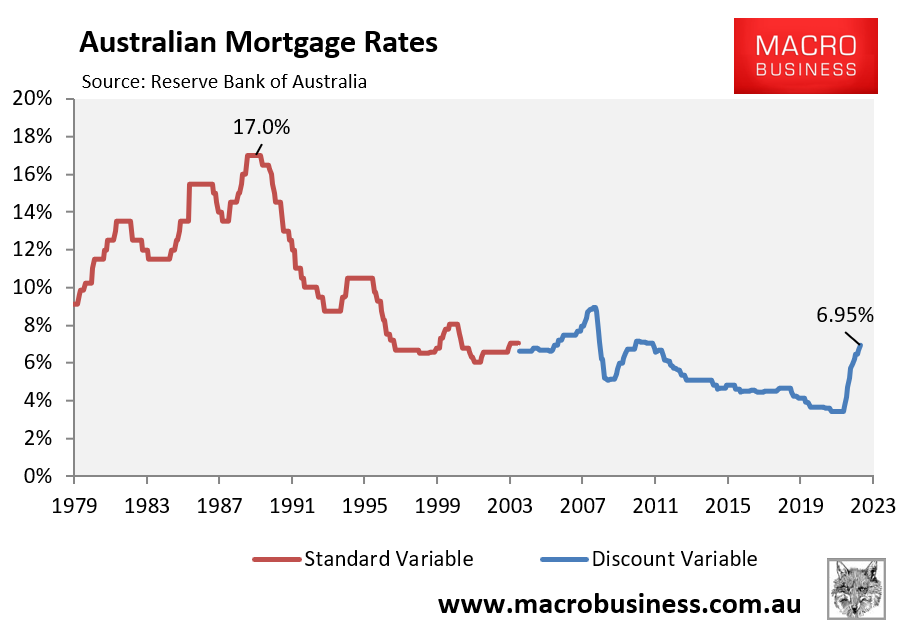

A common retort to the Reserve Bank of Australia’s (RBA) aggressive interest rate hikes is that interest rates were far higher in 1989-90 when they peaked at 17%:

Australian mortgage rates peaked at 17% in 1989-90.

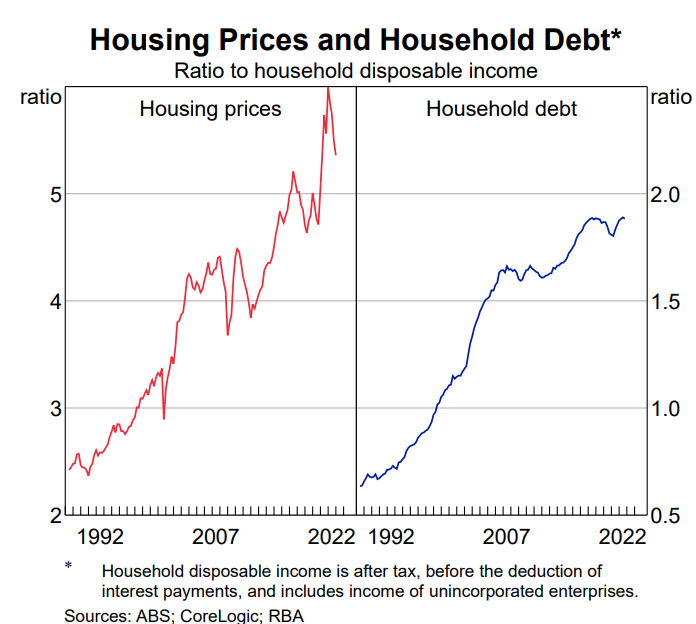

While this claim is superficially true, it ignores the fact that Australian households today hold roughly three times the debt loads of the average household in 1990, as illustrated clearly below:

Australian household debt loads have tripled since 1990 as house prices soared.

Therefore, Australian households today are far more sensitive to interest rate hikes than they were in 1990.

