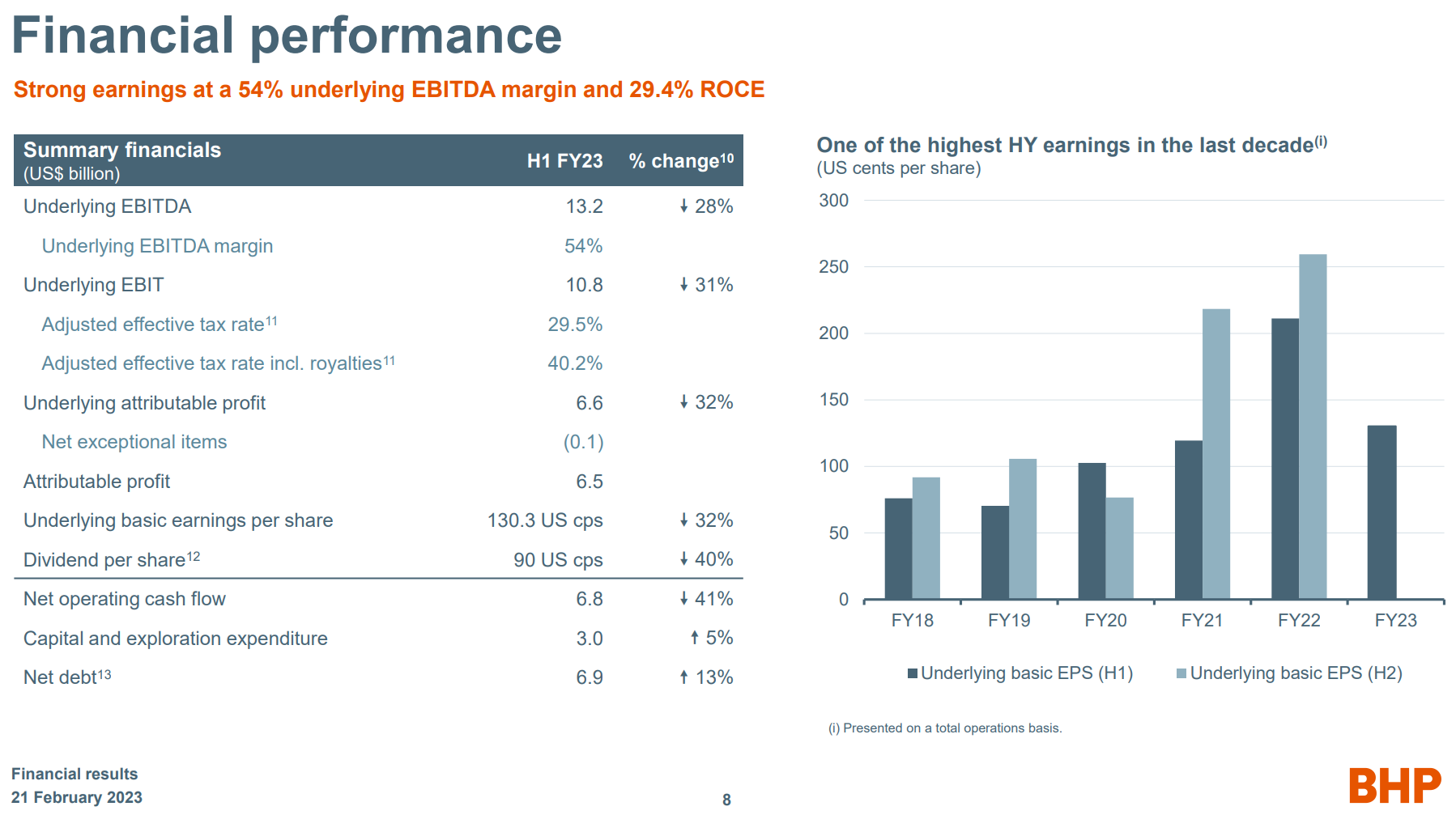

It’s boring to recount how many folks argued that the miners were the best dividend stocks in the last year. They are not. Once, again, the inevitable has happened with a big fall in profits for BHP and a 40% dividend cut:

I waded through Dr Huw McKay’s voluminous waffle on China and could not anything to change my mind on the outlook. I expect short-term iron ore prices to be firm on seasonal tailwinds and trouble to set in after April/May as the Chinese housing recovery fails to materialise plus infrastructure comes off. Industrial investment is also likely to ease given the pressure on exports.

This is the complete reverse of Dr McKay’s outlook. He will not be right unless or until Emperor Xi pivots to a revival of Evergrande&Co, which is possible given his history of panic, but not the base case.