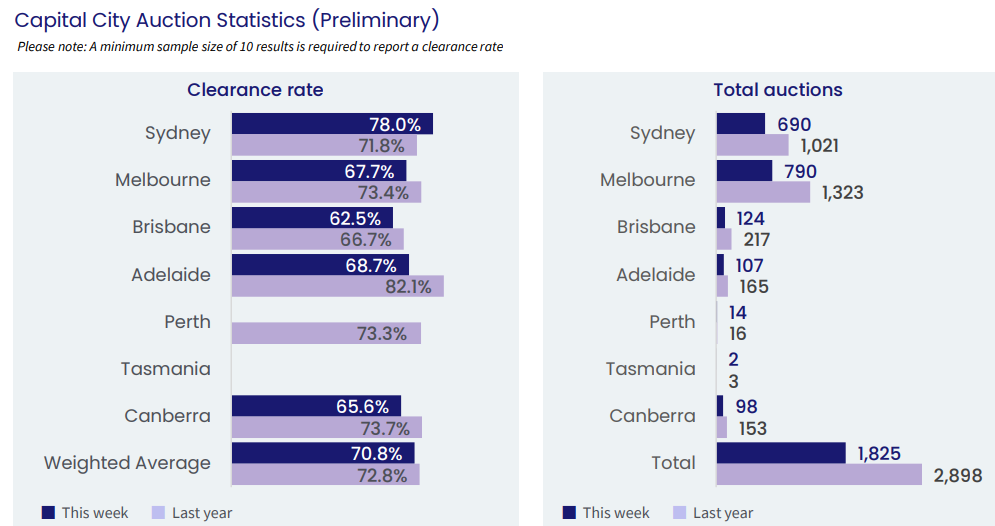

Panos has given a pretty accurate assessment of Sydney’s market as it stands right now. Clearance rates have risen sharply off volumes that are around 40% below the same time last year:

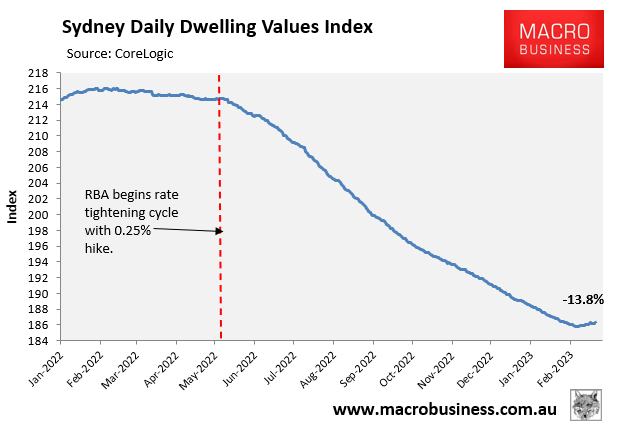

Sydney dwelling values have also posted a mini rebound over the past fortnight, according to the CoreLogic daily index:

Where I differ from Panos is that further rate hikes have been flagged by the RBA, which will necessarily slash borrowing capacity further and pull prices lower.

Distressed selling is also likely to emerge in coming months as huge numbers of cheap pandemic fixed rate mortgages reset to variable rates that are double or triple current levels, and unemployment rises.

Sydney will likely be hit especially hard by the fixed rate mortgage reset given it has the most indebted borrowers in the nation (owing to its status as Australia’s most expensive housing market).

That said, I can see house prices commencing another up-cycle late in the year after the RBA begins cutting rates to ward off recession.

There is also a strong chance that APRA will this year lower the mortgage repayment buffer, in turn lifting borrowing capacity and helping drive a late 2023 house price upswing.