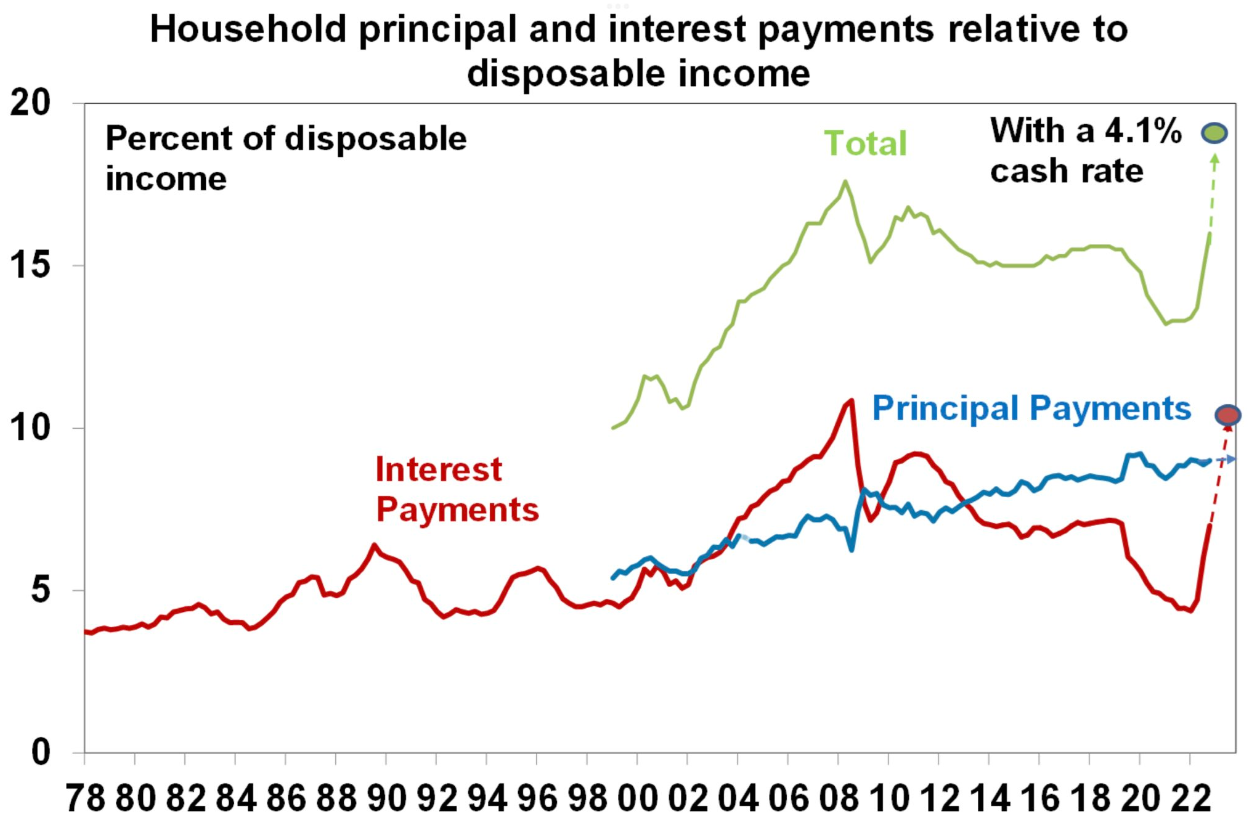

AMP Capital’s chief economist, Shane Oliver, published the below chart on Twitter showing how household interest repayments relative to household income have already surpassed their level in 1990 when mortgage rates touched 17%.

Moreover, when principal repayments are added into the mix, household debt repayments relative to household disposable income will increase to a record high if the RBA delivers another two 0.25% rate hikes, lifting the official cash rate to 4.1%:

Household debt repayments to household income will soon hit a record high.

The above chart shows why the RBA’s aggressive rate hikes are biting so hard.

And if the RBA continues to tighten, households will soon be in uncharted territory.