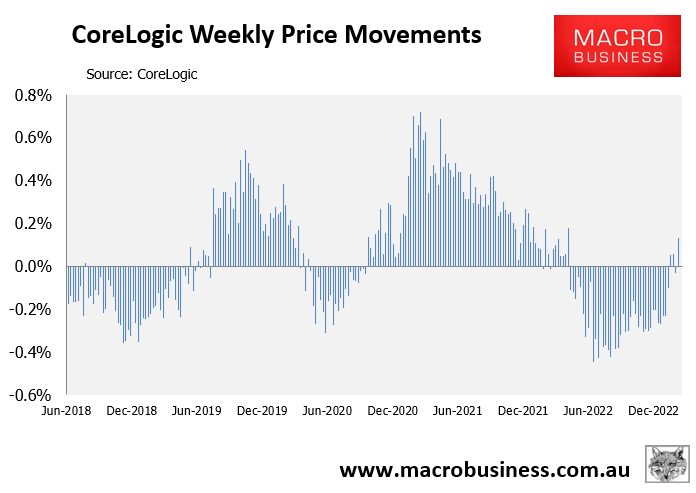

Australian home values continue to shrug off the recent interest rate hikes from the Reserve Bank of Australia (RBA), with CoreLogic’s daily dwelling values index rising another 0.13% in the week ended 9 March – the third value increase in four weeks:

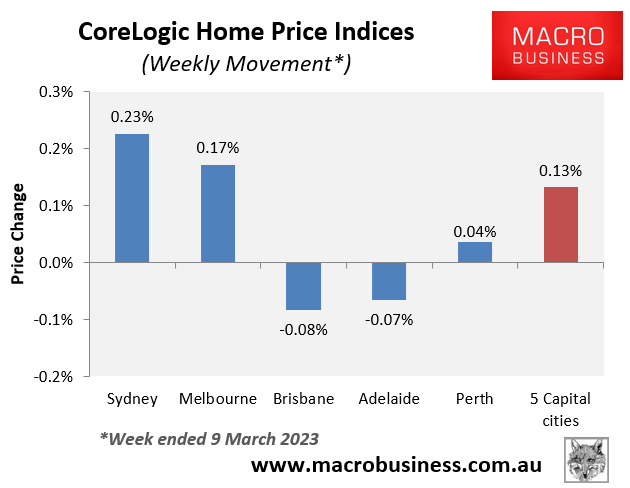

The weekly increase was once again driven by Sydney, where values jumped by 0.23%. Melbourne (+0.17%) also recorded a solid weekly rise:

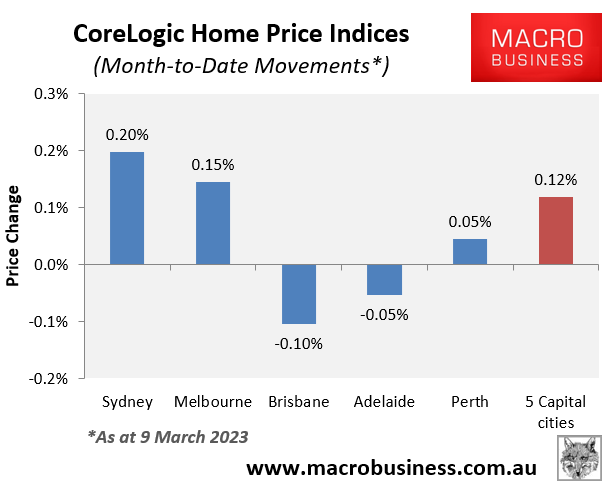

Following April’s modest 0.1% decline, dwelling values at the 5-city aggregate level were up 0.12% over the first nine days of March, again led by Sydney (+0.20%) and Melbourne (+0.15%):

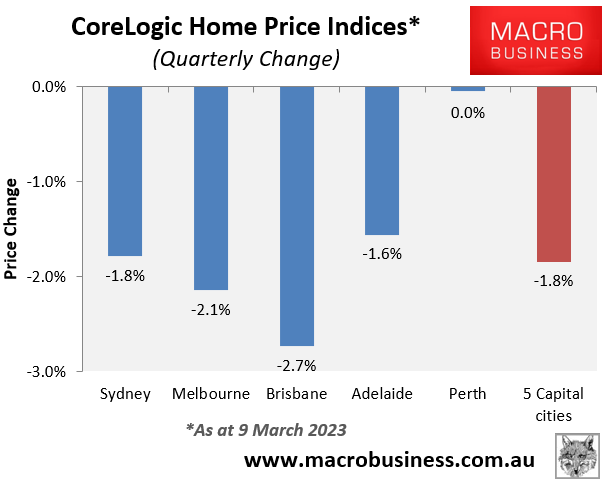

The quarterly rate of decline has slowed significantly to only -1.8% at the 5-city aggregate level, with Sydney and Brisbane both pulling back sharply:

