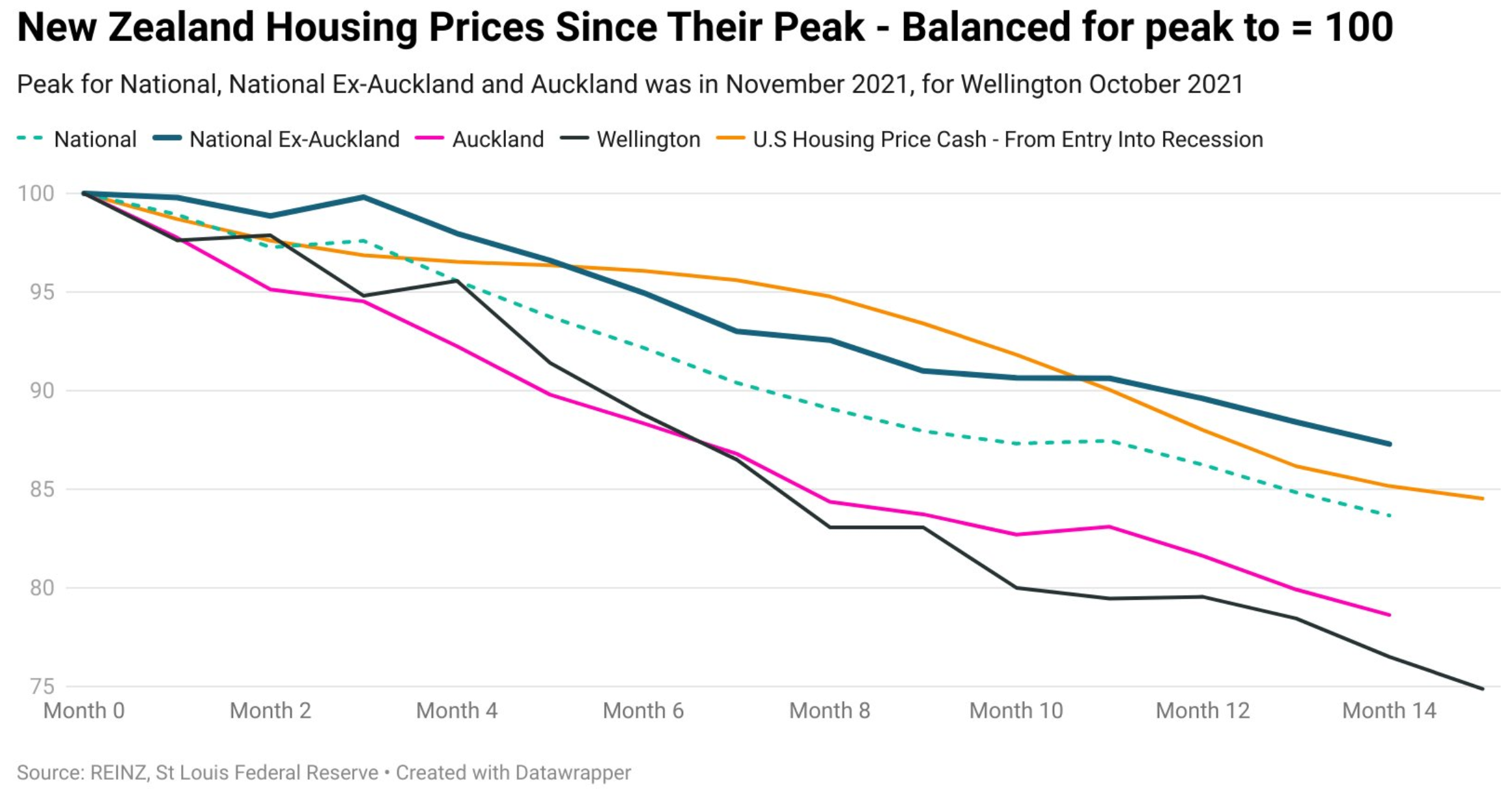

Independent economist Tarric Brooker has published the below chart tracking New Zealand’s house price crash:

According to the REINZ House Price Index, which takes into account changes in the mix of properties sold each month and is the preferred index used by the Reserve Bank, New Zealand house prices have fallen 16.3% from their November 2021 peak.

House prices across New Zealand’s largest and most expensive city, Auckland, have plunged 21.4% from their peak, whereas Wellington’s prices have collapsed by 26.1%.

Interest.co.nz reported that “the REINZ’s median price figures also suggest there has been extreme price carnage in some of the Auckland and Wellington sub-districts that do not have their own HPI figures”.

“In Auckland, the median selling price in Rodney declined by $435,000 between January last year ($1,345,000) and January this year ($910,000), while the median price in Auckland’s leafy central suburbs declined by $332,500. Over the same period the median in Manukau was down by $272,000, and in Waitakere it dropped by $253,000 for the year”.

“Within the Wellington region, median price declines over the year to January were particularly steep in South Wairarapa -$320,000, Wellington City -$175,000, Masterton -$170,000 and Kapiti Coast -$140,000”.

The Reserve Bank has increased the official cash rate by 4.0% since October 2021, and has flagged a further increase to 5.5% alongside a recession.

Given more than half of all New Zealand mortgages will shift off cheap pandemic fixed rates this year, and will face large increases in repayments, significant further house price falls seem likely in 2023.