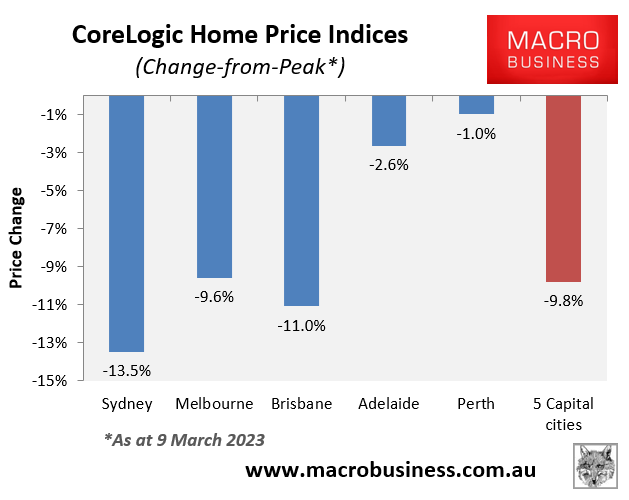

With prices rebounding, values are now down 9.8% from their peak at the 5-city aggregate level, led by the three largest capital cities:

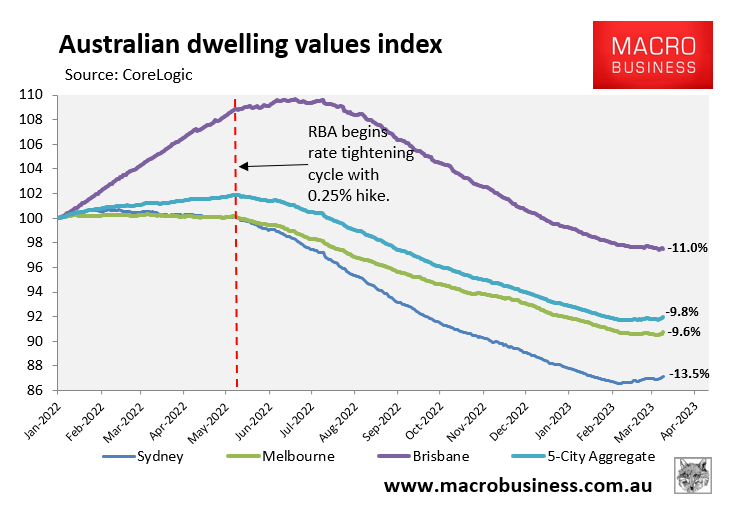

Finally, the below chart plots the time series of changes across these three major markets, which clearly illustrates the change in momentum over the past month:

Logically, price falls should resume based on the ongoing increase in interest rates from the RBA, which will further restrict borrowing capacity.

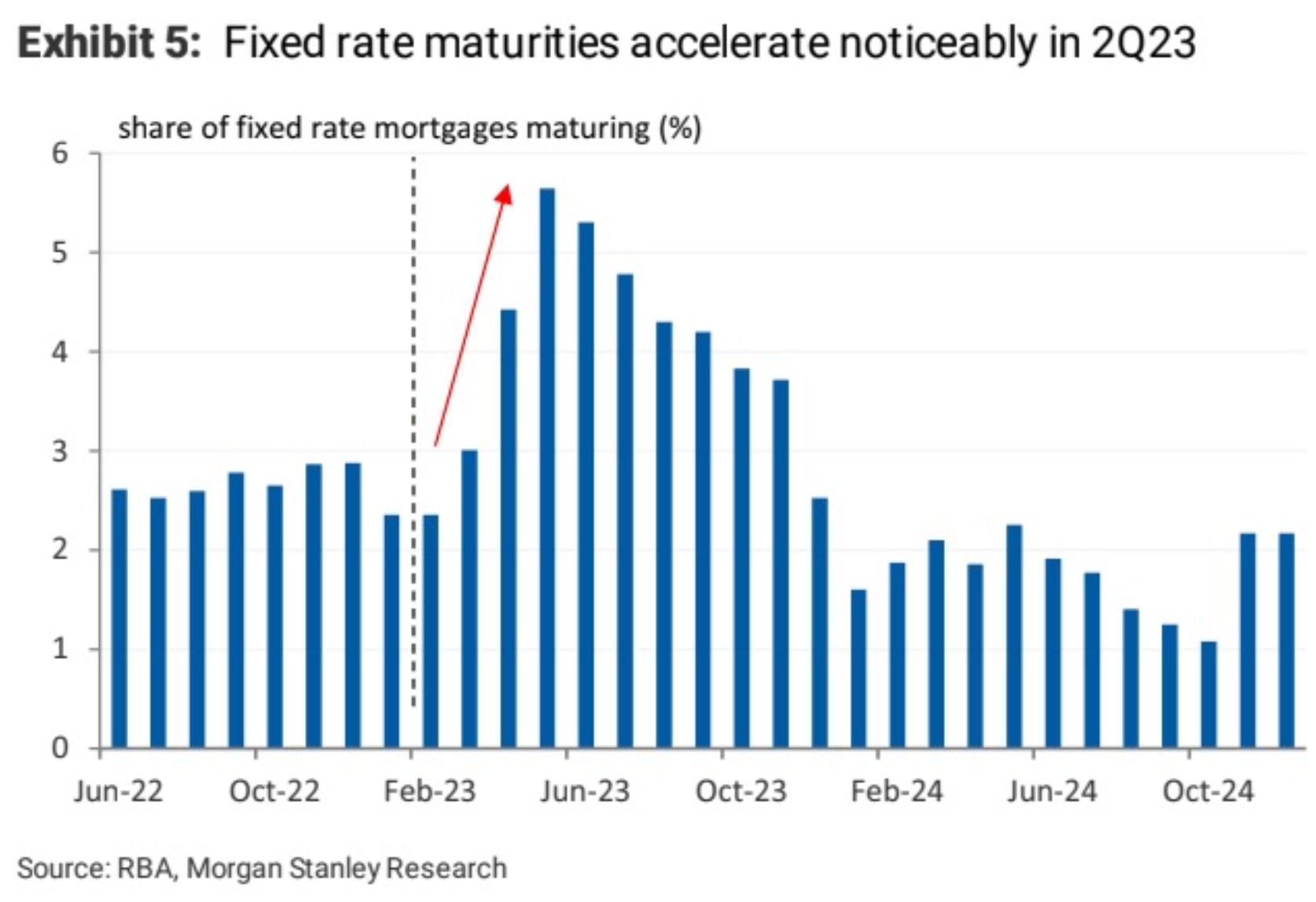

Then there’s the fixed rate mortgage reset, which will hit especially hard from April, peak in May, and then remain at elevated levels through the rest of the year:

Thousands of fixed rate mortgage borrowers that purchased near the peak over the pandemic are facing more than a doubling of interest rates when they convert back to variable, which should logically see a wave of distressed sales hit the market.

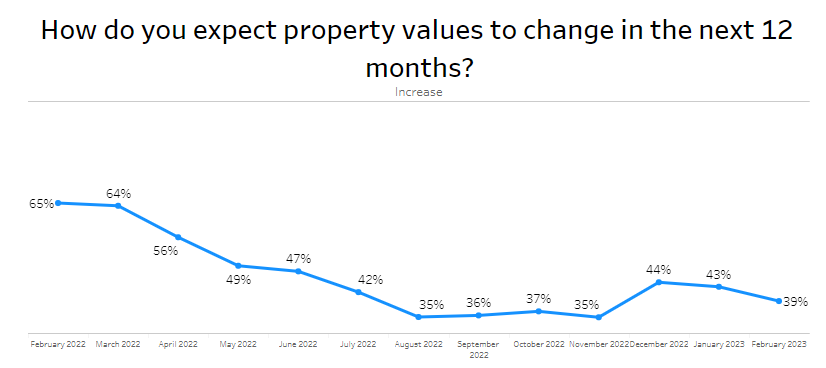

Accordingly, Finder’s latest Consumer Sentiment Tracker shows that the share of people expecting house prices to rise over the next 12 months fell sharply in February:

On the other side of the coin, immigration is running at all-time high levels, construction costs have soared, and rents are rising at a double-digit pace.

So, there is likely to be some ‘fear of missing out’ (FOMO) in the market as people desperately try to escape the broken rental market.

For now, FOMO is beating the interest rate effect. Will it last? Logically, no. But you can never say never with Aussie housing.

Grab the popcorn.